You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Strategy<br />

India<br />

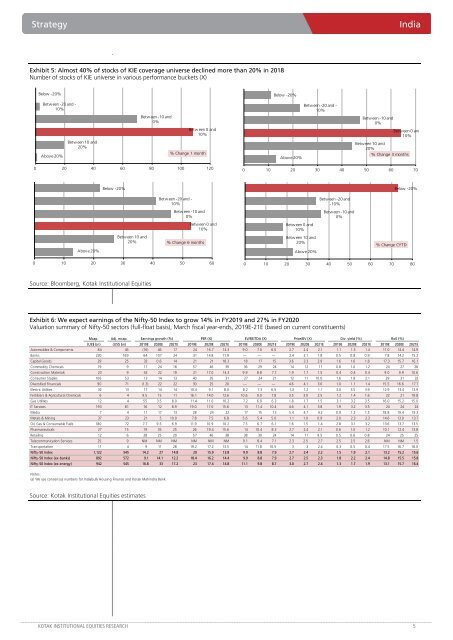

Exhibit 5: Almost 40% of stocks of KIE coverage universe declined more than 20% in 2018<br />

Number of stocks of KIE universe in various performance buckets (X)<br />

Below -20%<br />

Below -20%<br />

Betw een -20 and -<br />

10%<br />

Betw een -20 and -<br />

10%<br />

Betw een -10 and<br />

0%<br />

Betw een -10 and<br />

0%<br />

Betw een 0 and<br />

10%<br />

Betw een 0 and<br />

10%<br />

Above 20%<br />

Betw een 10 and<br />

20%<br />

% Change 1 month<br />

Above 20%<br />

Betw een 10 and<br />

20%<br />

% Change 3 months<br />

0 20 40 60 80 100 120<br />

0 10 20 30 40 50 60 70<br />

Below -20%<br />

Below -20%<br />

Betw een -20 and -<br />

10%<br />

Betw een -20 and<br />

-10%<br />

Betw een -10 and<br />

0%<br />

Betw een -10 and<br />

0%<br />

Betw een 0 and<br />

10%<br />

Betw een 0 and<br />

10%<br />

Betw een 10 and<br />

20%<br />

% Change 6 months<br />

Betw een 10 and<br />

20%<br />

% Change CYTD<br />

Above 20%<br />

Above 20%<br />

0 10 20 30 40 50 60<br />

0 10 20 30 40 50 60 70 80<br />

Source: Bloomberg, Kotak Institutional Equities<br />

Exhibit 6: We expect earnings of the Nifty-50 Index to grow 14% in FY2019 and 27% in FY2020<br />

Valuation summary of Nifty-50 sectors (full-float basis), March fiscal year-ends, 2019E-21E (based on current constituents)<br />

Mcap.<br />

Adj. mcap.<br />

Earnings growth (%) PER (X) EV/EBITDA (X) Price/BV (X) Div. yield (%)<br />

(US$ bn) (US$ bn) 2019E 2020E 2021E 2019E 2020E 2021E 2019E 2020E 2021E 2019E 2020E 2021E 2019E 2020E 2021E 2019E 2020E 2021E<br />

Automobiles & Components 84 46 (16) 46 17 24 16.7 14.3 9.0 7.0 6.0 2.7 2.4 2.1 1.1 1.3 1.4 11.0 14.4 14.9<br />

Banks 230 169 64 107 24 31 14.8 11.9 — — — 2.4 2.1 1.8 0.5 0.8 0.9 7.8 14.2 15.2<br />

Capital Goods 29 25 33 0.6 14 21 21 18.3 18 17 15 3.6 3.3 2.9 1.6 1.6 1.8 17.3 15.7 16.1<br />

Commodity Chemicals 19 9 17 24 18 57 46 39 36 29 24 14 12 11 0.8 1.0 1.2 24 27 28<br />

Construction Materials 23 9 43 22 19 21 17.0 14.3 9.9 8.8 7.7 1.9 1.7 1.5 0.4 0.4 0.4 9.0 9.9 10.6<br />

Consumer Staples 106 53 13 14 13 40 35 31 27 24 21 12 11 10.0 1.6 1.8 2.1 29 31 32<br />

Diversified Financials 90 71 (1.3) 22 22 30 25 20 — — — 4.6 4.1 3.6 1.0 1.1 1.4 15.5 16.6 17.7<br />

Electric Utilities 32 13 17 14 14 10.4 9.1 8.0 8.2 7.3 6.5 1.3 1.2 1.1 3.0 3.5 3.9 12.9 13.4 13.9<br />

Fertilizers & Agricultural Chemicals 6 4 9.5 15 11 16.1 14.0 12.6 10.6 9.0 7.8 3.5 3.0 2.5 1.2 1.4 1.6 22 21 19.8<br />

Gas Utilities 12 4 55 3.5 8.0 11.4 11.0 10.2 7.2 6.9 6.3 1.8 1.7 1.5 3.1 3.2 3.5 16.0 15.2 15.0<br />

IT Services 193 81 16 12 8.9 19.0 17.0 15.6 13 11.4 10.4 4.6 4.1 3.8 1.9 3.2 3.5 24 24 24<br />

Media 7 4 11 17 13 28 24 22 17 15 13 5.4 4.7 4.2 0.9 1.2 1.5 18.8 19.4 19.3<br />

Metals & Mining 37 23 21 5 10.0 7.8 7.5 6.8 5.6 5.4 5.0 1.1 1.0 0.9 2.0 2.3 2.3 14.6 13.9 13.7<br />

Oil, Gas & Consumable Fuels 180 72 7.7 9.5 6.9 11.9 10.9 10.2 7.5 6.7 6.1 1.6 1.5 1.4 2.8 3.1 3.2 13.6 13.7 13.5<br />

Pharmaceuticals 27 15 19 35 25 26 19.4 15.6 14 10.4 8.3 2.7 2.4 2.1 0.6 1.0 1.2 10.1 12.4 13.8<br />

Retailing 12 6 28 25 20 57 46 38 38 30 24 14 11 9.5 0.5 0.6 0.8 24 25 25<br />

Telecommunication Services 25 9 NM NM NM NM NM NM 9.1 8.4 7.1 2.3 2.5 2.7 2.5 2.5 2.6 NM NM 1.5<br />

Transportation 11 4 9 11 28 19.2 17.2 13.5 14 11.8 10.5 3 3 2.4 0.3 0.5 0.4 17.5 16.7 18.0<br />

Nifty-50 Index 1,122 545 14.2 27 14.8 20 15.9 13.8 9.9 8.8 7.9 2.7 2.4 2.2 1.5 1.9 2.1 13.2 15.2 15.6<br />

Nifty-50 Index (ex-banks) 892 572 9.1 14.1 12.2 18.4 16.2 14.4 9.9 8.8 7.9 2.7 2.5 2.3 1.8 2.2 2.4 14.8 15.5 15.8<br />

Nifty-50 Index (ex-energy) 942 545 16.8 33 17.2 23 17.4 14.8 11.1 9.8 8.7 3.0 2.7 2.4 1.3 1.7 1.9 13.1 15.7 16.4<br />

RoE (%)<br />

Notes:<br />

(a) We use consensus numbers for Indiabulls Housing Finance and Kotak Mahindra Bank.<br />

Source: Kotak Institutional Equities estimates<br />

KOTAK INSTITUTIONAL EQUITIES RESEARCH 5