Download PDF version - Bisnode

Download PDF version - Bisnode

Download PDF version - Bisnode

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

54<br />

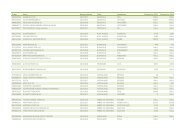

note 27. other provisions<br />

Group<br />

2010 2009<br />

Contingent purchase consideration 35,330 142,118<br />

Legal claims 23,808 4,058<br />

Restoration charges 5,155 6,076<br />

Restructuring 6,222 2,963<br />

Sales agents 11,469 14,442<br />

Other 12,073 20,125<br />

Total 94,057 189,782<br />

of which non-current portion 54,164 188,544<br />

of which current portion 39,893 1,238<br />

Group<br />

2010 2009<br />

Beginning of year 189,782 191,243<br />

Acquisition of subsidiaries 2,588 8,119<br />

New provisions for the period 27,583 648<br />

Utilised during the period -14,548 -14,403<br />

Provisions for contingent purchase consideration 2,253 8,925<br />

Contingent purchase consideration paid -108,301 -9,220<br />

Unused/reversed contingent purchase<br />

consideration<br />

Capitalised interest on contingent<br />

-4,348<br />

purchase consideration 3,607 6,344<br />

Exchange differences -4,559 -1,874<br />

End of year 94,057 189,782<br />

Contingent purchase consideration<br />

The provision mainly pertains to contingent purchase consideration for the acquisition<br />

of Svenska Nyhetsbrev AB. The amount will be used during 2011.<br />

Legal claims<br />

Provisions for legal claims pertain to potential claims from information suppliers<br />

and ongoing tax disputes.<br />

Restoration charges<br />

Pertains to provisions for future restoration expenses for rented premises.<br />

Restructuring<br />

Pertains to provisions for vacant premises and future payments to redundant<br />

personnel.<br />

Sales agents<br />

The provisons pertain to future costs related to the retirement or termination of<br />

collaboration with German sales agents.<br />

note 28. Trade and other payables<br />

Group<br />

31/12/2010 31/12/2009<br />

Trade payables 195,853 212,821<br />

Advances from customers 40,874 62,090<br />

Holiday pay liabilities 104,206 115,426<br />

Social security and other taxes 40,194 33,319<br />

Accrued interest expenses 189 284<br />

Other accrued expenses 279,198 327,364<br />

Deferred income 658,644 664,971<br />

Other liabilities - non interest-bearing 132,335 151,789<br />

Total 1,451,493 1,568,064<br />

of which non-current portion 2,234<br />

of which current portion 1,451,493 1,565,830<br />

The fair value of trade and other payables equals their carrying amounts.<br />

note 29. Derivative financial instruments<br />

Group<br />

31/12/2010 31/12/2009<br />

Interest rate swaps – cash flow hedges -74,481 -135,581<br />

Total -74,481 -135,581<br />

Type of contract<br />

Contract term<br />

beginning on ending on<br />

Amount Currency<br />

Interest<br />

rate<br />

Interest rate swap 31/01/2008 31/01/2013 1,398,250 SEK K 4.51%<br />

Interest rate swap 31/01/2008 31/01/2013 53,550 EUR K 4.42%<br />

The cash flow hedges are determined to be 85% effective. The current Interest<br />

rate swap agreements had a negative value of SEK 23,851 thousand on the contractual<br />

date. The ineffective portion has been recognised in the income statement<br />

on a straight-line basis. During the year, SEK 4,770 thousand has been recognised<br />

as financial income in the income statement.<br />

The fair value of the interest rate swaps which have been calculated using valuation<br />

techniques are found in level 2.