Panalpina Annual Report 2011

Panalpina Annual Report 2011

Panalpina Annual Report 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

100<br />

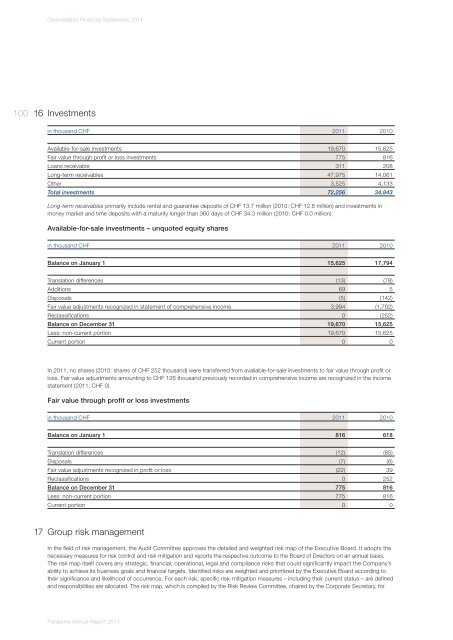

16<br />

Consolidated Financial Statements <strong>2011</strong><br />

Investments<br />

in thousand CHF <strong>2011</strong> 2010<br />

Available-for-sale investments 19,670 15,625<br />

Fair value through profit or loss investments 775 816<br />

Loans receivable 311 208<br />

Long-term receivables 47,975 14,061<br />

Other 3,525 4,133<br />

Total investments 72,256 34,843<br />

Long-term receivables primarily include rental and guarantee deposits of CHF 13.7 million (2010: CHF 12.8 million) and investments in<br />

money market and time deposits with a maturity longer than 360 days of CHF 34.3 million (2010: CHF 0.0 million).<br />

Available-for-sale investments – unquoted equity shares<br />

in thousand CHF <strong>2011</strong> 2010<br />

Balance on January 1 15,625 17,794<br />

Translation differences (13) (78)<br />

Additions 69 5<br />

Disposals (5) (142)<br />

Fair value adjustments recognized in statement of comprehensive income 3,994 (1,702)<br />

Reclassifications 0 (252)<br />

Balance on December 31 19,670 15,625<br />

Less: non-current portion 19,670 15,625<br />

Current portion 0 0<br />

In <strong>2011</strong>, no shares (2010: shares of CHF 252 thousand) were transferred from available-for-sale investments to fair value through profit or<br />

loss. Fair value adjustments amounting to CHF 126 thousand previously recorded in comprehensive income are recognized in the income<br />

statement (<strong>2011</strong>: CHF 0).<br />

Fair value through profit or loss investments<br />

in thousand CHF <strong>2011</strong> 2010<br />

Balance on January 1 816 618<br />

Translation differences (12) (85)<br />

Disposals (7) (8)<br />

Fair value adjustments recognized in profit or loss (22) 39<br />

Reclassifications 0 252<br />

Balance on December 31 775 816<br />

Less: non-current portion 775 816<br />

Current portion 0 0<br />

17<br />

Group risk management<br />

In the field of risk management, the Audit Committee approves the detailed and weighted risk map of the Executive Board. It adopts the<br />

necessary measures for risk control and risk mitigation and reports the respective outcome to the Board of Directors on an annual basis.<br />

The risk map itself covers any strategic, financial, operational, legal and compliance risks that could significantly impact the Company’s<br />

ability to achieve its business goals and financial targets. Identified risks are weighted and prioritized by the Executive Board according to<br />

their significance and likelihood of occurrence. For each risk, specific risk-mitigation measures – including their current status – are defined<br />

and responsibilities are allocated. The risk map, which is compiled by the Risk Review Committee, chaired by the Corporate Secretary, for<br />

<strong>Panalpina</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>