You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Tax changes<br />

they must report the amount of the advance recovery rebate credit<br />

payment they received. If they did not receive the full amount<br />

to which they were entitled, they can receive the difference as a<br />

refund on their return. If they received more than they were entitled<br />

to receive, they are not required to repay the difference. These<br />

differences may arise because the IRS based the advance payment<br />

upon 2020 information, but the actual credit is calculated based<br />

upon <strong>2021</strong> information. For example, if a single farmer had $60,000<br />

of income in 2020, the IRS would have sent that farmer a $1,400<br />

payment in early <strong>2021</strong>. If that farmer turns out to have income of<br />

$80,000 on his <strong>2021</strong> return, he is not eligible for the recovery rebate<br />

credit because his income is too high. Even so, the law does not<br />

require the farmer to repay the difference.<br />

Increased Premium Tax Credits for Insurance<br />

Purchased on the Marketplace<br />

The Rescue Plan also significantly enhanced the availability of<br />

the Affordable Care Act’s premium tax credit (PTC) for <strong>2021</strong> and<br />

2022. This credit was designed to make healthcare acquired on the<br />

ACA’s Health Insurance Marketplace more affordable. Because<br />

many farmers and ranchers are self-employed or owners of small<br />

partnerships or corporations for which insurance plans may be costly,<br />

they may benefit from purchasing insurance on the marketplace.<br />

The ACA created the refundable PTC for those taxpayers purchasing<br />

insurance on the ACA Marketplace with household income<br />

generally between 100% and 400% of the federal poverty level. To<br />

qualify for the benefit, the taxpayer may not be eligible for affordable<br />

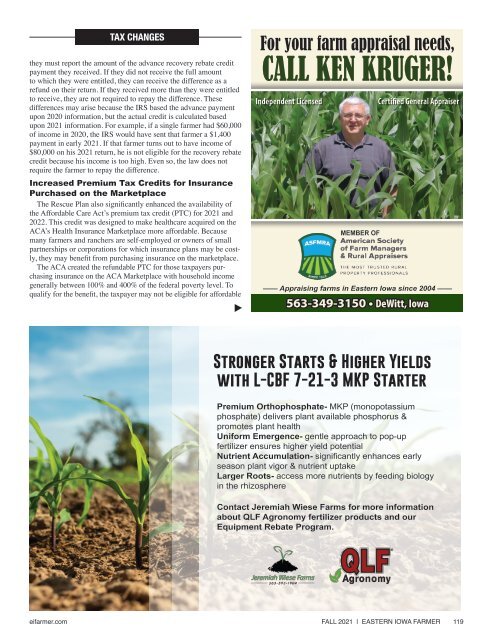

For your farm appraisal needs,<br />

call Ken Kruger!<br />

Independent Licensed<br />

MeMber of<br />

Certified General Appraiser<br />

—— Appraising farms in <strong>Eastern</strong> <strong>Iowa</strong> since 2004 ——<br />

563-349-3150 • DeWitt, <strong>Iowa</strong><br />

Stronger Starts & Higher Yields<br />

with L-CBF 7-21-3 MKP Starter<br />

Premium Orthophosphate- MKP (monopotassium<br />

phosphate) delivers plant available phosphorus &<br />

promotes plant health<br />

Uniform Emergence- gentle approach to pop-up<br />

fertilizer ensures higher yield potential<br />

Nutrient Accumulation- significantly enhances early<br />

season plant vigor & nutrient uptake<br />

Larger Roots- access more nutrients by feeding biology<br />

in the rhizosphere<br />

Contact Jeremiah Wiese Farms for more information<br />

about QLF Agronomy fertilizer products and our<br />

Equipment Rebate Program.<br />

eifarmer.com <strong>Fall</strong> <strong>2021</strong> | <strong>Eastern</strong> <strong>Iowa</strong> <strong>Farmer</strong> 119<br />

<strong>Eastern</strong><strong>Iowa</strong><strong>Farmer</strong>_<strong>Fall</strong><strong>2021</strong>.indd 119<br />

9/15/21 10:27 am