SUSTAINABLE BUS 2-2023

Topics? A clear picture of fundings available for zero emission buses in UK, an insight on the fuel cell bus market, a glimpse of the largest electric bus fleet in Middle East (hint: Mowasalat). Again: focus on safety precautions in H2 bus depots, a commentary on the market for second hand e-buses (and battery residual value). Finally: technical presentations of VDL Citea new generation (cover story!), Iveco Bus Crossway LE CNG, Rampini Hydron (and new zero emission bus range)

Topics? A clear picture of fundings available for zero emission buses in UK, an insight on the fuel cell bus market, a glimpse of the largest electric bus fleet in Middle East (hint: Mowasalat). Again: focus on safety precautions in H2 bus depots, a commentary on the market for second hand e-buses (and battery residual value).

Finally: technical presentations of VDL Citea new generation (cover story!), Iveco Bus Crossway LE CNG, Rampini Hydron (and new zero emission bus range)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OUTLOOKS<br />

22<br />

Amount (€M)<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

and deployment of fuel cells and hydrogen<br />

technologies.<br />

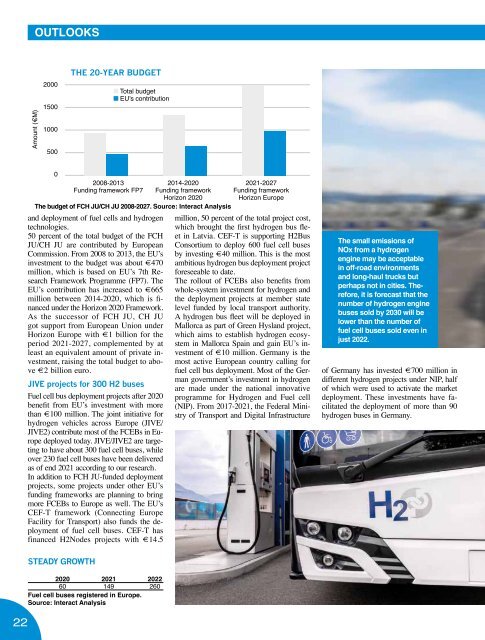

50 percent of the total budget of the FCH<br />

JU/CH JU are contributed by European<br />

Commission. From 2008 to 2013, the EU’s<br />

investment to the budget was about €470<br />

million, which is based on EU’s 7th Research<br />

Framework Programme (FP7). The<br />

EU’s contribution has increased to €665<br />

million between 2014-2020, which is financed<br />

under the Horizon 2020 Framework.<br />

As the successor of FCH JU, CH JU<br />

got support from European Union under<br />

Horizon Europe with €1 billion for the<br />

period 2021-2027, complemented by at<br />

least an equivalent amount of private investment,<br />

raising the total budget to above<br />

€2 billion euro.<br />

JIVE projects for 300 H2 buses<br />

Fuel cell bus deployment projects after 2020<br />

benefit from EU’s investment with more<br />

than €100 million. The joint initiative for<br />

hydrogen vehicles across Europe (JIVE/<br />

JIVE2) contribute most of the FCEBs in Europe<br />

deployed today. JIVE/JIVE2 are targeting<br />

to have about 300 fuel cell buses, while<br />

over 230 fuel cell buses have been delivered<br />

as of end 2021 according to our research.<br />

In addition to FCH JU-funded deployment<br />

projects, some projects under other EU’s<br />

funding frameworks are planning to bring<br />

more FCEBs to Europe as well. The EU’s<br />

CEF-T framework (Connecting Europe<br />

Facility for Transport) also funds the deployment<br />

of fuel cell buses. CEF-T has<br />

financed H2Nodes projects with €14.5<br />

STEADY GROWTH<br />

THE 20-YEAR BUDGET<br />

Total budget<br />

EU’s contribution<br />

2008-2013<br />

Funding framework FP7<br />

2020 2021 2022<br />

60 149 260<br />

Fuel cell buses registered in Europe.<br />

Source: Interact Analysis<br />

2014-2020<br />

Funding framework<br />

Horizon 2020<br />

The budget of FCH JU/CH JU 2008-2027. Source: Interact Analysis<br />

2021-2027<br />

Funding framework<br />

Horizon Europe<br />

million, 50 percent of the total project cost,<br />

which brought the first hydrogen bus fleet<br />

in Latvia. CEF-T is supporting H2Bus<br />

Consortium to deploy 600 fuel cell buses<br />

by investing €40 million. This is the most<br />

ambitious hydrogen bus deployment project<br />

foreseeable to date.<br />

The rollout of FCEBs also benefits from<br />

whole-system investment for hydrogen and<br />

the deployment projects at member state<br />

level funded by local transport authority.<br />

A hydrogen bus fleet will be deployed in<br />

Mallorca as part of Green Hysland project,<br />

which aims to establish hydrogen ecosystem<br />

in Mallorca Spain and gain EU’s investment<br />

of €10 million. Germany is the<br />

most active European country calling for<br />

fuel cell bus deployment. Most of the German<br />

government’s investment in hydrogen<br />

are made under the national innovative<br />

programme for Hydrogen and Fuel cell<br />

(NIP). From 2017-2021, the Federal Ministry<br />

of Transport and Digital Infrastructure<br />

The small emissions of<br />

NOx from a hydrogen<br />

engine may be acceptable<br />

in off-road environments<br />

and long-haul trucks but<br />

perhaps not in cities. Therefore,<br />

it is forecast that the<br />

number of hydrogen engine<br />

buses sold by 2030 will be<br />

lower than the number of<br />

fuel cell buses sold even in<br />

just 2022.<br />

of Germany has invested €700 million in<br />

different hydrogen projects under NIP, half<br />

of which were used to activate the market<br />

deployment. These investments have facilitated<br />

the deployment of more than 90<br />

hydrogen buses in Germany.<br />

A LOOK AT EUROPEAN MAIN FUEL CELL <strong>BUS</strong> PROJECTS<br />

Fuel cell bus deployment<br />

projects after 2020 benefit<br />

from EU’s investment with<br />

more than €100 million.<br />

JIVE and JIVE2 contribute<br />

most of the FCEBs in Europe<br />

deployed today. JIVE/<br />

JIVE2 are targeting to have<br />

about 300 fuel cell buses,<br />

while over 230 fuel cell<br />

buses have been delivered<br />

as of end 2021.<br />

50 percent of the total<br />

budget of the FCH JU/<br />

CH JU are contributed by<br />

EU Commission. From<br />

2008 to 2013, the EU’s<br />

investment to the budget<br />

was about €470 million.<br />

The EU’s contribution has<br />

increased to €665 million<br />

between 2014-2020, which<br />

is financed under Horizon<br />

2020 Framework. As the<br />

successor of FCH JU, CH<br />

JU got support from European<br />

Union under Horizon<br />

Europe with €1 billion<br />

for the period 2021-2027,<br />

complemented by at least<br />

an equivalent amount of<br />

private investment, raising<br />

the total budget to above<br />

€2 billion euro.<br />

Project Timescale Status Project cost (M€) EU investment (M€) Funding framework Targetting # of FCEBs<br />

CoacHyfied 2021-2025 Ongoing 7.3 5 Horizon 2020 6 coaches<br />

JIVE 2017-2022 Ongoing 102.5 32 Horizon 2020 142 buses<br />

JIVE2 2018-<strong>2023</strong> Ongoing 105.5 25 Horizon 2020 152 buses<br />

3Emotion 2015-2022 Ongoing 39 15 FP7 29 buses<br />

CHIC 2010-2016 Closed 82 26 FP7 26 buses<br />

High VLO city 2012-2019 Closed 30.5 13.5 FP7 14 buses<br />

Hytransit 2013-2018 Closed 17.8 7 FP7 6 buses<br />

An overview of FCH JU-funded FCEB market deployment project after 2010. Source: Interact Analysis<br />

Hydrogen fuel cell vehicles have zero tailpipe<br />

emissions so certainly will have no difficulty<br />

with meeting the Euro VII emission<br />

standards or any other regulations. This goes<br />

some way to explaining the EU’s support<br />

(although there are legitimate questions<br />

about the percentage of hydrogen that is<br />

produced from green sources and hydrogen<br />

being an inefficient use of electrical energy).<br />

H2-powered ICEs?<br />

What about hydrogen combustion engines?<br />

All hydrogen buses so far use a fuel cell.<br />

An alternative technology, hydrogen combustion<br />

engines, does exist but buses are not<br />

the main target market for this. One reason<br />

is that, unlike a fuel cell or battery electric<br />

vehicle, hydrogen engines buses would still<br />

have NOx emissions. The small emissions of<br />

NOx from a hydrogen engine may be acceptable<br />

in off-road environments and long-haul<br />

trucks but perhaps not in cities. Also, hydro-<br />

gen engine vehicles have higher fuel cost<br />

than other alternatives in this market as they<br />

are less efficient. Therefore, it is forecast that<br />

the number of hydrogen engine buses sold<br />

by 2030 will be lower than the number of<br />

fuel cell buses sold even in just 2022.<br />

Fuel cells are the way forward for hydrogen<br />

buses therefore, both in Europe and globally.<br />

While sales levels are lower than BEV<br />

and diesel, fuel cell buses will continue to<br />

take a share of the market in the coming years.<br />

The funding is helping fuel cell buses in<br />

Europe reach levels not seen elsewhere and<br />

the sales of 260 buses in Europe is just the<br />

start, with further growth to come.<br />

Jamie Fox and Marco Wang (Interact<br />

Analysis)<br />

23