Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

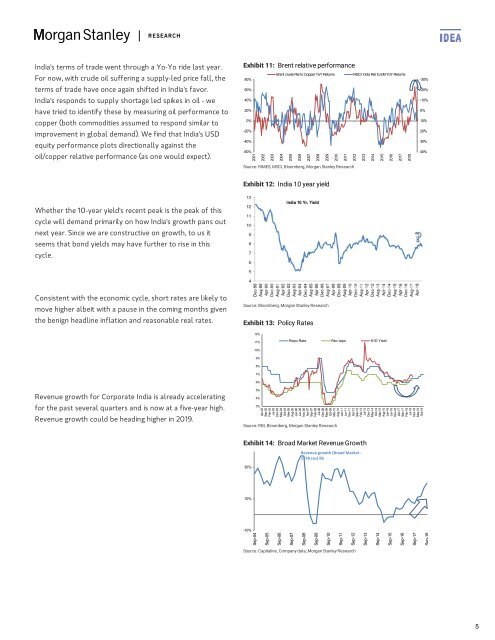

India's terms of trade went through a Yo-Yo ride last year.<br />

For now, with crude oil suffering a supply-led price fall, the<br />

terms of trade have once again shifted in India's favor.<br />

India's responds to supply shortage led spikes in oil - we<br />

have tried to identify these by measuring oil performance to<br />

copper (both commodities assumed to respond similar to<br />

improvement in global demand). We find that India's USD<br />

equity performance plots directionally against the<br />

oil/copper relative performance (as one would expect).<br />

Exhibit 11: Brent relative performance<br />

Brent crude Rel to Copper YoY Returns MSCI India Rel to EM YoY Returns<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

-20%<br />

-40%<br />

-60%<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

2015<br />

2016<br />

2017<br />

2018<br />

Source: RIMES, MSCI, Bloomberg, Morgan Stanley Research<br />

Exhibit 12: India 10 year yield<br />

-30%<br />

-20%<br />

-10%<br />

0%<br />

10%<br />

20%<br />

30%<br />

40%<br />

Whether the 10-year yield's recent peak is the peak of this<br />

cycle will demand primarily on how India's growth pans out<br />

next year. Since we are constructive on growth, to us it<br />

seems that bond yields may have further to rise in this<br />

cycle.<br />

Consistent with the economic cycle, short rates are likely to<br />

move higher albeit with a pause in the coming months given<br />

the benign headline inflation and reasonable real rates.<br />

Source: Bloomberg, Morgan Stanley Research<br />

Exhibit 13: Policy Rates<br />

12%<br />

11%<br />

Repo Rate Rev repo 91D Yield<br />

10%<br />

9%<br />

8%<br />

7%<br />

6%<br />

Revenue growth for Corporate India is already accelerating<br />

for the past several quarters and is now at a five-year high.<br />

Revenue growth could be heading higher in 2019.<br />

5%<br />

4%<br />

3%<br />

Apr-02<br />

Sep-02<br />

Feb-03<br />

Jul-03<br />

Dec-03<br />

May-04<br />

Oct-04<br />

Mar-05<br />

Aug-05<br />

Jan-06<br />

Jun-06<br />

Nov-06<br />

Apr-07<br />

Sep-07<br />

Feb-08<br />

Jul-08<br />

Dec-08<br />

May-09<br />

Oct-09<br />

Mar-10<br />

Aug-10<br />

Jan-11<br />

Jun-11<br />

Nov-11<br />

Apr-12<br />

Sep-12<br />

Feb-13<br />

Jul-13<br />

Dec-13<br />

May-14<br />

Oct-14<br />

Mar-15<br />

Aug-15<br />

Jan-16<br />

Jun-16<br />

Nov-16<br />

Apr-17<br />

Sep-17<br />

Feb-18<br />

Jul-18<br />

Dec-18<br />

May-19<br />

Oct-19<br />

Source: RBI, Bloomberg, Morgan Stanley Research<br />

Exhibit 14: Broad Market Revenue Growth<br />

30%<br />

Revenue growth (Broad Market -<br />

1178 cos) RS<br />

10%<br />

-10%<br />

Sep-04<br />

Sep-05<br />

Sep-06<br />

Sep-07<br />

Sep-08<br />

Sep-09<br />

Sep-10<br />

Sep-11<br />

Sep-12<br />

Sep-13<br />

Sep-14<br />

Sep-15<br />

Sep-16<br />

Sep-17<br />

Sep-18<br />

Source: Capitaline, Company data, Morgan Stanley Research<br />

5