Download PDF version - Bisnode

Download PDF version - Bisnode

Download PDF version - Bisnode

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

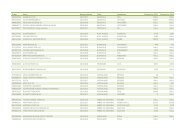

Maturity dates on non-current liabilities – Parent Company<br />

Maturity date<br />

Current Within Between Later than<br />

31/12/2010<br />

liability 1 year 1–5 years 5 years<br />

Liabilities to group companies 860,026 860,026<br />

Other liabilities 368,582 368,582<br />

Total 1,228,608 0 1,228,608 0<br />

31/12/2009<br />

Current<br />

liability<br />

Within<br />

1 year<br />

Maturity date<br />

Between Later than<br />

1–5 years 5 years<br />

Liabilities to group companies 796,320 796,320<br />

Other liabilities 341,280 341,280<br />

Total 1,137,600 0 1,137,600 0<br />

note 26. provisions for pensions<br />

Defined contribution plans<br />

The expense for defined contribution plans during the year amounted to SEK<br />

92,665 thousand (93,730).<br />

Commitments for old-age pensions and family pensions for white-collar<br />

employees in Sweden have been safeguarded through insurance in Alecta.<br />

According to statement URA 42 from the Swedish Financial Accounting Standards<br />

Council’s Urgent Issues Task Force, this is classified as a “multi-employer”<br />

defined benefit plan. For financial years when the company has not had access to<br />

the information necessary to report this plan as a defined benefit plan, a pension<br />

plan according to Supplementary Pension for Employees in industry and Commerce,<br />

safeguarded through insurance with Alecta, is reported as a defined contribution<br />

plan. The year’s costs for pension insurance subscribed to through Alecta<br />

amounted to SEK 28,000 thousand (28,079). Alecta’s surplus can be distributed<br />

to the policyholders (the employers) and/or the insureds. At year-end 2010,<br />

Alecta’s collective funding ratio was 146% (141). The collective funding ratio is the<br />

market value of Alecta’s plan assets as a percentage of insurance obligations<br />

computed according to Alecta’s own actuarial assumptions, which do not comply<br />

with IAS 19.<br />

Defined benefit plans<br />

The amounts recognised in the income statement are as follows:<br />

Group<br />

2010 2009<br />

Current service cost 20,348 15,913<br />

Interest cost 13,822 12,721<br />

Expected return on plan assets -4,342 -4,586<br />

Actuarial gains (-) and losses (+) recognised in year 920 343<br />

Other cost reductions -1,283<br />

Total 30,748 23,108<br />

The actual return on plan assets during the period was SEK 7,449 thousand (34).<br />

Actuarial assumptions<br />

There are defined benefit plans in Finland, Germany, Norway, Sweden and Switzerland.<br />

The principal actuarial assumptions used as of balance sheet date were<br />

as follows (weighted average):<br />

2010 2009<br />

Discount rate 3.9% 4.4%<br />

Inflation 1.7% 1.7%<br />

Annual salary increases 2.4% 2.4%<br />

Annual pension increases 1.5% 1.3%<br />

Annual paid-up policy increases 1.1% 1.3%<br />

Remaining service period 13 years 14 years<br />

Expected return on plan assets 3.2% 3.9%<br />

53<br />

The amounts recognised in the balance sheet are determined as follows:<br />

2010 2009<br />

Present value of funded obligations 146,364 139,768<br />

Fair value of plan assets -110,397 -115,488<br />

Net value of entirely or partially funded obligations 35,967 24,280<br />

Present value of unfunded obligations 199,036 198,048<br />

Unrecognised actuarial gains (+) and losses (–) -25,435 -4,617<br />

Net liability on the balance sheet 209,568 217,711<br />

The movement in the fair value of plan assets over the year is as follows:<br />

2010 2009<br />

Beginning of year 337,816 323,172<br />

Current service cost 20,348 15,913<br />

Interest cost 13,704 13,706<br />

Actuarial gains (-)/losses (+) 8,518 -2,785<br />

Employer contributions -1,088 -7,071<br />

Employee contributions 2,733 3,032<br />

Benefits paid -17,511 -4,984<br />

Acquisition of subsidiaries -48 3,432<br />

Other changes 1,243<br />

Exchange differences -19,072 -7,842<br />

End of the year 345,400 337,816<br />

The movement in the fair value of plan assets over the year is as follows:<br />

2010 2009<br />

Beginning of year 115,488 106,273<br />

Expected return on plan assets 4,342 4,586<br />

Actuarial losses (-)/gains (+) -11,791 -4,552<br />

Employer contributions 11,371 10,694<br />

Employee contributions 2,733 3,032<br />

Benefits paid -11,741 -4,984<br />

Acquisition of subsidiaries 373<br />

Other changes 93<br />

Exchange differences -5 -27<br />

End of year 110,397 115,488<br />

Plan assets are comprised as follows:<br />

2010 2009 2010 2009<br />

Shares 23,232 19,193 21% 17%<br />

Interest-bearing securities 37,931 42,233 34% 37%<br />

Property 14,275 11,386 13% 10%<br />

Other 34,959 42,676 32% 37%<br />

Total 110,397 115,488 100% 100%<br />

The expected return on plan assets was determined by considering the expected<br />

returns available on the assets underlying the current investment policy. Expected<br />

yields on fixed-interest investments are based on gross redemption yields at the<br />

balance sheet date. Expected returns on shares and property investments reflect<br />

long-term rates of return in the respective market.<br />

Expected contributions to post-employment benefit plans for the financial year<br />

2011 amount to SEK 18,591 thousand.<br />

2010 2009 2008 2007<br />

Present value of defined<br />

benefit obligation 345,400 337,816 323,172 247,091<br />

Fair value of plan assets -110,397 -115,488 -106,273 -79,859<br />

Deficit (+)/surplus (-) 235,003 222,328 216,899 167,232