Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Strategy<br />

Market<br />

INDIA<br />

DECEMBER 31, 2018<br />

UPDATE<br />

BSE-30: 36,068<br />

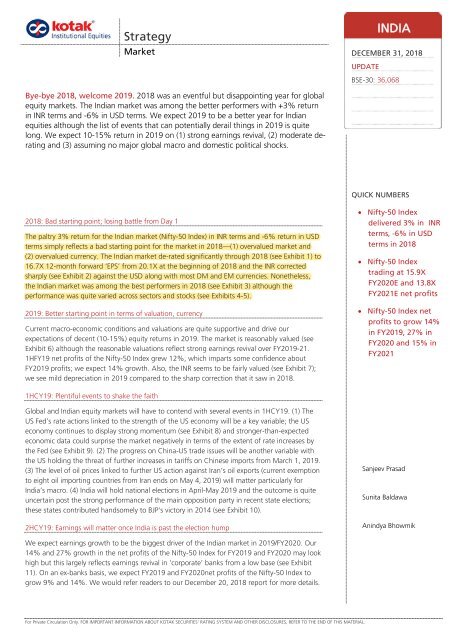

Bye-bye 2018, welcome 2019. 2018 was an eventful but disappointing year for global<br />

equity markets. The Indian market was among the better performers with +3% return<br />

in INR terms and -6% in USD terms. We expect 2019 to be a better year for Indian<br />

equities although the list of events that can potentially derail things in 2019 is quite<br />

long. We expect 10-15% return in 2019 on (1) strong earnings revival, (2) moderate derating<br />

and (3) assuming no major global macro and domestic political shocks.<br />

QUICK NUMBERS<br />

2018: Bad starting point; losing battle from Day 1<br />

The paltry 3% return for the Indian market (Nifty-50 Index) in INR terms and -6% return in USD<br />

terms simply reflects a bad starting point for the market in 2018—(1) overvalued market and<br />

(2) overvalued currency. The Indian market de-rated significantly through 2018 (see Exhibit 1) to<br />

16.7X 12-month forward ‘EPS’ from 20.1X at the beginning of 2018 and the INR corrected<br />

sharply (see Exhibit 2) against the USD along with most DM and EM currencies. Nonetheless,<br />

the Indian market was among the best performers in 2018 (see Exhibit 3) although the<br />

performance was quite varied across sectors and stocks (see Exhibits 4-5).<br />

2019: Better starting point in terms of valuation, currency<br />

Current macro-economic conditions and valuations are quite supportive and drive our<br />

expectations of decent (10-15%) equity returns in 2019. The market is reasonably valued (see<br />

Exhibit 6) although the reasonable valuations reflect strong earnings revival over FY2019-21.<br />

1HFY19 net profits of the Nifty-50 Index grew 12%, which imparts some confidence about<br />

FY2019 profits; we expect 14% growth. Also, the INR seems to be fairly valued (see Exhibit 7);<br />

we see mild depreciation in 2019 compared to the sharp correction that it saw in 2018.<br />

1HCY19: Plentiful events to shake the faith<br />

Global and Indian equity markets will have to contend with several events in 1HCY19. (1) The<br />

US Fed’s rate actions linked to the strength of the US economy will be a key variable; the US<br />

economy continues to display strong momentum (see Exhibit 8) and stronger-than-expected<br />

economic data could surprise the market negatively in terms of the extent of rate increases by<br />

the Fed (see Exhibit 9). (2) The progress on China-US trade issues will be another variable with<br />

the US holding the threat of further increases in tariffs on Chinese imports from March 1, 2019.<br />

(3) The level of oil prices linked to further US action against Iran’s oil exports (current exemption<br />

to eight oil importing countries from Iran ends on May 4, 2019) will matter particularly for<br />

India’s macro. (4) India will hold national elections in April-May 2019 and the outcome is quite<br />

uncertain post the strong performance of the main opposition party in recent state elections;<br />

these states contributed handsomely to BJP’s victory in 2014 (see Exhibit 10).<br />

<br />

<br />

<br />

Nifty-50 Index<br />

delivered 3% in INR<br />

terms, -6% in USD<br />

terms in 2018<br />

Nifty-50 Index<br />

trading at 15.9X<br />

FY2020E and 13.8X<br />

FY2021E net profits<br />

Nifty-50 Index net<br />

profits to grow 14%<br />

in FY2019, 27% in<br />

FY2020 and 15% in<br />

FY2021<br />

Sanjeev Prasad<br />

Sunita Baldawa<br />

2HCY19: Earnings will matter once India is past the election hump<br />

Anindya Bhowmik<br />

We expect earnings growth to be the biggest driver of the Indian market in 2019/FY2020. Our<br />

14% and 27% growth in the net profits of the Nifty-50 Index for FY2019 and FY2020 may look<br />

high but this largely reflects earnings revival in ‘corporate’ banks from a low base (see Exhibit<br />

11). On an ex-banks basis, we expect FY2019 and FY2020net profits of the Nifty-50 Index to<br />

grow 9% and 14%. We would refer readers to our December 20, 2018 report for more details.<br />

For Private Circulation Only. FOR IMPORTANT INFORMATION ABOUT KOTAK SECURITIES’ RATING SYSTEM AND OTHER DISCLOSURES, REFER TO THE END OF THIS MATERIAL.