01 05 09 02 06 10 03 07 11 04 08 12 13 14

01 05 09 02 06 10 03 07 11 04 08 12 13 14

01 05 09 02 06 10 03 07 11 04 08 12 13 14

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

P ◀ CONTENTS ▶<br />

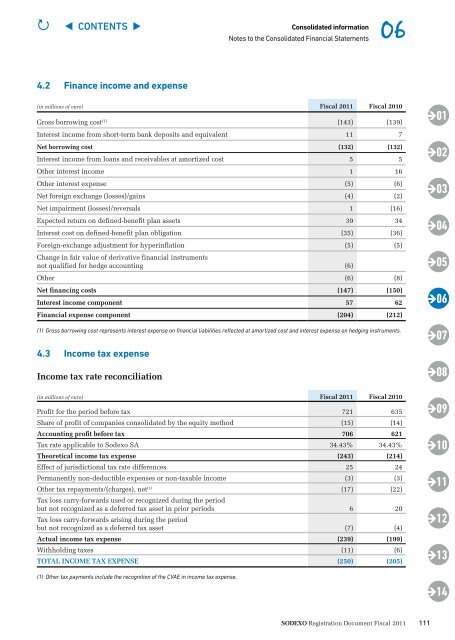

4.2 Finance income and expense<br />

Consolidated information <strong>06</strong><br />

Notes to the Consolidated Financial Statements<br />

(in millions of euro) Fiscal 2<strong>01</strong>1 Fiscal 2<strong>01</strong>0<br />

Gross borrowing cost (1) (<strong>14</strong>3) (<strong>13</strong>9)<br />

Interest income from short-term bank deposits and equivalent <strong>11</strong> 7<br />

Net borrowing cost (<strong>13</strong>2) (<strong>13</strong>2)<br />

Interest income from loans and receivables at amortized cost 5 5<br />

Other interest income 1 16<br />

Other interest expense (5) (6)<br />

Net foreign exchange (losses)/gains (4) (2)<br />

Net impairment (losses)/reversals 1 (16)<br />

Expected return on defined-benefit plan assets 39 34<br />

Interest cost on defined-benefit plan obligation (35) (36)<br />

Foreign-exchange adjustment for hyperinflation (5) (5)<br />

Change in fair value of derivative financial instruments<br />

not qualified for hedge accounting (6)<br />

Other (6) (8)<br />

Net financing costs (<strong>14</strong>7) (150)<br />

Interest income component 57 62<br />

Financial expense component (2<strong>04</strong>) (2<strong>12</strong>)<br />

(1) Gross borrowing cost represents interest expense on financial liabilities reflected at amortized cost and interest expense on hedging instruments.<br />

4.3 Income tax expense<br />

Income tax rate reconciliation<br />

(in millions of euro) Fiscal 2<strong>01</strong>1 Fiscal 2<strong>01</strong>0<br />

Profit for the period before tax 721 635<br />

Share of profit of companies consolidated by the equity method (15) (<strong>14</strong>)<br />

Accounting profit before tax 7<strong>06</strong> 621<br />

Tax rate applicable to Sodexo SA 34.43% 34.43%<br />

Theoretical income tax expense (243) (2<strong>14</strong>)<br />

Effect of jurisdictional tax rate differences 25 24<br />

Permanently non-deductible expenses or non-taxable income (3) (3)<br />

Other tax repayments/(charges), net (1) Tax loss carry-forwards used or recognized during the period<br />

(17) (22)<br />

but not recognized as a deferred tax asset in prior periods<br />

Tax loss carry-forwards arising during the period<br />

6 20<br />

but not recognized as a deferred tax asset (7) (4)<br />

Actual income tax expense (239) (199)<br />

Withholding taxes (<strong>11</strong>) (6)<br />

ToTAL INCoMe TAx exPeNSe (250) (2<strong>05</strong>)<br />

(1) Other tax payments include the recognition of the CVAE in income tax expense.<br />

Sodexo Registration Document Fiscal 2<strong>01</strong>1<br />

<strong>11</strong>1<br />

<strong>01</strong><br />

<strong>02</strong><br />

<strong>03</strong><br />

<strong>04</strong><br />

<strong>05</strong><br />

<strong>06</strong><br />

<strong>07</strong><br />

<strong>08</strong><br />

<strong>09</strong><br />

<strong>10</strong><br />

<strong>11</strong><br />

<strong>12</strong><br />

<strong>13</strong><br />

<strong>14</strong>