01 05 09 02 06 10 03 07 11 04 08 12 13 14

01 05 09 02 06 10 03 07 11 04 08 12 13 14

01 05 09 02 06 10 03 07 11 04 08 12 13 14

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>01</strong><br />

<strong>02</strong><br />

<strong>03</strong><br />

<strong>04</strong><br />

<strong>05</strong><br />

<strong>06</strong><br />

<strong>07</strong><br />

<strong>08</strong><br />

<strong>09</strong><br />

<strong>10</strong><br />

<strong>11</strong><br />

<strong>12</strong><br />

<strong>13</strong><br />

<strong>14</strong><br />

<strong>12</strong>6<br />

<strong>06</strong><br />

Consolidated information<br />

Notes to the Consolidated Financial Statements<br />

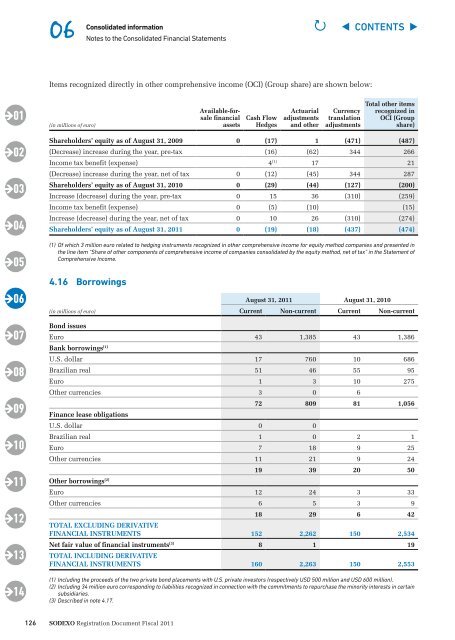

Items recognized directly in other comprehensive income (OCI) (Group share) are shown below:<br />

(in millions of euro)<br />

Sodexo Registration Document Fiscal 2<strong>01</strong>1<br />

Available-forsale<br />

financial<br />

assets<br />

Cash Flow<br />

Hedges<br />

Actuarial<br />

adjustments<br />

and other<br />

Currency<br />

translation<br />

adjustments<br />

Total other items<br />

recognized in<br />

oCI (Group<br />

share)<br />

Shareholders’ equity as of August 31, 20<strong>09</strong> 0 (17) 1 (471) (487)<br />

(Decrease) increase during the year, pre-tax (16) (62) 344 266<br />

Income tax benefit (expense) 4 (1) 17 21<br />

(Decrease) increase during the year, net of tax 0 (<strong>12</strong>) (45) 344 287<br />

Shareholders’ equity as of August 31, 2<strong>01</strong>0 0 (29) (44) (<strong>12</strong>7) (200)<br />

Increase (decrease) during the year, pre-tax 0 15 36 (3<strong>10</strong>) (259)<br />

Income tax benefit (expense) 0 (5) (<strong>10</strong>) (15)<br />

Increase (decrease) during the year, net of tax 0 <strong>10</strong> 26 (3<strong>10</strong>) (274)<br />

Shareholders’ equity as of August 31, 2<strong>01</strong>1 0 (19) (18) (437) (474)<br />

(1) Of which 3 million euro related to hedging instruments recognized in other comprehensive income for equity method companies and presented in<br />

the line item “Share of other components of comprehensive income of companies consolidated by the equity method, net of tax” in the Statement of<br />

Comprehensive Income.<br />

4.16 Borrowings<br />

(in millions of euro)<br />

P ◀ CONTENTS ▶<br />

August 31, 2<strong>01</strong>1 August 31, 2<strong>01</strong>0<br />

Current Non-current Current Non-current<br />

Bond issues<br />

Euro<br />

Bank borrowings<br />

43 1,385 43 1,386<br />

(1)<br />

U.S. dollar 17 760 <strong>10</strong> 686<br />

Brazilian real 51 46 55 95<br />

Euro 1 3 <strong>10</strong> 275<br />

Other currencies 3 0 6<br />

Finance lease obligations<br />

72 8<strong>09</strong> 81 1,<strong>05</strong>6<br />

U.S. dollar 0 0<br />

Brazilian real 1 0 2 1<br />

Euro 7 18 9 25<br />

Other currencies <strong>11</strong> 21 9 24<br />

other borrowings<br />

19 39 20 50<br />

(2)<br />

Euro <strong>12</strong> 24 3 33<br />

Other currencies 6 5 3 9<br />

ToTAL exCLUdING deRIVATIVe<br />

18 29 6 42<br />

FINANCIAL INSTRUMeNTS 152 2,262 150 2,534<br />

Net fair value of financial instruments (3) ToTAL INCLUdING deRIVATIVe<br />

8 1 19<br />

FINANCIAL INSTRUMeNTS 160 2,263 150 2,553<br />

(1) Including the proceeds of the two private bond placements with U.S. private investors (respectively USD 500 million and USD 600 million).<br />

(2) Including 34 million euro corresponding to liabilities recognized in connection with the commitments to repurchase the minority interests in certain<br />

subsidiaries.<br />

(3) Described in note 4.17.