2009 Annual Report and Financial Statements - UBA Plc

2009 Annual Report and Financial Statements - UBA Plc

2009 Annual Report and Financial Statements - UBA Plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the consolidated fi nancial statements<br />

for the period ended 31 December <strong>2009</strong><br />

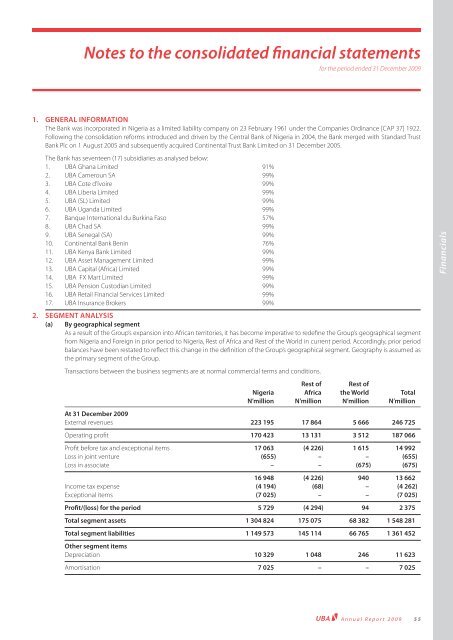

1. GENERAL INFORMATION<br />

The Bank was incorporated in Nigeria as a limited liability company on 23 February 1961 under the Companies Ordinance [CAP 37] 1922.<br />

Following the consolidation reforms introduced <strong>and</strong> driven by the Central Bank of Nigeria in 2004, the Bank merged with St<strong>and</strong>ard Trust<br />

Bank <strong>Plc</strong> on 1 August 2005 <strong>and</strong> subsequently acquired Continental Trust Bank Limited on 31 December 2005.<br />

The Bank has seventeen (17) subsidiaries as analysed below:<br />

1. <strong>UBA</strong> Ghana Limited 91%<br />

2. <strong>UBA</strong> Cameroun SA 99%<br />

3. <strong>UBA</strong> Cote d’lvoire 99%<br />

4. <strong>UBA</strong> Liberia Limited 99%<br />

5. <strong>UBA</strong> (SL) Limited 99%<br />

6. <strong>UBA</strong> Ug<strong>and</strong>a Limited 99%<br />

7. Banque International du Burkina Faso 57%<br />

8. <strong>UBA</strong> Chad SA 99%<br />

9. <strong>UBA</strong> Senegal (SA) 99%<br />

10. Continental Bank Benin 76%<br />

11. <strong>UBA</strong> Kenya Bank Limited 99%<br />

12. <strong>UBA</strong> Asset Management Limited 99%<br />

13. <strong>UBA</strong> Capital (Africa) Limited 99%<br />

14. <strong>UBA</strong> FX Mart Limited 99%<br />

15. <strong>UBA</strong> Pension Custodian Limited 99%<br />

16. <strong>UBA</strong> Retail <strong>Financial</strong> Services Limited 99%<br />

17. <strong>UBA</strong> Insurance Brokers 99%<br />

2. SEGMENT ANALYSIS<br />

(a) By geographical segment<br />

As a result of the Group’s expansion into African territories, it has become imperative to redefi ne the Group’s geographical segment<br />

from Nigeria <strong>and</strong> Foreign in prior period to Nigeria, Rest of Africa <strong>and</strong> Rest of the World in current period. Accordingly, prior period<br />

balances have been restated to refl ect this change in the defi nition of the Group’s geographical segment. Geography is assumed as<br />

the primary segment of the Group.<br />

Transactions between the business segments are at normal commercial terms <strong>and</strong> conditions.<br />

Rest of Rest of<br />

Nigeria Africa the World Total<br />

N’million N’million N’million N’million<br />

At 31 December <strong>2009</strong><br />

External revenues 223 195 17 864 5 666 246 725<br />

Operating profi t 170 423 13 131 3 512 187 066<br />

Profi t before tax <strong>and</strong> exceptional items 17 063 (4 226) 1 615 14 992<br />

Loss in joint venture (655) – – (655)<br />

Loss in associate – – (675) (675)<br />

16 948 (4 226) 940 13 662<br />

Income tax expense (4 194) (68) – (4 262)<br />

Exceptional items (7 025) – – (7 025)<br />

Profi t/(loss) for the period 5 729 (4 294) 94 2 375<br />

Total segment assets 1 304 824 175 075 68 382 1 548 281<br />

Total segment liabilities 1 149 573 145 114 66 765 1 361 452<br />

Other segment items<br />

Depreciation 10 329 1 048 246 11 623<br />

Amortisation 7 025 – – 7 025<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2009</strong> 55<br />

<strong>Financial</strong>s