You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE INVESTMENT OUTLOOK FOR 2019: LATE-CYCLE RISKS AND OPPORTUNITIES<br />

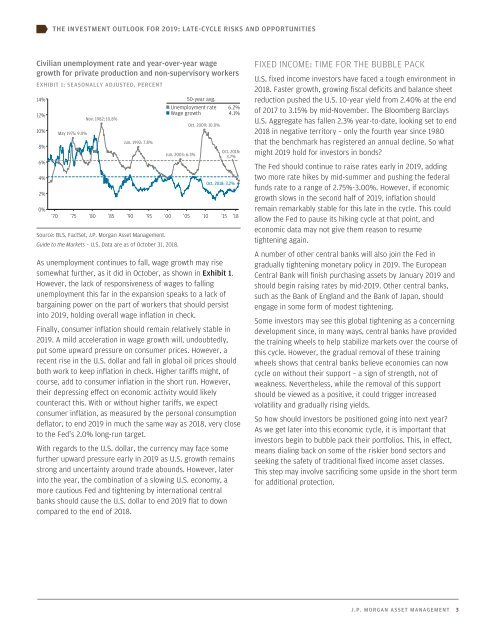

Civilian unemployment rate and year-over-year wage<br />

growth for private production and non-supervisory workers<br />

EXHIBIT 1: SEASONALLY ADJUSTED, PERCENT<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

May 1975: 9.0%<br />

Nov. 1982: 10.8%<br />

Jun. 1992: 7.8%<br />

50-year avg.<br />

• Unemployment rate<br />

• Wage growth<br />

Jun. 2003: 6.3%<br />

Oct. 2009: 10.0%<br />

6.2%<br />

4.1%<br />

Oct. 2018:<br />

3.7%<br />

Oct. 2018: 3.2%<br />

’70 ’75 ’80 ’85 ’90 ’95 ’00 ’05 ’10 ’15 ’18<br />

Source: BLS, FactSet, J.P. Morgan Asset Management.<br />

Guide to the Markets – U.S. Data are as of October 31, 2018.<br />

As unemployment continues to fall, wage growth may rise<br />

somewhat further, as it did in October, as shown in Exhibit 1.<br />

However, the lack of responsiveness of wages to falling<br />

unemployment this far in the expansion speaks to a lack of<br />

bargaining power on the part of workers that should persist<br />

into 2019, holding overall wage inflation in check.<br />

Finally, consumer inflation should remain relatively stable in<br />

2019. A mild acceleration in wage growth will, undoubtedly,<br />

put some upward pressure on consumer prices. However, a<br />

recent rise in the U.S. dollar and fall in global oil prices should<br />

both work to keep inflation in check. Higher tariffs might, of<br />

course, add to consumer inflation in the short run. However,<br />

their depressing effect on economic activity would likely<br />

counteract this. With or without higher tariffs, we expect<br />

consumer inflation, as measured by the personal consumption<br />

deflator, to end 2019 in much the same way as 2018, very close<br />

to the Fed’s 2.0% long-run target.<br />

With regards to the U.S. dollar, the currency may face some<br />

further upward pressure early in 2019 as U.S. growth remains<br />

strong and uncertainty around trade abounds. However, later<br />

into the year, the combination of a slowing U.S. economy, a<br />

more cautious Fed and tightening by international central<br />

banks should cause the U.S. dollar to end 2019 flat to down<br />

compared to the end of 2018.<br />

FIXED INCOME: TIME FOR THE BUBBLE PACK<br />

U.S. fixed income investors have faced a tough environment in<br />

2018. Faster growth, growing fiscal deficits and balance sheet<br />

reduction pushed the U.S. 10-year yield from 2.40% at the end<br />

of 2017 to 3.15% by mid-November. The Bloomberg Barclays<br />

U.S. Aggregate has fallen 2.3% year-to-date, looking set to end<br />

2018 in negative territory – only the fourth year since 1980<br />

that the benchmark has registered an annual decline. So what<br />

might 2019 hold for investors in bonds?<br />

The Fed should continue to raise rates early in 2019, adding<br />

two more rate hikes by mid-summer and pushing the federal<br />

funds rate to a range of 2.75%-3.00%. However, if economic<br />

growth slows in the second half of 2019, inflation should<br />

remain remarkably stable for this late in the cycle. This could<br />

allow the Fed to pause its hiking cycle at that point, and<br />

economic data may not give them reason to resume<br />

tightening again.<br />

A number of other central banks will also join the Fed in<br />

gradually tightening monetary policy in 2019. The European<br />

Central Bank will finish purchasing assets by January 2019 and<br />

should begin raising rates by mid-2019. Other central banks,<br />

such as the Bank of England and the Bank of Japan, should<br />

engage in some form of modest tightening.<br />

Some investors may see this global tightening as a concerning<br />

development since, in many ways, central banks have provided<br />

the training wheels to help stabilize markets over the course of<br />

this cycle. However, the gradual removal of these training<br />

wheels shows that central banks believe economies can now<br />

cycle on without their support – a sign of strength, not of<br />

weakness. Nevertheless, while the removal of this support<br />

should be viewed as a positive, it could trigger increased<br />

volatility and gradually rising yields.<br />

So how should investors be positioned going into next year?<br />

As we get later into this economic cycle, it is important that<br />

investors begin to bubble pack their portfolios. This, in effect,<br />

means dialing back on some of the riskier bond sectors and<br />

seeking the safety of traditional fixed income asset classes.<br />

This step may involve sacrificing some upside in the short term<br />

for additional protection.<br />

J.P. MORGAN ASSET MANAGEMENT 3