01 05 09 02 06 10 03 07 11 04 08 12 13 14

01 05 09 02 06 10 03 07 11 04 08 12 13 14

01 05 09 02 06 10 03 07 11 04 08 12 13 14

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>01</strong><br />

<strong>02</strong><br />

<strong>03</strong><br />

<strong>04</strong><br />

<strong>05</strong><br />

<strong>06</strong><br />

<strong>07</strong><br />

<strong>08</strong><br />

<strong>09</strong><br />

<strong>10</strong><br />

<strong>11</strong><br />

<strong>12</strong><br />

<strong>13</strong><br />

<strong>14</strong><br />

84<br />

<strong>06</strong><br />

Consolidated information<br />

Fiscal 2<strong>01</strong>1 Activity Report<br />

2.3 Net financing costs<br />

Net financing costs decreased from 150 million euro<br />

in Fiscal 2<strong>01</strong>0 to <strong>14</strong>7 million euro in Fiscal 2<strong>01</strong>1,<br />

notably as a result of favorable effects of movements<br />

in the discounting rate of pension liabilities.<br />

2.4 Income tax expense<br />

Income tax expense totaled 250 million euro, with<br />

an effective tax rate of 35.4%, as compared to the<br />

prior year rate of 33%. The difference compared<br />

to the prior year resulted from the <strong>14</strong> million euro<br />

reduction in the utilization of tax loss carryforwards<br />

in several countries.<br />

2.5 Profit attributable to equity<br />

holders of the parent<br />

Profit attributable to equity holders of the parent<br />

was 451 million euro, compared to 4<strong>09</strong> million<br />

euro in the prior year, an increase of <strong>10</strong>.3% or 9.3%<br />

excluding exchange rate effects. The increase was<br />

3. FINANCIAL POSITION OF THE GROUP<br />

3.1 Cash flows<br />

Sodexo Registration Document Fiscal 2<strong>01</strong>1<br />

slightly less than for operating profit, mainly due to<br />

the rise in the effective tax rate.<br />

2.6 Earnings per share<br />

Earnings per share was 2.95 euro, an increase of<br />

<strong>11</strong>.7% at current exchange rates and <strong>10</strong>.6% excluding<br />

exchange rate effects. This item rose faster than net<br />

income because of the increase in the number of<br />

treasury shares compared to the prior year. Treasury<br />

shares are excluded from the calculation of earnings<br />

per share.<br />

2.7 Dividend<br />

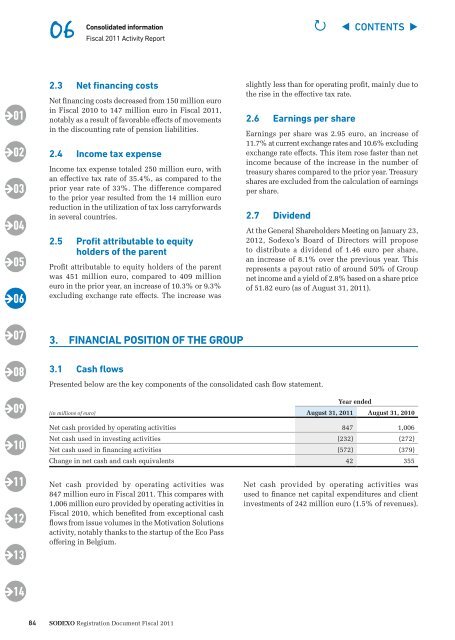

Presented below are the key components of the consolidated cash flow statement.<br />

(in millions of euro)<br />

At the General Shareholders Meeting on January 23,<br />

2<strong>01</strong>2, Sodexo’s Board of Directors will propose<br />

to distribute a dividend of 1.46 euro per share,<br />

an increase of 8.1% over the previous year. This<br />

represents a payout ratio of around 50% of Group<br />

net income and a yield of 2.8% based on a share price<br />

of 51.82 euro (as of August 31, 2<strong>01</strong>1).<br />

Year ended<br />

August 31, 2<strong>01</strong>1 August 31, 2<strong>01</strong>0<br />

Net cash provided by operating activities 847 1,0<strong>06</strong><br />

Net cash used in investing activities (232) (272)<br />

Net cash used in financing activities (572) (379)<br />

Change in net cash and cash equivalents 42 355<br />

Net cash provided by operating activities was<br />

847 million euro in Fiscal 2<strong>01</strong>1. This compares with<br />

1,0<strong>06</strong> million euro provided by operating activities in<br />

Fiscal 2<strong>01</strong>0, which benefited from exceptional cash<br />

flows from issue volumes in the Motivation Solutions<br />

activity, notably thanks to the startup of the Eco Pass<br />

offering in Belgium.<br />

P ◀ CONTENTS ▶<br />

Net cash provided by operating activities was<br />

used to finance net capital expenditures and client<br />

investments of 242 million euro (1.5% of revenues).