Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

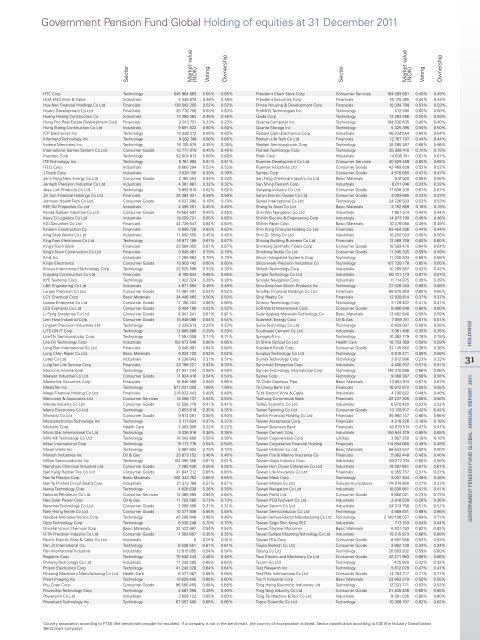

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

HtC Corp technology 545 964 665 0.65% 0.65%<br />

Hua enG Wire & Cable industrials 4 348 873 0.48% 0.48%<br />

Hua nan Financial <strong>Holding</strong>s Co ltd Financials 136 542 250 0.52% 0.52%<br />

Huaku Development Co ltd Financials 20 778 708 0.63% 0.63%<br />

Huang Hsiang Construction Co industrials 13 489 363 0.45% 0.45%<br />

Hung Poo real est<strong>at</strong>e Development Corp Financials 2 913 701 0.23% 0.23%<br />

Hung sheng Construction Co ltd industrials 9 691 622 0.60% 0.60%<br />

iCP electronics inc technology 10 328 212 0.60% 0.60%<br />

infortrend technology inc technology 8 932 748 0.66% 0.66%<br />

inotera memories inc technology 16 125 875 0.35% 0.35%<br />

intern<strong>at</strong>ional Games system Co ltd Consumer Goods 12 771 079 0.45% 0.45%<br />

inventec Corp technology 52 004 813 0.69% 0.69%<br />

ite technology inc technology 5 761 982 0.61% 0.61%<br />

iteQ Corp industrials 8 660 294 0.53% 0.53%<br />

J touch Corp industrials 3 028 150 0.39% 0.39%<br />

Jenn Feng new energy Co ltd Consumer Goods 2 165 353 0.34% 0.34%<br />

Jentech Precision industrial Co ltd industrials 4 381 887 0.32% 0.32%<br />

Jess-link Products Co ltd technology 5 892 818 0.62% 0.62%<br />

Jih sun Financial <strong>Holding</strong>s Co ltd Financials 24 384 3<strong>31</strong> 0.59% 0.59%<br />

Johnson Health tech Co ltd Consumer Goods 4 527 590 0.19% 0.19%<br />

Kee tai Properties Co ltd industrials 4 395 251 0.45% 0.45%<br />

Kenda rubber industrial Co ltd Consumer Goods 18 564 697 0.45% 0.45%<br />

Kerry tJ logistics Co ltd industrials 19 259 7<strong>31</strong> 0.65% 0.65%<br />

KGi securities Co ltd Financials 44 739 547 0.64% 0.64%<br />

Kindom Construction Co Financials 8 856 726 0.63% 0.63%<br />

King slide Works Co ltd industrials 11 650 555 0.45% 0.45%<br />

King Yuan electronics Co ltd technology 16 877 199 0.67% 0.67%<br />

King’s town bank Financials 23 564 050 0.67% 0.67%<br />

King’s town Construction Co ltd Financials 9 948 481 0.79% 0.79%<br />

Kinik Co industrials 7 263 662 0.79% 0.79%<br />

Kinpo electronics Consumer Goods 10 903 142 0.60% 0.60%<br />

Kinsus interconnect technology Corp technology 23 525 598 0.33% 0.33%<br />

Kuoyang Construction Co ltd Financials 6 109 644 0.65% 0.65%<br />

KYe systems Corp technology 1 922 324 0.28% 0.28%<br />

l&K engineering Co ltd industrials 4 871 894 0.49% 0.49%<br />

largan Precision Co ltd Consumer Goods 77 481 491 0.52% 0.52%<br />

lCY Chemical Corp basic m<strong>at</strong>erials 34 446 465 0.50% 0.50%<br />

lealea enterprise Co ltd Consumer Goods 11 196 203 0.66% 0.66%<br />

les enphants Co ltd Consumer Goods 6 404 189 0.52% 0.52%<br />

li Peng enterprise Co ltd Consumer Goods 6 941 341 0.61% 0.61%<br />

lien Hwa industrial Corp Consumer Goods 15 949 066 0.54% 0.54%<br />

lingsen Precision industries ltd technology 2 220 513 0.23% 0.23%<br />

lite-on it Corp technology 12 805 686 0.29% 0.29%<br />

lite-on semiconductor Corp technology 7 551 008 0.71% 0.71%<br />

lite-on technology Corp industrials 102 873 546 0.66% 0.66%<br />

long bon intern<strong>at</strong>ional Co ltd Financials 9 046 891 0.84% 0.84%<br />

long Chen Paper Co ltd basic m<strong>at</strong>erials 6 034 125 0.52% 0.52%<br />

lotes Co ltd industrials 4 238 843 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

lung Yen life service Corp Financials 23 199 221 0.33% 0.33%<br />

macronix intern<strong>at</strong>ional technology 47 941 244 0.59% 0.59%<br />

makalot industrial Co ltd Consumer Goods 11 924 416 0.54% 0.54%<br />

masterlink securities Corp Financials 16 846 568 0.60% 0.60%<br />

medi<strong>at</strong>ek inc technology 677 0<strong>31</strong> 050 1.08% 1.08%<br />

mega Financial <strong>Holding</strong> Co ltd Financials 219 922 443 0.49% 0.49%<br />

mercuries & associ<strong>at</strong>es ltd Consumer services 18 288 137 0.53% 0.53%<br />

merida industry Co ltd Consumer Goods 12 558 779 0.41% 0.41%<br />

merry electronics Co ltd technology 3 653 618 0.35% 0.35%<br />

microbio Co ltd Consumer Goods 9 914 091 0.50% 0.50%<br />

microelectronics technology inc technology 2 117 624 0.37% 0.37%<br />

microlife Corp Health Care 2 403 906 0.22% 0.22%<br />

micro-star intern<strong>at</strong>ional Co ltd technology 9 336 916 0.38% 0.38%<br />

min aiK technology Co ltd technology 10 343 666 0.59% 0.59%<br />

mitac intern<strong>at</strong>ional Corp technology 15 172 776 0.54% 0.54%<br />

mosel vitelic inc technology 3 987 604 0.73% 0.73%<br />

motech industries inc oil & Gas 20 873 152 0.46% 0.46%<br />

mstar semiconductor inc technology 102 095 356 0.61% 0.61%<br />

namchow Chemical industrial ltd Consumer Goods 7 280 430 0.55% 0.55%<br />

nan Kang rubber tire Co ltd Consumer Goods 41 841 212 0.65% 0.65%<br />

nan Ya Plastics Corp basic m<strong>at</strong>erials 601 343 762 0.65% 0.65%<br />

nan Ya Printed Circuit board Corp industrials 21 <strong>31</strong>2 769 0.27% 0.27%<br />

nanya technology Corp technology 4 626 639 0.26% 0.26%<br />

n<strong>at</strong>ional Petroleum Co ltd Consumer services 12 085 695 0.64% 0.64%<br />

neo solar Power Corp oil & Gas 11 703 585 0.73% 0.73%<br />

newmax technology Co ltd Consumer Goods 2 099 396 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

nien Hsing textile Co ltd Consumer Goods 10 377 836 0.55% 0.55%<br />

nov<strong>at</strong>ek microelectronics Corp technology 43 208 848 0.48% 0.48%<br />

opto technology Corp technology 8 530 248 0.70% 0.70%<br />

oriental union Chemical Corp basic m<strong>at</strong>erials 32 422 867 0.54% 0.54%<br />

o-ta Precision industry Co ltd Consumer Goods 1 503 867 0.35% 0.35%<br />

Pacific electric Wire & Cable Co ltd industrials 5 0.01% 0.01%<br />

Pan Jit intern<strong>at</strong>ional inc technology 6 538 551 0.61% 0.61%<br />

Pan-intern<strong>at</strong>ional industrial industrials 12 615 855 0.54% 0.54%<br />

Peg<strong>at</strong>ron Corp technology 70 540 243 0.48% 0.48%<br />

Phihong technology Co ltd industrials 11 332 585 0.60% 0.60%<br />

Phison electronics Corp technology 41 240 326 0.64% 0.64%<br />

Pihsiang machinery manufacturing Co ltd Health Care 8 377 067 0.58% 0.58%<br />

Pixart imaging inc technology 10 620 495 0.60% 0.60%<br />

Pou Chen Corp Consumer Goods 96 550 450 0.68% 0.68%<br />

Powerchip technology Corp technology 4 587 356 0.49% 0.49%<br />

Powercom Co ltd industrials 3 605 122 0.65% 0.65%<br />

Powertech technology inc technology 67 057 480 0.66% 0.66%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

President Chain store Corp Consumer services 164 093 681 0.49% 0.49%<br />

President securities Corp Financials 16 175 385 0.44% 0.44%<br />

Prince Housing & Development Corp Financials 18 339 799 0.53% 0.53%<br />

Promos technologies inc technology 512 580 0.60% 0.60%<br />

Qisda Corp technology 13 263 266 0.55% 0.55%<br />

Quanta Computer inc technology 194 530 435 0.40% 0.40%<br />

Quanta storage inc technology 5 325 395 0.50% 0.50%<br />

radiant opto-electronics Corp industrials 48 224 554 0.64% 0.64%<br />

radium life tech Co ltd Financials 12 767 197 0.44% 0.44%<br />

realtek semiconductor Corp technology 28 285 267 0.66% 0.66%<br />

richtek technology Corp technology 25 938 415 0.70% 0.70%<br />

ritek Corp industrials 14 636 741 0.61% 0.61%<br />

ruentex Development Co ltd Consumer services 40 529 459 0.65% 0.65%<br />

ruentex industries ltd Consumer Goods 42 469 828 0.52% 0.52%<br />

sampo Corp Consumer Goods 4 570 650 0.47% 0.47%<br />

san Fang Chemical industry Co ltd basic m<strong>at</strong>erials 912 500 0.06% 0.06%<br />

san shing Fastech Corp industrials 6 011 046 0.33% 0.33%<br />

sanyang industry Co ltd Consumer Goods 17 838 200 0.61% 0.61%<br />

sanyo electric taiwan Co ltd Consumer Goods 4 003 665 0.23% 0.23%<br />

senao intern<strong>at</strong>ional Co ltd technology 24 726 503 0.53% 0.53%<br />

sheng Yu steel Co ltd basic m<strong>at</strong>erials 2 152 869 0.18% 0.18%<br />

shih Wei navig<strong>at</strong>ion Co ltd industrials 7 857 514 0.44% 0.44%<br />

shihlin electric & engineering Corp industrials 14 973 190 0.46% 0.46%<br />

shihlin Paper Corp basic m<strong>at</strong>erials 10 478 060 0.49% 0.49%<br />

shin Kong Financial <strong>Holding</strong> Co ltd Financials 63 454 336 0.44% 0.44%<br />

shin Zu shing Co ltd industrials 10 250 503 0.56% 0.56%<br />

shining building business Co ltd Financials 12 469 709 0.60% 0.60%<br />

shinkong synthetic Fibers Corp Consumer Goods 18 583 470 0.64% 0.64%<br />

shinkong textile Co ltd Consumer Goods 11 345 325 0.59% 0.59%<br />

silicon integr<strong>at</strong>ed systems Corp technology 11 230 033 0.68% 0.68%<br />

siliconware Precision industries Co technology 107 728 178 0.65% 0.65%<br />

silitech technology Corp industrials 10 265 957 0.42% 0.42%<br />

simplo technology Co ltd industrials 65 721 173 0.67% 0.67%<br />

sincere navig<strong>at</strong>ion Corp industrials 11 114 875 0.39% 0.39%<br />

sino-american silicon Products inc technology 27 528 343 0.68% 0.68%<br />

sinoPac Financial <strong>Holding</strong>s Co ltd Financials 85 875 903 0.65% 0.65%<br />

sinyi realty Co Financials 12 028 614 0.37% 0.37%<br />

sitronix technology Corp technology 3 129 407 0.41% 0.41%<br />

s<strong>of</strong>t-World intern<strong>at</strong>ional Corp Consumer Goods 8 066 048 0.60% 0.60%<br />

solar applied m<strong>at</strong>erials technology Co basic m<strong>at</strong>erials 13 462 840 0.59% 0.59%<br />

solartech energy Corp oil & Gas 7 069 741 0.51% 0.51%<br />

sonix technology Co ltd technology 6 829 697 0.56% 0.56%<br />

southeast Cement Co ltd industrials 3 961 486 0.35% 0.35%<br />

springs<strong>of</strong>t inc technology 10 362 779 0.78% 0.78%<br />

st shine optical Co ltd Health Care 18 703 369 0.59% 0.59%<br />

standard Foods Corp Consumer Goods 32 145 682 0.38% 0.38%<br />

sunplus technology Co ltd technology 6 510 471 0.56% 0.56%<br />

sunrex technology Corp technology 2 812 996 0.23% 0.23%<br />

syncmold enterprise Corp industrials 4 406 337 0.51% 0.51%<br />

synnex technology intern<strong>at</strong>ional Corp technology 146 <strong>31</strong>0 898 0.66% 0.66%<br />

systex Corp technology 9 368 387 0.58% 0.58%<br />

ta Chen stainless Pipe basic m<strong>at</strong>erials 13 954 974 0.67% 0.67%<br />

ta Chong bank ltd Financials 16 672 872 0.55% 0.55%<br />

ta Ya electric Wire & Cable industrials 4 190 822 0.48% 0.48%<br />

taichung Commercial bank Financials 22 237 305 0.58% 0.58%<br />

taiflex scientific Co ltd industrials 6 870 420 0.52% 0.52%<br />

tainan spinning Co ltd Consumer Goods 13 178 617 0.42% 0.42%<br />

taishin Financial <strong>Holding</strong> Co ltd Financials 85 960 147 0.66% 0.66%<br />

taiwan acceptance Corp Financials 4 218 226 0.18% 0.18%<br />

taiwan business bank Financials 40 879 574 0.47% 0.47%<br />

taiwan Cement Corp industrials 164 644 019 0.65% 0.65%<br />

taiwan Cogener<strong>at</strong>ion Corp utilities 3 987 250 0.18% 0.18%<br />

taiwan Cooper<strong>at</strong>ive Financial <strong>Holding</strong> Financials 114 844 660 0.49% 0.49%<br />

taiwan Fertilizer Co ltd basic m<strong>at</strong>erials 68 643 547 0.50% 0.50%<br />

taiwan Fire & marine insurance Co Financials 5 982 449 0.40% 0.40%<br />

taiwan Glass industry Corp industrials 69 272 374 0.50% 0.50%<br />

taiwan Hon Chuan enterprise Co ltd industrials 19 287 651 0.67% 0.67%<br />

taiwan life insurance Co ltd Financials 8 355 757 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

taiwan mask Corp technology 3 007 484 0.48% 0.48%<br />

taiwan mobile Co ltd telecommunic<strong>at</strong>ions 174 074 900 0.27% 0.27%<br />

taiwan navig<strong>at</strong>ion Co ltd industrials 10 630 861 0.41% 0.41%<br />

taiwan Paiho ltd Consumer Goods 9 882 021 0.73% 0.73%<br />

taiwan PCb techvest Co ltd industrials 2 818 539 0.26% 0.26%<br />

taiwan secom Co ltd industrials 24 <strong>31</strong>3 756 0.51% 0.51%<br />

taiwan semiconductor Co ltd technology 4 569 8<strong>31</strong> 0.66% 0.66%<br />

taiwan semiconductor manufacturing Co ltd technology 2 748 168 057 0.64% 0.71%<br />

taiwan sogo shin Kong seC industrials 713 103 0.04% 0.04%<br />

taiwan styrene monomer basic m<strong>at</strong>erials 6 5<strong>31</strong> 193 0.82% 0.82%<br />

taiwan surface mounting technology Co ltd industrials 19 215 873 0.68% 0.68%<br />

taiwan tea Corp Consumer Goods 8 597 558 0.53% 0.53%<br />

taiyen biotech Co ltd Consumer Goods 3 862 739 0.34% 0.34%<br />

t<strong>at</strong>ung Co ltd technology 20 893 932 0.59% 0.60%<br />

teco electric and machinery Co ltd Consumer Goods 42 271 983 0.66% 0.66%<br />

tecom Co ltd technology 475 500 0.32% 0.32%<br />

test research inc technology 5 612 078 0.47% 0.47%<br />

test-rite intern<strong>at</strong>ional Co ltd Consumer Goods 14 754 717 0.71% 0.71%<br />

ton Yi industrial Corp basic m<strong>at</strong>erials 23 963 379 0.55% 0.55%<br />

tong Hsing electronic industries ltd technology 12 323 771 0.53% 0.53%<br />

tong Yang industry Co ltd Consumer Goods 21 405 436 0.60% 0.60%<br />

tong-tai machine & tool Co ltd industrials 8 381 035 0.80% 0.80%<br />

topco scientific Co ltd technology 10 308 197 0.82% 0.82%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

<strong>31</strong><br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011