2009 Annual Report and Financial Statements - UBA Plc

2009 Annual Report and Financial Statements - UBA Plc

2009 Annual Report and Financial Statements - UBA Plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Risk management report (continued)<br />

96<br />

Provisioning policies<br />

The internal <strong>and</strong> external rating systems described on page 95 focus more on credit-quality mapping from the inception of the lending <strong>and</strong><br />

investment activities. In contrast, loan loss provisions are recognised for fi nancial reporting purposes only for losses that have been incurred<br />

at the balance sheet date based on criteria set out in the Prudential Guidelines for Licensed Banks.<br />

Non-performing credit:<br />

A credit facility is regarded as non-performing when any of the following conditions exists:<br />

• Interest on principal is due <strong>and</strong> unpaid for 90 days <strong>and</strong> above<br />

• Where principal is outst<strong>and</strong>ing for 90 days <strong>and</strong> above<br />

Non-performing credit is categorised into three namely:<br />

• Sub-st<strong>and</strong>ard – This occurs where principal <strong>and</strong> or interest remain outst<strong>and</strong>ing for more than 90 days but less than 180 days <strong>and</strong> 10%<br />

provision is suspended on the outst<strong>and</strong>ing balance.<br />

• Doubtful – This occurs where principal <strong>and</strong>/or interest remain outst<strong>and</strong>ing for at least 180 days, but less than 360 days.<br />

• Lost – This occurs where principal <strong>and</strong> or interest remain outst<strong>and</strong>ing for more than 360 days.<br />

These defi nitions are the same for both personal <strong>and</strong> corporate loans.<br />

In the determination of the amount to be raised as provision according to the above categorisation, no value of collateral is recognised <strong>and</strong> set<br />

off against the fi nal provision amount.<br />

(b) Debt securities <strong>and</strong> other bills<br />

For debt securities <strong>and</strong> other bills, external rating such as St<strong>and</strong>ard & Poor’s rating or their equivalents are used by Treasury primarily to<br />

manage their liquidity risk exposures.<br />

RISK LIMIT CONTROL AND MITIGATION POLICIES<br />

The Group manages limits <strong>and</strong> controls concentrations of credit risk wherever they are identifi ed – in particular, to individual counterparties <strong>and</strong><br />

groups, <strong>and</strong> to industries <strong>and</strong> countries.<br />

The Group structures the levels of credit risk it undertakes by placing limits on the amount of risk accepted in relation to one borrower, or groups<br />

of borrowers (single obligor limits), <strong>and</strong> to geographical <strong>and</strong> industry segments.<br />

Such risks are monitored on a revolving basis <strong>and</strong> subject to an annual or more frequent review, when considered necessary. Limits on the level<br />

of credit risk by product, industry sector <strong>and</strong> by country are approved quarterly by the Board of Directors.<br />

The exposure to any one borrower including banks <strong>and</strong> brokers is further restricted by sub-limits covering on- <strong>and</strong> off -balance sheet exposures,<br />

<strong>and</strong> daily delivery risk limits in relation to trading items such as forward foreign exchange contracts. Actual exposures against limits are monitored<br />

daily.<br />

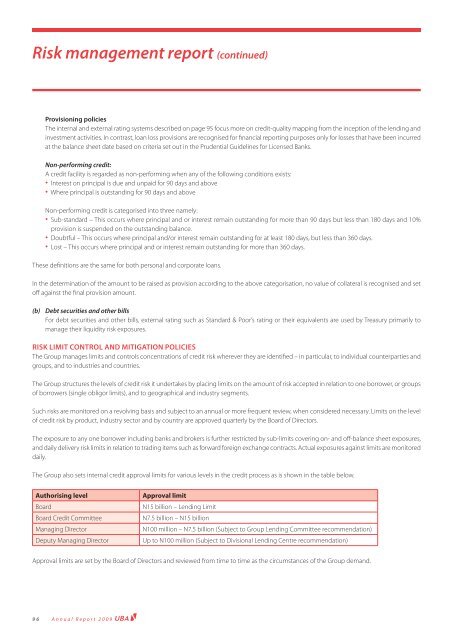

The Group also sets internal credit approval limits for various levels in the credit process as is shown in the table below.<br />

Authorising level Approval limit<br />

Board N15 billion – Lending Limit<br />

Board Credit Committee N7.5 billion – N15 billion<br />

Managing Director N100 million – N7.5 billion (Subject to Group Lending Committee recommendation)<br />

Deputy Managing Director Up to N100 million (Subject to Divisional Lending Centre recommendation)<br />

Approval limits are set by the Board of Directors <strong>and</strong> reviewed from time to time as the circumstances of the Group dem<strong>and</strong>.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2009</strong>