Download PDF version - Bisnode

Download PDF version - Bisnode

Download PDF version - Bisnode

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

56<br />

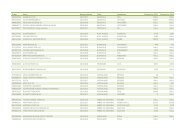

note 34. related party transactions<br />

The related parties of the Group consist of the Parent Company Ratos AB and the<br />

Group’s key management personnel and their families. Key management personnel<br />

relates to members of the executive management team.<br />

Ratos owns 70% of the Parent Company’s shares and has control over the<br />

Group. Ratos is the Parent Company of the largest and smallest groups that <strong>Bisnode</strong><br />

Business Information Group AB is part of and where the consolidated accounts<br />

are prepared.<br />

Any transactions between related parties are carried out on an arm’s length basis.<br />

Transactions with the Parent Company<br />

Loans to Ratos<br />

Group<br />

2010 2009<br />

Beginning of year 0 2,792<br />

Borrowings 11,788<br />

Repayments -11,788 -2,792<br />

End of year 0 0<br />

Group<br />

Borrowings from Ratos 2010 2009<br />

Beginning of year 796,320 742,598<br />

Repayments -5,265<br />

Interest expense capitalised 63,706 58,987<br />

End of year 860,026 796,320<br />

The year-end borrowings from Ratos pertain to shareholder loans from the<br />

Parent Company Ratos. The loans mature on 31 January 2013 and carry interest<br />

of 8%. The interest is capitalised until maturity.<br />

Transactions with key management personnel<br />

During 2010 and 2009 the Parent Company did not grant any loans to Board<br />

members, key management personnel or their families. Renumeration to key<br />

management personnel is specified in Note 10.<br />

note 35. contingent liabilities and pledged assets<br />

Group Parent Company<br />

Contingent liabilities 31/12/2010 31/12/2009 31/12/2010 31/12/2009<br />

Guarantee commitment FPG/PRI 917 768<br />

Guarantee to previous owners 61,665 86,902<br />

Other guarantees 16,690 19,277 2,237,126 2,625,416<br />

Total 79,272 106,947 2,237,126 2,625,416<br />

Pledged assets for own liabilities and provisions<br />

Shares 1,107,539 1,298,012 1,107,539 1,298,012<br />

Other pledged assets 916 2,120<br />

Total 1,108,455 1,300,132 1,107,539 1,298,012<br />

Other pledged assets None None None None<br />

Guarantee to previous owners pertains to guarantees pledged to Dun & Bradstreet<br />

International to complete financing required for the Dun & Bradstreet Group<br />

companies in Sweden, Norway, Denmark, Finland, Germany, Switzerland,<br />

the Czech Republic, Austria, Hungary and Poland.<br />

note 36. share capital<br />

The share capital of the Parent Company amounts to SEK 482,355,912, divided<br />

between 66,328,528 A shares and 54,260,450 B shares with a quota value of 4<br />

each.<br />

There are no outstanding options or convertible bonds that could lead to future<br />

dilution.<br />

note 37. earnings per share<br />

Basic earnings per share are calculated by dividing profit attributable to owners of<br />

the Parent Company by the number of shares outstanding for the period. There<br />

are no option or convertible bond programmes outstanding that could cause<br />

future dilution.<br />

2010 2009<br />

Profit attributable to owners of the Parent Company 180,567 50,551<br />

Number of shares outstanding (thousands) 120,589 120,589<br />

Earnings per share before and after dilution (SEK per share) 1.50 0.42