2009 Annual Report and Financial Statements - UBA Plc

2009 Annual Report and Financial Statements - UBA Plc

2009 Annual Report and Financial Statements - UBA Plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Risk management report (continued)<br />

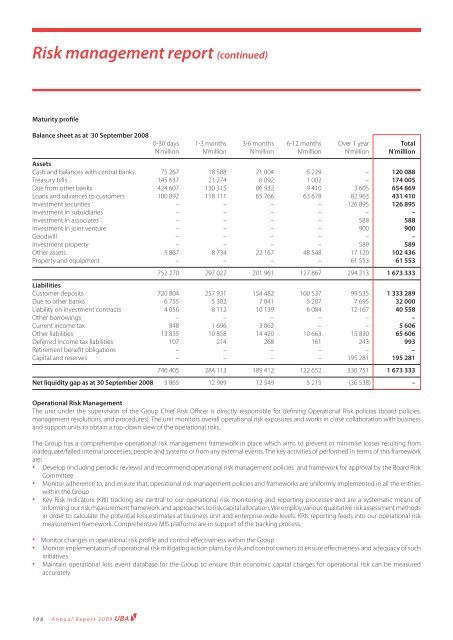

Maturity profi le<br />

Balance sheet as at 30 September 2008<br />

0-30 days 1-3 months 3-6 months 6-12 months Over 1 year Total<br />

N’million N’million N’million N’million N’million N’million<br />

Assets<br />

Cash <strong>and</strong> balances with central banks 75 267 18 588 21 004 5 229 – 120 088<br />

Treasury bills 145 637 21 274 6 092 1 002 – 174 005<br />

Due from other banks 424 607 130 315 86 932 9 410 3 605 654 869<br />

Loans <strong>and</strong> advances to customers 100 892 118 111 65 766 63 678 82 963 431 410<br />

Investment securities – – – – 126 895 126 895<br />

Investment in subsidiaries – – – – – –<br />

Investment in associates – – – – 588 588<br />

Investment in joint venture – – – – 900 900<br />

Goodwill – – – – – –<br />

Investment property – – – – 589 589<br />

Other assets 5 867 8 734 22 167 48 548 17 120 102 436<br />

Property <strong>and</strong> equipment – – – – 61 553 61 553<br />

Liabilities<br />

752 270 297 022 201 961 127 867 294 213 1 673 333<br />

Customer deposits 720 804 257 931 154 482 100 537 99 535 1 333 289<br />

Due to other banks 6 755 5 302 7 041 5 207 7 695 32 000<br />

Liability on investment contracts 4 056 8 112 10 139 6 084 12 167 40 558<br />

Other borrowings – – – – – –<br />

Current income tax 848 1 696 3 062 – – 5 606<br />

Other liabilities 13 835 10 858 14 420 10 663 15 830 65 606<br />

Deferred income tax liabilities 107 214 268 161 243 993<br />

Retirement benefi t obligations – – – – – –<br />

Capital <strong>and</strong> reserves – – – – 195 281 195 281<br />

746 405 284 113 189 412 122 652 330 751 1 673 333<br />

Net liquidity gap as at 30 September 2008 5 865 12 909 12 549 5 215 (36 538) –<br />

Operational Risk Management<br />

The unit under the supervision of the Group Chief Risk Offi cer is directly responsible for defi ning Operational Risk policies (board policies,<br />

management resolutions, <strong>and</strong> procedures). The unit monitors overall operational risk exposures <strong>and</strong> works in close collaboration with business<br />

<strong>and</strong> support units to obtain a top-down view of the operational risks.<br />

The Group has a comprehensive operational risk management framework in place which aims to prevent or minimise losses resulting from<br />

inadequate/failed internal processes, people <strong>and</strong> systems or from any external events. The key activities of performed in terms of this framework<br />

are:<br />

• Develop (including periodic reviews) <strong>and</strong> recommend operational risk management policies <strong>and</strong> framework for approval by the Board Risk<br />

Committee<br />

• Monitor adherence to, <strong>and</strong> ensure that, operational risk management policies <strong>and</strong> frameworks are uniformly implemented in all the entities<br />

within the Group<br />

• Key Risk Indicators (KRI) tracking are central to our operational risk monitoring <strong>and</strong> reporting processes <strong>and</strong> are a systematic means of<br />

informing our risk measurement framework <strong>and</strong> approaches to risk capital allocation. We employ various qualitative risk assessment methods<br />

in order to calculate the potential loss estimates at business unit <strong>and</strong> enterprise-wide levels. KRIs reporting feeds into our operational risk<br />

measurement framework. Comprehensive MIS platforms are in support of the tracking process.<br />

• Monitor changes in operational risk profi le <strong>and</strong> control eff ectiveness within the Group<br />

• Monitor implementation of operational risk mitigating action plans by risk <strong>and</strong> control owners to ensure eff ectiveness <strong>and</strong> adequacy of such<br />

initiatives<br />

• Maintain operational loss event database for the Group to ensure that economic capital charges for operational risk can be measured<br />

accurately<br />

108<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2009</strong>