Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

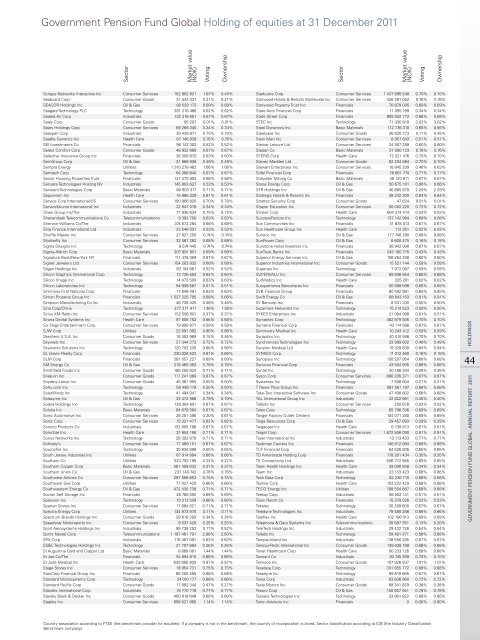

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

scripps networks interactive inc Consumer services 162 802 921 1.87% 0.40%<br />

seaboard Corp Consumer Goods <strong>31</strong> 543 337 0.21% 0.21%<br />

seaCor <strong>Holding</strong>s inc oil & Gas 80 020 172 0.69% 0.69%<br />

seag<strong>at</strong>e technology PlC technology 281 216 486 0.62% 0.62%<br />

sealed air Corp industrials 132 216 651 0.67% 0.67%<br />

sealy Corp Consumer Goods 95 207 0.01% 0.01%<br />

sears <strong>Holding</strong>s Corp Consumer services 69 268 345 0.34% 0.34%<br />

seaspan Corp industrials 39 428 871 0.70% 0.70%<br />

se<strong>at</strong>tle Genetics inc Health Care 87 146 939 0.76% 0.76%<br />

sei investments Co Financials 96 142 302 0.52% 0.52%<br />

select Comfort Corp Consumer Goods 48 932 866 0.67% 0.67%<br />

selective insurance Group inc Financials 36 306 870 0.63% 0.63%<br />

semGroup Corp oil & Gas <strong>31</strong> 986 936 0.49% 0.49%<br />

sempra energy utilities 1 <strong>31</strong>0 278 462 1.66% 1.66%<br />

semtech Corp technology 64 388 840 0.67% 0.67%<br />

senior Housing Properties trust Financials 147 470 904 0.68% 0.68%<br />

sens<strong>at</strong>a technologies <strong>Holding</strong> nv industrials 145 903 627 0.53% 0.53%<br />

sensient technologies Corp basic m<strong>at</strong>erials 80 903 <strong>31</strong>7 0.71% 0.71%<br />

sequenom inc Health Care 15 965 339 0.61% 0.61%<br />

service Corp intern<strong>at</strong>ional/us Consumer services 100 966 820 0.70% 0.70%<br />

servicesource intern<strong>at</strong>ional inc industrials 22 647 078 0.34% 0.34%<br />

shaw Group inc/the industrials 77 936 634 0.75% 0.75%<br />

shenandoah telecommunic<strong>at</strong>ions Co telecommunic<strong>at</strong>ions 9 392 750 0.63% 0.63%<br />

sherwin-Williams Co/the industrials 374 672 284 0.68% 0.68%<br />

ship Finance intern<strong>at</strong>ional ltd industrials 23 548 5<strong>31</strong> 0.53% 0.53%<br />

shuffle master inc Consumer services 27 927 250 0.74% 0.74%<br />

shutterfly inc Consumer services 32 067 282 0.68% 0.68%<br />

sigma Designs inc technology 8 574 440 0.74% 0.74%<br />

sigma-aldrich Corp basic m<strong>at</strong>erials 307 891 901 0.69% 0.69%<br />

sign<strong>at</strong>ure bank/new York nY Financials 111 478 359 0.67% 0.67%<br />

signet Jewelers ltd Consumer services 154 203 932 0.68% 0.68%<br />

silgan <strong>Holding</strong>s inc industrials 83 104 661 0.52% 0.52%<br />

silicon Graphics intern<strong>at</strong>ional Corp technology 13 726 553 0.64% 0.64%<br />

silicon image inc technology 14 473 500 0.63% 0.63%<br />

silicon labor<strong>at</strong>ories inc technology 54 938 587 0.51% 0.51%<br />

simmons First n<strong>at</strong>ional Corp Financials 17 648 491 0.63% 0.63%<br />

simon Property Group inc Financials 1 527 220 705 0.68% 0.68%<br />

simpson manufacturing Co inc industrials 46 738 425 0.48% 0.48%<br />

sina Corp/China technology 277 271 411 1.36% 1.36%<br />

sirius Xm radio inc Consumer services 152 596 001 0.37% 0.37%<br />

sirona Dental systems inc Health Care 97 506 752 0.66% 0.66%<br />

six Flags entertainment Corp Consumer services 79 890 971 0.59% 0.59%<br />

sJW Corp utilities 22 591 092 0.86% 0.86%<br />

skechers u.s.a. inc Consumer Goods 16 452 969 0.15% 0.46%<br />

skywest inc Consumer services 27 344 273 0.72% 0.72%<br />

skyworks solutions inc technology 120 702 235 0.66% 0.66%<br />

sl Green realty Corp Financials 230 028 523 0.67% 0.66%<br />

slm Corp Financials 281 057 227 0.69% 0.69%<br />

sm energy Co oil & Gas 218 465 363 0.78% 0.78%<br />

smithfield Foods inc Consumer Goods 165 250 824 0.71% 0.71%<br />

snap-on inc Consumer Goods 117 241 069 0.67% 0.67%<br />

snyders-lance inc Consumer Goods 45 361 955 0.50% 0.50%<br />

sohu.com inc technology 56 499 179 0.50% 0.50%<br />

solarWinds inc technology 41 494 047 0.34% 0.34%<br />

solazyme inc oil & Gas 33 472 986 0.79% 0.79%<br />

solera <strong>Holding</strong>s inc technology 126 364 601 0.67% 0.67%<br />

solutia inc basic m<strong>at</strong>erials 84 679 584 0.67% 0.67%<br />

sonic automotive inc Consumer services 28 251 490 0.20% 0.61%<br />

sonic Corp Consumer services 15 321 477 0.62% 0.62%<br />

sonoco Products Co industrials 132 605 786 0.67% 0.67%<br />

sonosite inc Health Care <strong>31</strong> 654 156 0.71% 0.71%<br />

sonus networks inc technology 28 302 879 0.71% 0.71%<br />

sotheby’s Consumer services 77 469 151 0.67% 0.67%<br />

sourcefire inc technology 30 834 888 0.55% 0.55%<br />

south Jersey industries inc utilities 67 914 984 0.66% 0.66%<br />

southern Co utilities 523 793 195 0.22% 0.22%<br />

southern Copper Corp basic m<strong>at</strong>erials 561 458 032 0.37% 0.37%<br />

southern union Co oil & Gas 237 140 742 0.76% 0.76%<br />

southwest airlines Co Consumer services 297 558 853 0.75% 0.75%<br />

southwest Gas Corp utilities 77 027 420 0.66% 0.66%<br />

southwestern energy Co oil & Gas 472 430 738 0.71% 0.71%<br />

sovran self storage inc Financials 48 760 592 0.69% 0.69%<br />

spansion inc technology 19 <strong>31</strong>3 509 0.66% 0.66%<br />

spartan stores inc Consumer services 17 884 621 0.71% 0.71%<br />

spectra energy Corp utilities 134 973 970 0.11% 0.11%<br />

spectrum brands <strong>Holding</strong>s inc Consumer Goods 28 618 283 0.34% 0.34%<br />

speedway motorsports inc Consumer services 9 537 420 0.25% 0.25%<br />

spirit aerosystems <strong>Holding</strong>s inc industrials 99 739 252 0.17% 0.52%<br />

sprint nextel Corp telecommunic<strong>at</strong>ions 1 197 461 791 2.86% 2.83%<br />

sPX Corp industrials 116 467 087 0.63% 0.63%<br />

ss&C technologies <strong>Holding</strong>s inc technology 21 707 884 0.26% 0.26%<br />

st augustine Gold and Copper ltd basic m<strong>at</strong>erials 8 868 081 1.44% 1.44%<br />

st Joe Co/the Financials 54 694 815 0.68% 0.68%<br />

st Jude medical inc Health Care 630 860 900 0.97% 0.97%<br />

stage stores inc Consumer services 18 954 7<strong>31</strong> 0.75% 0.75%<br />

stanCorp Financial Group inc Financials 66 205 465 0.68% 0.68%<br />

standard microsystems Corp technology 24 010 177 0.68% 0.68%<br />

standard Pacific Corp Consumer Goods 17 882 344 0.47% 0.27%<br />

standex intern<strong>at</strong>ional Corp industrials 19 770 718 0.77% 0.77%<br />

stanley black & Decker inc Consumer Goods 460 918 648 0.68% 0.68%<br />

staples inc Consumer services 658 521 965 1.14% 1.14%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

starbucks Corp Consumer services 1 437 695 548 0.70% 0.70%<br />

starwood Hotels & resorts Worldwide inc Consumer services 426 291 052 0.76% 0.76%<br />

starwood Property trust inc Financials 70 879 005 0.69% 0.69%<br />

st<strong>at</strong>e auto Financial Corp Financials 11 095 169 0.34% 0.34%<br />

st<strong>at</strong>e street Corp Financials 809 932 772 0.68% 0.68%<br />

steC inc technology 71 330 818 3.02% 3.02%<br />

steel Dynamics inc basic m<strong>at</strong>erials 112 736 <strong>31</strong>0 0.66% 0.66%<br />

steelcase inc Consumer Goods 26 625 773 0.11% 0.45%<br />

stein mart inc Consumer services 8 957 643 0.51% 0.51%<br />

steiner leisure ltd Consumer services 24 507 259 0.60% 0.60%<br />

stepan Co basic m<strong>at</strong>erials 37 090 123 0.76% 0.76%<br />

steris Corp Health Care 72 321 476 0.70% 0.70%<br />

steven madden ltd Consumer Goods 62 204 984 0.70% 0.70%<br />

stewart enterprises inc Consumer services 18 845 209 0.46% 0.63%<br />

stifel Financial Corp Financials 78 861 774 0.77% 0.77%<br />

stillw<strong>at</strong>er mining Co basic m<strong>at</strong>erials 48 120 811 0.67% 0.67%<br />

stone energy Corp oil & Gas 50 675 181 0.66% 0.66%<br />

str <strong>Holding</strong>s inc oil & Gas 46 865 870 2.29% 2.29%<br />

str<strong>at</strong>egic Hotels & resorts inc Financials 38 242 300 0.64% 0.64%<br />

str<strong>at</strong>tec security Corp Consumer Goods 47 624 0.01% 0.01%<br />

strayer educ<strong>at</strong>ion inc Consumer services 50 002 220 0.72% 0.72%<br />

stryker Corp Health Care 604 <strong>31</strong>4 414 0.53% 0.53%<br />

successFactors inc technology 137 142 964 0.68% 0.68%<br />

sun Communities inc Financials <strong>31</strong> 835 013 0.67% 0.67%<br />

sun Healthcare Group inc Health Care 112 351 0.02% 0.02%<br />

sunoco inc oil & Gas 177 746 280 0.68% 0.68%<br />

sunPower Corp oil & Gas 6 600 475 0.18% 0.18%<br />

sunstone Hotel investors inc Financials 38 942 990 0.67% 0.67%<br />

suntrust banks inc Financials 245 180 715 0.43% 0.43%<br />

superior energy services inc oil & Gas 108 264 208 0.80% 0.80%<br />

superior industries intern<strong>at</strong>ional inc Consumer Goods 15 521 144 0.58% 0.58%<br />

supertex inc technology 7 972 087 0.59% 0.59%<br />

suPervalu inc Consumer services 69 836 854 0.68% 0.68%<br />

surmodics inc Health Care 325 201 0.02% 0.02%<br />

susquehanna bancshares inc Financials 50 568 598 0.65% 0.65%<br />

svb Financial Group Financials 80 492 981 0.65% 0.65%<br />

swift energy Co oil & Gas 68 643 163 0.91% 0.91%<br />

sY bancorp inc Financials 8 5<strong>31</strong> 330 0.50% 0.50%<br />

sycamore networks inc technology 15 214 523 0.50% 0.50%<br />

sYKes enterprises inc industrials 21 084 988 0.51% 0.51%<br />

symantec Corp technology 482 979 935 0.70% 0.70%<br />

symetra Financial Corp Financials 43 114 588 0.67% 0.67%<br />

symmetry medical inc Health Care 10 243 412 0.59% 0.59%<br />

synaptics inc technology 40 410 588 0.70% 0.70%<br />

synchronoss technologies inc technology 33 999 602 0.49% 0.49%<br />

syneron medical ltd Health Care 19 328 830 0.84% 0.84%<br />

sYnneX Corp technology 11 012 460 0.16% 0.16%<br />

synopsys inc technology 158 297 954 0.68% 0.68%<br />

synovus Financial Corp Financials 43 504 935 0.66% 0.66%<br />

syntel inc technology 30 166 284 0.26% 0.26%<br />

sysco Corp Consumer services 690 205 371 0.67% 0.67%<br />

systemax inc technology 7 508 604 0.21% 0.21%<br />

t rowe Price Group inc Financials 587 561 197 0.68% 0.68%<br />

take-two interactive s<strong>of</strong>tware inc Consumer Goods 47 406 802 0.68% 0.68%<br />

tal intern<strong>at</strong>ional Group inc industrials 22 822 661 0.40% 0.40%<br />

talbots inc Consumer services 250 678 0.02% 0.02%<br />

taleo Corp technology 65 796 336 0.69% 0.69%<br />

tanger Factory outlet Centers Financials 104 071 280 0.69% 0.69%<br />

targa resources Corp oil & Gas 29 457 693 0.29% 0.29%<br />

targacept inc Health Care 6 738 813 0.61% 0.61%<br />

target Corp Consumer services 1 872 506 090 0.91% 0.91%<br />

taser intern<strong>at</strong>ional inc industrials 13 113 433 0.77% 0.77%<br />

taubman Centers inc Financials 146 612 084 0.68% 0.68%<br />

tCF Financial Corp Financials 64 526 805 0.65% 0.65%<br />

tD ameritrade <strong>Holding</strong> Corp Financials 178 261 434 0.35% 0.35%<br />

te Connectivity ltd industrials 506 772 945 0.65% 0.65%<br />

team Health <strong>Holding</strong>s inc Health Care 29 090 848 0.34% 0.34%<br />

team inc industrials 23 133 423 0.66% 0.66%<br />

tech D<strong>at</strong>a Corp technology 82 230 710 0.68% 0.68%<br />

techne Corp Health Care 103 222 429 0.68% 0.68%<br />

teCo energy inc utilities 168 554 887 0.68% 0.68%<br />

teekay Corp industrials 58 502 141 0.51% 0.51%<br />

tejon ranch Co Financials 15 379 026 0.53% 0.53%<br />

tekelec technology 30 289 800 0.67% 0.67%<br />

teledyne technologies inc industrials 79 480 288 0.66% 0.66%<br />

teleflex inc Health Care 102 186 013 0.69% 0.69%<br />

telephone & D<strong>at</strong>a systems inc telecommunic<strong>at</strong>ions 30 587 351 0.13% 0.20%<br />

teletech <strong>Holding</strong>s inc industrials 29 432 726 0.54% 0.54%<br />

tellabs inc technology 59 481 371 0.68% 0.68%<br />

temple-inland inc industrials 138 556 285 0.67% 0.67%<br />

tempur-Pedic intern<strong>at</strong>ional inc Consumer Goods 139 638 199 0.68% 0.68%<br />

tenet Healthcare Corp Health Care 90 233 126 0.68% 0.68%<br />

tennant Co industrials 30 745 399 0.70% 0.70%<br />

tenneco inc Consumer Goods 107 926 507 1.01% 1.01%<br />

terad<strong>at</strong>a Corp technology 3<strong>31</strong> 655 772 0.68% 0.68%<br />

teradyne inc technology 99 619 665 0.67% 0.67%<br />

terex Corp industrials 63 636 960 0.72% 0.72%<br />

tesla motors inc Consumer Goods 68 341 829 0.38% 0.38%<br />

tesoro Corp oil & Gas 150 927 941 0.78% 0.78%<br />

tessera technologies inc technology 33 861 822 0.66% 0.66%<br />

teton advisors inc Financials 0 0.00% 0.00%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

44<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011