Download PDF version - Bisnode

Download PDF version - Bisnode

Download PDF version - Bisnode

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

58<br />

2009<br />

Date of<br />

acquisition<br />

share of<br />

capital Operation<br />

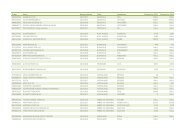

Inter Dialog AS 15/05/2009 20.0% Acquisition of minority.<br />

Kauppalehti 121 Oy (name change to 121 Media Oy) 02/11/2009 100.0% Finnish leader in direct marketing services.<br />

One Holding AS 07/12/2009 9.9% Acquisition of minority.<br />

TA Teleadress Information AB (name change to Relevant<br />

information Sverige AB) 14/12/2009 80.1% Has a leading position on the Swedish market for direct marketing information.<br />

RAAD Research (asset deal) 29/10/2009 100.0% German operator in market research and analysis for the IT sector.<br />

Purchase price Relevant<br />

Information 121 Media Other acquisitions Total<br />

Cash paid 58,670 72,175 6,566 137,411<br />

Direct costs relating to acquisitions 46 2,307 111 2,464<br />

Contingent purchase consideration paid 9,220 9,220<br />

Utilisation of contingent purchase consideration -9,195 -9,195<br />

Total 58,716 74,482 6,702 139,900<br />

Fair value of acquired net assets -6,356 -6,667 -1,053 -14,076<br />

Goodwill due to step acquisition 13,840 13,840<br />

Revaluation of contingent purchase consideration 8,900 8,900<br />

Negative goodwill – transferred to the income statement 1,533 1,533<br />

Total Goodwill 66,200 67,815 16,082 150,097<br />

Cash flow effect Relevant<br />

Information 121 Media Other acquisitions Total<br />

Cash paid 58,670 72,175 6,566 137,411<br />

Direct costs relating to acquisitions 46 2,307 111 2,464<br />

Contingent purchase consideration paid 9,220 9,220<br />

Cash and cash equivalents in acquired subsidiaries -17,624 -8,036 -25,660<br />

Change in cash and cash equivalents 41,092 66,446 15,897 123,435<br />

Supplementary information<br />

Revenue since acquisition date 58,836 16,777 75,613<br />

Revenue in 2009 58,836 85,775 144,611<br />

Profit before tax since acquisition date 6,097 492 6,589<br />

Profit before tax in 2009 6,097 5,730 11,827<br />

Fair value of acquired<br />

assets and liabilities<br />

Relevant Information 121 Media Other acquisitions Total<br />

Carrying<br />

amount<br />

Fair<br />

value<br />

Carrying<br />

amount Fair value<br />

Carrying<br />

amount<br />

Fair<br />

value<br />

Carrying<br />

amount<br />

Assets<br />

Intangible assets 531 531 531 531<br />

Property, plant and equipment 240 240 819 819 294 294 1,353 1,353<br />

Deferred tax assets 221 221 104 104 325 325<br />

Trade and other receivables 9,765 9,765 12,100 12,100 1 1 21,866 21,866<br />

Cash and cash equivalents 17,624 17,624 8,036 8,036 25,660 25,660<br />

Total assets 27,850 27,850 21,059 21,059 826 826 49,735 49,735<br />

Liabilities<br />

Non-controlling interests 671 671 -227 -227 444 444<br />

Provisions for pensions 2,862 2,862 197 197 3,059 3,059<br />

Borrowings 311 311 311 311<br />

Deferred tax liabilities 346 346 346 346<br />

Tax liabilities 5 5 5 5<br />

Trade and other payables 17,610 17,610 13,884 13,884 31,494 31,494<br />

Total liabilities 21,494 21,494 14,392 14,392 -227 -227 35,659 35,659<br />

Net identifiable assets and liabilities 6,356 6,356 6,667 6,667 1,053 1,053 14,076 14,076<br />

Fair<br />

value