You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Assessing the Cycle - 2019 in Better Shape than 2018<br />

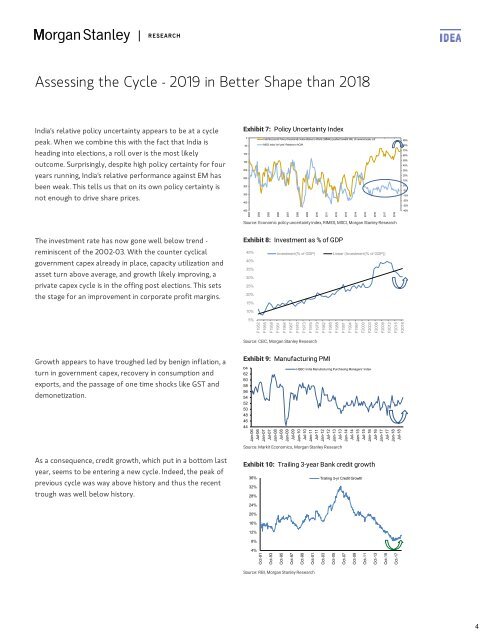

India's relative policy uncertainty appears to be at a cycle<br />

peak. When we combine this with the fact that India is<br />

heading into elections, a roll over is the most likely<br />

outcome. Surprisingly, despite high policy certainty for four<br />

years running, India's relative performance against EM has<br />

been weak. This tells us that on its own policy certainty is<br />

not enough to drive share prices.<br />

Exhibit 7: Policy Uncertainty Index<br />

0<br />

50<br />

100<br />

150<br />

200<br />

250<br />

300<br />

350<br />

400<br />

450<br />

India Economic Policy Uncertainity Index relative to World (3MMA) (pushed forward 3M) on reverse scale -LS<br />

MSCI India YoY perf. Relative to ACWI<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

2015<br />

2016<br />

2017<br />

2018<br />

Source: Economic policy uncertainty index, RIMES, MSCI, Morgan Stanley Research<br />

95%<br />

85%<br />

75%<br />

65%<br />

55%<br />

45%<br />

35%<br />

25%<br />

15%<br />

5%<br />

-5%<br />

-15%<br />

-25%<br />

-35%<br />

-45%<br />

The investment rate has now gone well below trend -<br />

reminiscent of the 2002-03. With the counter cyclical<br />

government capex already in place, capacity utilization and<br />

asset turn above average, and growth likely improving, a<br />

private capex cycle is in the offing post elections. This sets<br />

the stage for an improvement in corporate profit margins.<br />

Exhibit 8: Investment as % of GDP<br />

45%<br />

Investment(% of GDP) Linear (Investment(% of GDP))<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

F1952<br />

F1955<br />

F1958<br />

F1961<br />

F1964<br />

F1967<br />

F1970<br />

F1973<br />

F1976<br />

F1979<br />

F1982<br />

F1985<br />

F1988<br />

F1991<br />

F1994<br />

F1997<br />

F2000<br />

F2003<br />

F2006<br />

F2009<br />

F2012<br />

F2015<br />

F2018<br />

Source: CEIC, Morgan Stanley Research<br />

Growth appears to have troughed led by benign inflation, a<br />

turn in government capex, recovery in consumption and<br />

exports, and the passage of one time shocks like GST and<br />

demonetization.<br />

As a consequence, credit growth, which put in a bottom last<br />

year, seems to be entering a new cycle. Indeed, the peak of<br />

previous cycle was way above history and thus the recent<br />

trough was well below history.<br />

Exhibit 9: Manufacturing PMI<br />

64<br />

62<br />

60<br />

58<br />

56<br />

54<br />

52<br />

50<br />

48<br />

46<br />

44<br />

HSBC India Manufacturing Purchasing Managers’ Index<br />

Jan-06<br />

Jul-06<br />

Jan-07<br />

Jul-07<br />

Jan-08<br />

Jul-08<br />

Jan-09<br />

Jul-09<br />

Jan-10<br />

Jul-10<br />

Jan-11<br />

Jul-11<br />

Jan-12<br />

Jul-12<br />

Jan-13<br />

Jul-13<br />

Jan-14<br />

Jul-14<br />

Jan-15<br />

Jul-15<br />

Jan-16<br />

Jul-16<br />

Jan-17<br />

Jul-17<br />

Jan-18<br />

Jul-18<br />

Source: Markit Economics, Morgan Stanley Research<br />

Exhibit 10: Trailing 3-year Bank credit growth<br />

36%<br />

32%<br />

28%<br />

24%<br />

20%<br />

16%<br />

12%<br />

8%<br />

4%<br />

Oct-91<br />

Oct-93<br />

Oct-95<br />

Oct-97<br />

Oct-99<br />

Oct-01<br />

Trailing 3-yr Credit Growth<br />

Oct-03<br />

Oct-05<br />

Oct-07<br />

Oct-09<br />

Oct-11<br />

Oct-13<br />

Oct-15<br />

Oct-17<br />

Source: RBI, Morgan Stanley Research<br />

4