SUSTAINABLE BUS 2-2023

Topics? A clear picture of fundings available for zero emission buses in UK, an insight on the fuel cell bus market, a glimpse of the largest electric bus fleet in Middle East (hint: Mowasalat). Again: focus on safety precautions in H2 bus depots, a commentary on the market for second hand e-buses (and battery residual value). Finally: technical presentations of VDL Citea new generation (cover story!), Iveco Bus Crossway LE CNG, Rampini Hydron (and new zero emission bus range)

Topics? A clear picture of fundings available for zero emission buses in UK, an insight on the fuel cell bus market, a glimpse of the largest electric bus fleet in Middle East (hint: Mowasalat). Again: focus on safety precautions in H2 bus depots, a commentary on the market for second hand e-buses (and battery residual value).

Finally: technical presentations of VDL Citea new generation (cover story!), Iveco Bus Crossway LE CNG, Rampini Hydron (and new zero emission bus range)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OUTLOOKS<br />

FUNDING THE UK’S<br />

DEVOLVED ADMINISTRATIONS<br />

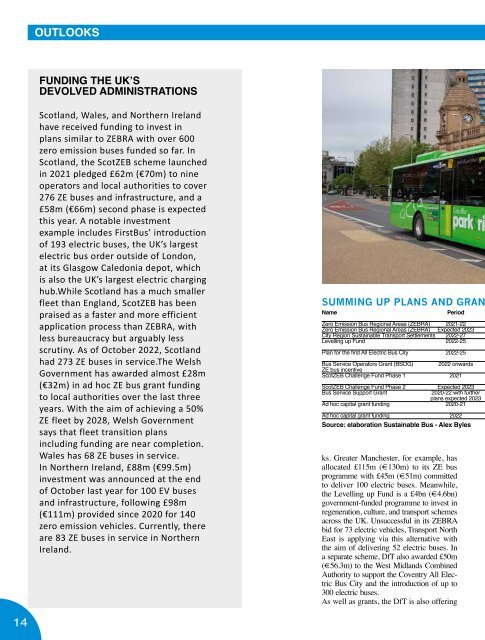

Scotland, Wales, and Northern Ireland<br />

have received funding to invest in<br />

plans similar to ZEBRA with over 600<br />

zero emission buses funded so far. In<br />

Scotland, the ScotZEB scheme launched<br />

in 2021 pledged £62m (€70m) to nine<br />

operators and local authorities to cover<br />

276 ZE buses and infrastructure, and a<br />

£58m (€66m) second phase is expected<br />

this year. A notable investment<br />

example includes FirstBus’ introduction<br />

of 193 electric buses, the UK’s largest<br />

electric bus order outside of London,<br />

at its Glasgow Caledonia depot, which<br />

is also the UK’s largest electric charging<br />

hub.While Scotland has a much smaller<br />

fleet than England, ScotZEB has been<br />

praised as a faster and more efficient<br />

application process than ZEBRA, with<br />

less bureaucracy but arguably less<br />

scrutiny. As of October 2022, Scotland<br />

had 273 ZE buses in service.The Welsh<br />

Government has awarded almost £28m<br />

(€32m) in ad hoc ZE bus grant funding<br />

to local authorities over the last three<br />

years. With the aim of achieving a 50%<br />

ZE fleet by 2028, Welsh Government<br />

says that fleet transition plans<br />

including funding are near completion.<br />

Wales has 68 ZE buses in service.<br />

In Northern Ireland, £88m (€99.5m)<br />

investment was announced at the end<br />

of October last year for 100 EV buses<br />

and infrastructure, following £98m<br />

(€111m) provided since 2020 for 140<br />

zero emission vehicles. Currently, there<br />

are 83 ZE buses in service in Northern<br />

Ireland.<br />

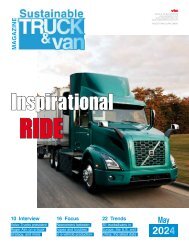

SUMMING UP PLANS AND GRANTS IN UK<br />

Name Period Supplier Beneficiaries Investment Vehicles (funded and/or<br />

already in operation)<br />

Zero Emission Bus Regional Areas (ZEBRA) 2021-22 DfT 17 local authorities £270m (€305.4m) 1,278 ZE buses funded<br />

Zero Emission Bus Regional Areas (ZEBRA) Expected <strong>2023</strong> DfT To be confirmed £205m (€232m) To be confirmed<br />

City Region Sustainable Transport Settlements 2022-27 DfT eight city regions outside of London £5.7bn (€6.5bn) To be confirmed<br />

Levelling up Fund 2022-25 Department for Levelling Up, Local authorities across England, £4bn (€4.6bn) To be confirmed<br />

HM Treasury, and DfT<br />

Wales, Scotland, and Northern Ireland<br />

Plan for the first All Electric Bus City 2022-25 DfT Midlands Combined Authority £50m up to 300 e-buses funded<br />

for the city of Coventry<br />

Bus Service Operators Grant (BSOG) 2022 onwards DfT Operators £0.22 (€0.25) per km To be confirmed<br />

ZE bus incentive<br />

ScotZEB Challenge Fund Phase 1 2021 Scottish government 9 PTOs and local authorities £62m (€70m) 276 ZE buses and<br />

infrastructure funded<br />

ScotZEB Challenge Fund Phase 2 Expected <strong>2023</strong> Scottish government To be confirmed £58m (€66m) To be confirmed<br />

Bus Service Support Grant 2020-22 with further Welsh government Welsh local authorities £28m (€32m) 68 e-buses<br />

plans expected <strong>2023</strong><br />

in operation<br />

Ad hoc capital grant funding 2020-21 North Irish government Translink £98m (€111m) 140 ZE buses funded<br />

(83 in operation)<br />

Ad hoc capital grant funding 2022 North Irish government Translink £88m (€99.5m) 100 ZE buses funded<br />

Source: elaboration Sustainable Bus - Alex Byles<br />

ks. Greater Manchester, for example, has<br />

allocated £115m (€130m) to its ZE bus<br />

programme with £45m (€51m) committed<br />

to deliver 100 electric buses. Meanwhile,<br />

the Levelling up Fund is a £4bn (€4.6bn)<br />

government-funded programme to invest in<br />

regeneration, culture, and transport schemes<br />

across the UK. Unsuccessful in its ZEBRA<br />

bid for 73 electric vehicles, Transport North<br />

East is applying via this alternative with<br />

the aim of delivering 52 electric buses. In<br />

a separate scheme, DfT also awarded £50m<br />

(€56.3m) to the West Midlands Combined<br />

Authority to support the Coventry All Electric<br />

Bus City and the introduction of up to<br />

300 electric buses.<br />

As well as grants, the DfT is also offering<br />

“We haven’t yet<br />

seen evidence of the<br />

effectiveness of the<br />

22p per km and while it<br />

accumulates over a 15-<br />

year vehicle life, it doesn’t<br />

remove the upfront capital<br />

cost” says Daniel Hayes,<br />

programme manager at<br />

Zemo Partnership. “The<br />

problem is also that the<br />

existing Bus Service<br />

Operators’ Grant (BSOG)<br />

of 35p per litre of diesel<br />

counteracts the ZE<br />

incentive”.<br />

operators an incentive of £0.22 (€0.25)<br />

per kilometre for accredited zero emissions<br />

vehicles.<br />

“We haven’t yet seen evidence of the effectiveness<br />

of the 22p per km, and while it accumulates<br />

over a 15-year vehicle life, it doesn’t<br />

remove the upfront capital cost,” says Daniel<br />

Hayes. “The problem, however, is that<br />

the existing Bus Service Operators’ Grant<br />

(BSOG) of 35p per litre of diesel counteracts<br />

the ZE incentive. Operators need this<br />

funding but it’s acting against the incentive”.<br />

Funding London’s ZE fleet<br />

Transport for London’s (TfL) franchised service<br />

now includes over 875 ZE buses. After<br />

an initial introductory phase of six electric<br />

As ZEBRA has comprised<br />

rounds of application and<br />

competition for funding<br />

at intervals, this has also<br />

created uncertainty and<br />

a stop-start procurement<br />

approach. Tim Griffen,<br />

project officer at Zemo<br />

Partnership, says: “Operators<br />

and local authorities<br />

work hard to compete for a<br />

share of government funding<br />

announced at intervals,<br />

then there’s a delay before<br />

the money is actually<br />

received, then there’s a<br />

rush to the manufacturer.<br />

And, if the application is<br />

unsuccessful, they may<br />

not receive any funding”.<br />

vehicles, TfL received £3.5m (€3.9m) in<br />

early 2019 via the Green Bus Fund, comprising<br />

44% DfT funding with 56% input<br />

from TfL itself. TfL says that by improving<br />

costs per bus, the budget was able to stretch<br />

to 126 vehicles. Over the next decade, TfL<br />

also plans to significantly expand its outer<br />

London bus network. Currently, the fleet has<br />

around 9,300 vehicles with a fully ZE fleet<br />

target date of 2034.<br />

Since 2021, all new buses entering TfL’s<br />

fleet have been ZE, with all funding after<br />

2019 coming from TfL’s network costs.<br />

Fares are the main contributor, typically<br />

reaching around £1.5bn (€1.6bn) per year<br />

since 2015, partially recovering after Covid<br />

to £1.2bn (€1.4bn) last year. Income also<br />

derives from road network compliance charges<br />

such as London’s Congestion Charge, as<br />

well as central and local government grants.<br />

More passengers needed<br />

Government grants and incentives are important<br />

contributors towards the UK’s ZE<br />

transition. However, a self-sustaining approach<br />

with a modal shift in consumer behaviour<br />

is important to achieve environmental<br />

and economic sustainability.<br />

“To be in a position to deliver on net zero<br />

goals, the focus must be on increasing passenger<br />

numbers travelling by bus,” says Alison<br />

Edwards. “This will deliver a sustainable<br />

model to enable operators to continue<br />

reinvesting and deliver a network that is<br />

continuously improving”. Alex Byles<br />

14<br />

15