01 05 09 02 06 10 03 07 11 04 08 12 13 14

01 05 09 02 06 10 03 07 11 04 08 12 13 14

01 05 09 02 06 10 03 07 11 04 08 12 13 14

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

P ◀ CONTENTS ▶<br />

2<strong>01</strong>1. These two loans are not subject to any financial<br />

covenants.<br />

Interest rate<br />

In order to comply with the Group’s financing policy,<br />

substantially all borrowings are at fixed rates of<br />

interest. Where acquisition financing is arranged in<br />

a currency other than that of the acquired entity, the<br />

debt is hedged by the use of currency swaps.<br />

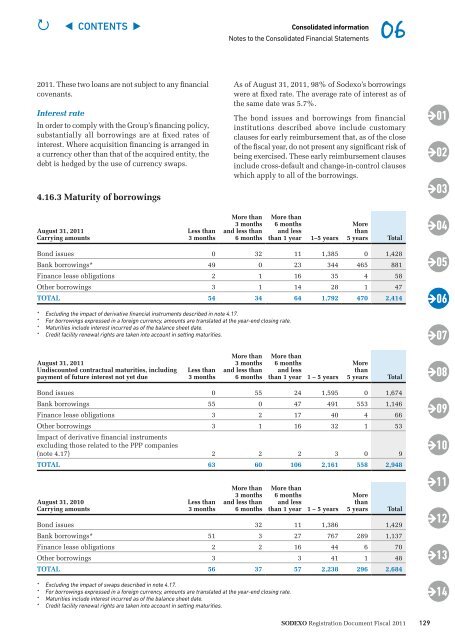

4.16.3 Maturity of borrowings<br />

August 31, 2<strong>01</strong>1<br />

Carrying amounts<br />

Less than<br />

3 months<br />

Consolidated information <strong>06</strong><br />

Notes to the Consolidated Financial Statements<br />

As of August 31, 2<strong>01</strong>1, 98% of Sodexo’s borrowings<br />

were at fixed rate. The average rate of interest as of<br />

the same date was 5.7%.<br />

The bond issues and borrowings from financial<br />

institutions described above include customary<br />

clauses for early reimbursement that, as of the close<br />

of the fiscal year, do not present any significant risk of<br />

being exercised. These early reimbursement clauses<br />

include cross-default and change-in-control clauses<br />

which apply to all of the borrowings.<br />

More than<br />

3 months<br />

and less than<br />

6 months<br />

More than<br />

6 months<br />

and less<br />

than 1 year 1–5 years<br />

More<br />

than<br />

5 years Total<br />

Bond issues 0 32 <strong>11</strong> 1,385 0 1,428<br />

Bank borrowings* 49 0 23 344 465 881<br />

Finance lease obligations 2 1 16 35 4 58<br />

Other borrowings 3 1 <strong>14</strong> 28 1 47<br />

ToTAL 54 34 64 1,792 470 2,4<strong>14</strong><br />

* Excluding the impact of derivative financial instruments described in note 4.17.<br />

* For borrowings expressed in a foreign currency, amounts are translated at the year-end closing rate.<br />

* Maturities include interest incurred as of the balance sheet date.<br />

* Credit facility renewal rights are taken into account in setting maturities.<br />

August 31, 2<strong>01</strong>1<br />

Undiscounted contractual maturities, including<br />

payment of future interest not yet due<br />

Less than<br />

3 months<br />

More than<br />

3 months<br />

and less than<br />

6 months<br />

More than<br />

6 months<br />

and less<br />

than 1 year 1 – 5 years<br />

More<br />

than<br />

5 years Total<br />

Bond issues 0 55 24 1,595 0 1,674<br />

Bank borrowings 55 0 47 491 553 1,<strong>14</strong>6<br />

Finance lease obligations 3 2 17 40 4 66<br />

Other borrowings<br />

Impact of derivative financial instruments<br />

excluding those related to the PPP companies<br />

3 1 16 32 1 53<br />

(note 4.17) 2 2 2 3 0 9<br />

ToTAL 63 60 1<strong>06</strong> 2,161 558 2,948<br />

August 31, 2<strong>01</strong>0<br />

Carrying amounts<br />

Less than<br />

3 months<br />

More than<br />

3 months<br />

and less than<br />

6 months<br />

More than<br />

6 months<br />

and less<br />

than 1 year 1 – 5 years<br />

More<br />

than<br />

5 years Total<br />

Bond issues 32 <strong>11</strong> 1,386 1,429<br />

Bank borrowings* 51 3 27 767 289 1,<strong>13</strong>7<br />

Finance lease obligations 2 2 16 44 6 70<br />

Other borrowings 3 3 41 1 48<br />

ToTAL 56 37 57 2,238 296 2,684<br />

* Excluding the impact of swaps described in note 4.17.<br />

* For borrowings expressed in a foreign currency, amounts are translated at the year-end closing rate.<br />

* Maturities include interest incurred as of the balance sheet date.<br />

* Credit facility renewal rights are taken into account in setting maturities.<br />

Sodexo Registration Document Fiscal 2<strong>01</strong>1<br />

<strong>12</strong>9<br />

<strong>01</strong><br />

<strong>02</strong><br />

<strong>03</strong><br />

<strong>04</strong><br />

<strong>05</strong><br />

<strong>06</strong><br />

<strong>07</strong><br />

<strong>08</strong><br />

<strong>09</strong><br />

<strong>10</strong><br />

<strong>11</strong><br />

<strong>12</strong><br />

<strong>13</strong><br />

<strong>14</strong>