You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

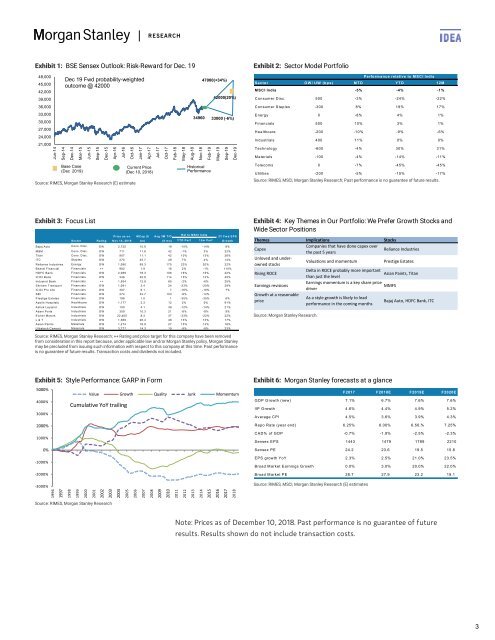

Exhibit 1: BSE Sensex Outlook: Risk-Reward for Dec. 19<br />

48,000<br />

45,000<br />

42,000<br />

39,000<br />

36,000<br />

33,000<br />

30,000<br />

27,000<br />

24,000<br />

21,000<br />

Jun-14<br />

Sep-14<br />

Dec 19 Fwd probability-weighted<br />

outcome @ 42000<br />

Dec-14<br />

Mar-15<br />

Base Case<br />

(Dec 2019)<br />

Jun-15<br />

Sep-15<br />

Dec-15<br />

Apr-16<br />

Jul-16<br />

Oct-16<br />

Source: RIMES, Morgan Stanley Research (E) estimate<br />

Jan-17<br />

Apr-17<br />

Current Price<br />

(Dec 10, 2018)<br />

Jul-17<br />

Oct-17<br />

Feb-18<br />

May-18<br />

Aug-18<br />

34960<br />

Nov-18<br />

47000(+34%)<br />

Feb-19<br />

Historical<br />

Performance<br />

42000(20%)<br />

33000 (-6%)<br />

May-19<br />

Sep-19<br />

Dec-19<br />

Exhibit 2: Sector Model Portfolio<br />

Perform ance relative to M SC I India<br />

Sector O W / U W (bps) M T D YT D 12M<br />

M SC I India -5% -4% -1%<br />

C onsumer D isc. 500 -3% -24% -22%<br />

C onsumer Staples -300 8% 19% 17%<br />

Energy 0 -8% 4% 1%<br />

Financials 500 10% 3% 1%<br />

H ealthcare -200 -10% -9% -6%<br />

Industrials 400 11% 0% 0%<br />

Technology -600 -4% 30% 31%<br />

M aterials -100 -4% -14% -11%<br />

Telecoms 0 -7% -45% -45%<br />

U tilities -200 -5% -15% -17%<br />

Source: RIMES, MSCI, Morgan Stanley Research; Past performance is no guarantee of future results.<br />

Exhibit 3: Focus List<br />

Sector<br />

R ating<br />

Price as on<br />

N ov 14, 2018<br />

M C ap ($<br />

Avg 3M T /O<br />

R el to M SC I India<br />

YT D Perf<br />

12m Perf<br />

Bajaj Auto C ons. D isc. EW 2,725 10.9 19 -15% -14% 8%<br />

M &M C ons. D isc. O W 711 11.6 42 -1% 3% 22%<br />

Titan C ons. D isc. O W 907 11.1 42 10% 13% 26%<br />

ITC Staples O W 270 45.7 49 7% 4% 14%<br />

R eliance Industries Energy O W 1,090 95.3 175 23% 20% 22%<br />

Bharat Financial Financials ++ 982 1.9 18 2% -1% 110%<br />

H D FC Bank Financials O W 2,089 78.3 106 16% 15% 22%<br />

IC IC I Bank Financials O W 346 30.8 114 15% 13% 45%<br />

Indusind Bank Financials ++ 1,554 12.9 65 -2% -6% 25%<br />

Shriram Transport Financials O W 1,091 3.4 24 -23% -20% 29%<br />

IC IC I Pru Life Financials O W 307 6.1 7 -16% -18% 7%<br />

SBI Financials O W 274 33.7 103 -8% -12%<br />

2Y Fw d EPS<br />

Prestige Estates Financials O W 198 1.0 1 -35% -35% 6%<br />

Apollo H ospitals H ealthcare O W 1,177 2.3 12 2% 0% 91%<br />

Ashok Leyland Industrials O W 100 4.1 38 -12% -14% 21%<br />

Adani Ports Industrials O W 359 10.3 21 -8% -8% 9%<br />

Eicher M otors Industrials O W 22,405 8.4 37 -23% -22% 22%<br />

L & T Industrials O W 1,368 26.4 48 13% 13% 17%<br />

Asian Paints M aterials O W 1,274 16.9 27 15% 13% 16%<br />

U ltratech C ement M aterials O W 3,777 14.3 19 -9% -8% 23%<br />

bn)<br />

($ m n)<br />

G row th<br />

Source: RIMES, Morgan Stanley Research; ++ Rating and price target for this company have been removed<br />

from consideration in this report because, under applicable law and/or Morgan Stanley policy, Morgan Stanley<br />

may be precluded from issuing such information with respect to this company at this time. Past performance<br />

is no guarantee of future results. Transaction costs and dividends not included.<br />

Exhibit 4: Key Themes in Our Portfolio: We Prefer Growth Stocks and<br />

Wide Sector Positions<br />

Themes Implications Stocks<br />

Capex<br />

Companies that have done capex over<br />

the past 5 years<br />

Reliance Industries<br />

Unloved and underowned<br />

stocks<br />

Valuations and momentum<br />

Prestige Estates<br />

Rising ROCE<br />

Delta in ROCE probably more important<br />

Asian Paints, Titan<br />

Earnings revisions<br />

Growth at a reasonable<br />

price<br />

Source: Morgan Stanley Research.<br />

than just the level<br />

Earnings momentum is a key share price<br />

driver<br />

As a style growth is likely to lead<br />

performance in the coming months<br />

MMFS<br />

Bajaj Auto, HDFC Bank, ITC<br />

Exhibit 5: Style Performance: GARP in Form<br />

5000%<br />

4000%<br />

3000%<br />

2000%<br />

1000%<br />

0%<br />

-1000%<br />

-2000%<br />

-3000%<br />

Value Growth Quality Junk Momemtum<br />

Cumulative YoY trailing<br />

1996<br />

1997<br />

1998<br />

1999<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

2015<br />

2016<br />

2017<br />

2018<br />

Source: RIMES, Morgan Stanley Research<br />

Exhibit 6: Morgan Stanley forecasts at a glance<br />

F2017 F2018E F2019E F2020E<br />

G DP G rowth (new) 7.1% 6.7% 7.6% 7.6%<br />

IIP G rowth 4.6% 4.4% 4.9% 5.2%<br />

Av erage CPI 4.5% 3.6% 3.9% 4.3%<br />

Repo Rate (year end) 6.25% 6.00% 6.50.% 7.25%<br />

CAD% of G DP -0.7% -1.9% -2.5% -2.3%<br />

Sensex EPS 1443 1479 1789 2210<br />

Sensex PE 24.2 23.6 19.5 15.8<br />

EPS growth YoY 2.3% 2.5% 21.0% 23.5%<br />

Broad M arket Earnings G rowth 0.0% 3.0% 20.0% 22.0%<br />

Broad M arket PE 28.7 27.9 23.2 19.1<br />

Source: RIMES, MSCI, Morgan Stanley Research (E) estimates<br />

Note: Prices as of December 10, 2018. Past performance is no guarantee of future<br />

results. Results shown do not include transaction costs.<br />

3