01 05 09 02 06 10 03 07 11 04 08 12 13 14

01 05 09 02 06 10 03 07 11 04 08 12 13 14

01 05 09 02 06 10 03 07 11 04 08 12 13 14

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>01</strong><br />

<strong>02</strong><br />

<strong>03</strong><br />

<strong>04</strong><br />

<strong>05</strong><br />

<strong>06</strong><br />

<strong>07</strong><br />

<strong>08</strong><br />

<strong>09</strong><br />

<strong>10</strong><br />

<strong>11</strong><br />

<strong>12</strong><br />

<strong>13</strong><br />

<strong>14</strong><br />

<strong>13</strong>0<br />

<strong>06</strong><br />

Consolidated information<br />

Notes to the Consolidated Financial Statements<br />

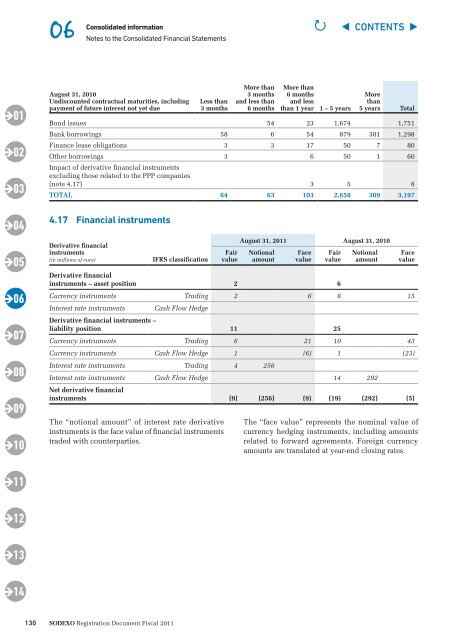

August 31, 2<strong>01</strong>0<br />

Undiscounted contractual maturities, including<br />

payment of future interest not yet due<br />

Sodexo Registration Document Fiscal 2<strong>01</strong>1<br />

Less than<br />

3 months<br />

More than<br />

3 months<br />

and less than<br />

6 months<br />

More than<br />

6 months<br />

and less<br />

than 1 year 1 – 5 years<br />

More<br />

than<br />

5 years Total<br />

Bond issues 54 23 1,674 1,751<br />

Bank borrowings 58 6 54 879 3<strong>01</strong> 1,298<br />

Finance lease obligations 3 3 17 50 7 80<br />

Other borrowings<br />

Impact of derivative financial instruments<br />

excluding those related to the PPP companies<br />

3 6 50 1 60<br />

(note 4.17) 3 5 8<br />

ToTAL 64 63 <strong>10</strong>3 2,658 3<strong>09</strong> 3,197<br />

4.17 Financial instruments<br />

derivative financial<br />

instruments<br />

(in millions of euro) IFRS classification<br />

Fair<br />

value<br />

August 31, 2<strong>01</strong>1 August 31, 2<strong>01</strong>0<br />

Notional<br />

amount<br />

Face<br />

value<br />

Fair<br />

value<br />

derivative financial<br />

instruments – asset position 2 6<br />

Notional<br />

amount<br />

Currency instruments Trading 2 6 6 15<br />

Interest rate instruments Cash Flow Hedge<br />

derivative financial instruments –<br />

liability position <strong>11</strong> 25<br />

Currency instruments Trading 6 21 <strong>10</strong> 43<br />

Currency instruments Cash Flow Hedge 1 (6) 1 (23)<br />

Interest rate instruments Trading 4 256<br />

Face<br />

value<br />

Interest rate instruments<br />

Net derivative financial<br />

Cash Flow Hedge <strong>14</strong> 292<br />

instruments (9) (256) (9) (19) (292) (5)<br />

The “notional amount” of interest rate derivative<br />

instruments is the face value of financial instruments<br />

traded with counterparties.<br />

P ◀ CONTENTS ▶<br />

The “face value” represents the nominal value of<br />

currency hedging instruments, including amounts<br />

related to forward agreements. Foreign currency<br />

amounts are translated at year-end closing rates.