Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Retail-NBFC – Key asset classes drive growth<br />

Exhibit 4 : Asset class wise growth-September 2018<br />

Exhibit 5 : Asset class wise growth<br />

Source: ICRA Research; Company/ Company Investor presentations<br />

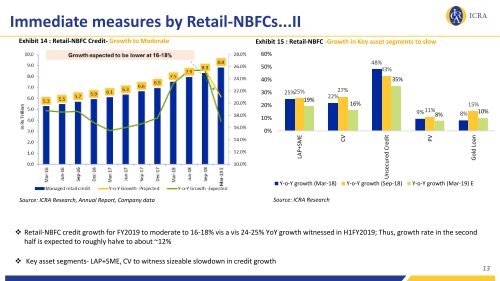

❖ Retail-NBFC credit growth was driven largely by LAP+SME, CV and unsecured credit (personal credit and microfinance); although almost all segments<br />

witnessed revival in FY2018 and this continued into H1FY2019. H1FY2019 growth rates was on the back of the lower pace of growth in H1FY2018<br />

❖ Competitive pricing pressures in some key segment, constrained funding availability and expected uptick in delinquencies would temper overall<br />

growth in the near to medium term<br />

❖ Growth would moderate in H2FY2019 and access to funding would be key driver in FY2020<br />

7