Download PDF version - Bisnode

Download PDF version - Bisnode

Download PDF version - Bisnode

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

52<br />

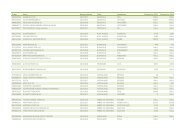

note 22. Trade and other receivables<br />

Group<br />

31/12/2010 31/12/2009<br />

Trade receivables – net 731,230 749,303<br />

Advance payments to suppliers 975 725<br />

Prepaid expenses 74,872 77,893<br />

Accrued interest income 500 52<br />

Other accrued income 18,305 28,050<br />

Receivables from Parent Company – non interest-bearing 37<br />

Other receivables – interest-bearing 19,112 31,245<br />

Other receivables – non interest-bearing 30,843 44,971<br />

Total 875,837 932,276<br />

whereof non-current portion 14,787 20,910<br />

whereof current portion 861,050 911,366<br />

Credit risk<br />

There is no concentration of credit risks for trade receivables, as the Group has a<br />

large number of customers who are well dispersed internationally. Receivables<br />

are tested for impairment at the company level after individual assessment of<br />

each customer. In the impairment test, the financial position and solvency of each<br />

customer is considered.<br />

The Group has recognised losses on trade receivables for the year amounting<br />

to SEK 8,302 thousand (19,830). The losses are recognised in other expenses in<br />

the income statement. The table below shows the age structure of outstanding<br />

trade receivables:<br />

31/12/2010 Not due<br />

Between<br />

Within 61 days-<br />

60 days 1 year<br />

Later<br />

than<br />

1 year Total<br />

Trade receivables 589,575 124,331 23,419 18,844 756,169<br />

Provision for impairment<br />

of receivables -1,003 -2,282 -6,362 -15,292 -24,939<br />

Trade receivables – net 588,572 122,049 17,057 3,552 731,230<br />

31/12/2009 Not due<br />

Between<br />

Within 61 days-<br />

60 days 1 year<br />

Later<br />

than<br />

1 year Total<br />

Trade receivables 579,091 145,338 31,946 22,247 778,622<br />

Provision for impairment<br />

of receivables -2,151 -2,202 -8,069 -16,897 -29,319<br />

Trade receivables – net 576,940 143,136 23,877 5,350 749,303<br />

The other categories within trade and other receivables do not contain impaired<br />

assets.<br />

The credit quality of trade and other receivables that are neither past due nor<br />

impaired is good since the receivables relate to customers with high credit ratings<br />

and/or good solvency.<br />

The carrying amounts of trade and other receivables are equal to their fair values.<br />

The maximum exposure to credit risk at the reporting date is the fair value of each<br />

class of Trade and other receivables. The Group does not hold any collateral as<br />

security for trade receivables past due.<br />

note 23. inventories<br />

Group<br />

31/12/2010 31/12/2009<br />

Raw materials 211<br />

Work in progress 4,843 10,158<br />

Finished goods 802 1,338<br />

Total 5,856 11,496<br />

note 24. cash and cash equivalents<br />

Group<br />

31/12/2010 31/12/2009<br />

Cash at bank and on hand 259,167 367,844<br />

Total 259,167 367,844<br />

note 25. Borrowings<br />

Group<br />

Non-current borrowings 31/12/2010 31/12/2009<br />

Bank borrowings 1,891,051 2,287,314<br />

Loans from shareholders 1,228,608 1,137,600<br />

Borrowings for finance leases 74,574 88,806<br />

Other borrowings 9,382 15,243<br />

Subtotal 3,203,615 3,528,963<br />

Current borrowings<br />

Bank borrowings 336,006 323,120<br />

Borrowings for finance leases 3,699 3,461<br />

Other borrowings 7,570 5,770<br />

Subtotal 347,275 332,351<br />

Total 3,550,890 3,861,314<br />

Bank borrowings mature until 31 January 2013 and carry interest equal to current<br />

3-month STIBOR plus 1.25%. 85% of the variable interest is converted to fixed<br />

interest until the maturity date through the use of interest rate swaps. Bank borrowings<br />

are secured by shares in subsidiaries of the Parent Company.<br />

The Group has granted bank overdraft amounting to SEK 100 million (100). In<br />

addition, the Group has a revolving credit facility of SEK 300 million. At the end of<br />

the year, SEK 25 million of the revolving credit had been utilised.<br />

Interest rate risks<br />

The exposure of the Group’s borrowings to changes in interest rates and contractual<br />

dates for interest rate con<strong>version</strong> is as follows:<br />

Date for interest rate con<strong>version</strong><br />

or maturity date<br />

31/12/2010<br />

Carrying<br />

amount<br />

Within<br />

1 year<br />

Between<br />

1–5 years<br />

Later than<br />

5 years<br />

Bank borrowings 2,227,057 336,006 1,891,051<br />

Loans from shareholders 1,228,608 1,228,608<br />

Borrowings for finance leases 78,273 3,699 15,307 59,267<br />

Other borrowings 16,952 7,570 9,382<br />

Date for interest rate con<strong>version</strong><br />

or maturity date<br />

Carrying Within Between Later than<br />

31/12/2009<br />

amount 1 year 1–5 years 5 years<br />

Bank borrowings 2,610,434 323,120 2,287,314<br />

Loans from shareholders 1,137,600 1,137,600<br />

Borrowings for finance leases 92,267 3,461 15,936 72,870<br />

Other borrowings 21,013 5,770 15,243<br />

The fair values of the Group’s borrowings are equal to their carrying amounts. The<br />

carrying amounts of the borrowings are denominated in the following currencies:<br />

31/12/2010 31/12/2009<br />

SEK 2,888,495 3,002,430<br />

EUR 647,198 837,683<br />

USD 15,152 21,013<br />

Other currencies 45 188<br />

Total 3,550,890 3,861,314