Download PDF version - Bisnode

Download PDF version - Bisnode

Download PDF version - Bisnode

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

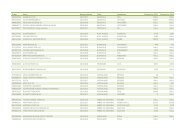

note 38. Business combinations<br />

2010<br />

Date of<br />

acquisition<br />

share of<br />

capital Operation<br />

Directinet SA/Netcollections SAS 06/01/2010 100.0% Leading provider of online direct marketing solutions in France.<br />

Bilfakta Sverige AB 01/04/2010 100.0% Owner of Sweden's largest database of automotive information.<br />

Yritystelse Oy (asset deal) 08/10/2010 100.0% B2B online business information and search operation in Finland.<br />

Purchase price Directinet/<br />

Netcollections<br />

57<br />

Other<br />

acquisitions Total<br />

Cash paid 85,070 9,907 94,977<br />

Contingent purchase consideration paid 108,301 108,301<br />

Utilisation of contingent purchase consideration -111,053 -111,053<br />

Total 85,070 7,155 92,225<br />

Fair value of acquired net assets -6,959 13,201 6,242<br />

Total Goodwill 78,111 20,356 98,467<br />

Cash flow effect Directinet/<br />

Netcollections<br />

Other<br />

acquisitions Total<br />

Cash paid 85,070 9,907 94,977<br />

Contingent purchase consideration paid 108,301 108,301<br />

Cash and cash equivalents in acquired subsidiaries -11,502 1,983 -9,519<br />

Change in cash and cash equivalents 73,568 120,191 193,759<br />

Supplementary information<br />

Revenue since acquisition date 121,156 7,911 129,067<br />

Revenue in 2010 121,156 8,537 129,693<br />

Profit before tax since acquisition date -4,269 -575 -4,844<br />

Profit before tax in 2010 -4,269 -1,859 -6,128<br />

Acquisition-related costs 740 740<br />

Fair value of acquired assets<br />

and liabilities<br />

Directinet/Netcollections Other acquisitions Total<br />

Carrying<br />

amount<br />

Fair<br />

value<br />

Carrying<br />

amount<br />

Fair<br />

value<br />

Carrying<br />

amount<br />

Assets<br />

Intangible assets 2,115 2,115 2,420 2,420 4,535 4,535<br />

Property, plant and equipment 2,082 2,082 573 573 2,655 2,655<br />

Deferred tax assets 984 984 984 984<br />

Inventories 35 35 35 35<br />

Trade and other receivables 52,125 52,125 614 614 52,739 52,739<br />

Cash and cash equivalents 11,502 11,502 -1,983 -1,983 9,519 9,519<br />

Total assets 68,808 68,808 1,659 1,659 70,467 70,467<br />

Liabilities<br />

Other provisions 2,588 2,588 2,588 2,588<br />

Tax liabilities 13 13 13 13<br />

Trade and other payables 59,261 59,261 14,847 14,847 74,108 74,108<br />

Total liabilities 61,849 61,849 14,860 14,860 76,709 76,709<br />

Net identifiable assets and liabilities 6,959 6,959 -13,201 -13,201 -6,242 -6,242<br />

The goodwill is attributable to the profitability of the acquired companies and the significant<br />

synergies expected to arise following acquisition. All acquisition balances are preliminary.<br />

Fair<br />

value