2009 Annual Report and Financial Statements - UBA Plc

2009 Annual Report and Financial Statements - UBA Plc

2009 Annual Report and Financial Statements - UBA Plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Shareholder information (continued)<br />

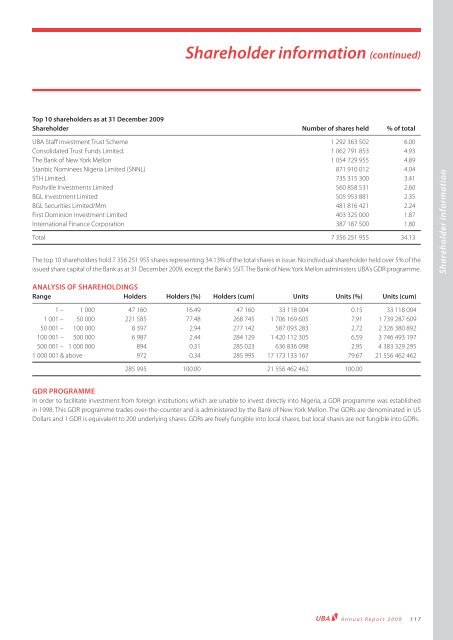

Top 10 shareholders as at 31 December <strong>2009</strong><br />

Shareholder Number of shares held % of total<br />

<strong>UBA</strong> Staff Investment Trust Scheme 1 292 363 502 6.00<br />

Consolidated Trust Funds Limited. 1 062 791 853 4.93<br />

The Bank of New York Mellon 1 054 729 955 4.89<br />

Stanbic Nominees Nigeria Limited (SNNL) 871 910 012 4.04<br />

STH Limited. 735 315 300 3.41<br />

Poshville Investments Limited 560 858 531 2.60<br />

BGL Investment Limited 505 953 881 2.35<br />

BGL Securities Limited/Mm 481 816 421 2.24<br />

First Dominion Investment Limited 403 325 000 1.87<br />

International Finance Corporation 387 187 500 1.80<br />

Total 7 356 251 955 34.13<br />

The top 10 shareholders hold 7 356 251 955 shares representing 34.13% of the total shares in issue. No individual shareholder held over 5% of the<br />

issued share capital of the Bank as at 31 December <strong>2009</strong>, except the Bank’s SSIT. The Bank of New York Mellon administers <strong>UBA</strong>’s GDR programme.<br />

ANALYSIS OF SHAREHOLDINGS<br />

Range Holders Holders (%) Holders (cum) Units Units (%) Units (cum)<br />

1 – 1 000 47 160 16.49 47 160 33 118 004 0.15 33 118 004<br />

1 001 – 50 000 221 585 77.48 268 745 1 706 169 605 7.91 1 739 287 609<br />

50 001 – 100 000 8 397 2.94 277 142 587 093 283 2.72 2 326 380 892<br />

100 001 – 500 000 6 987 2.44 284 129 1 420 112 305 6.59 3 746 493 197<br />

500 001 – 1 000 000 894 0.31 285 023 636 836 098 2.95 4 383 329 295<br />

1 000 001 & above 972 0.34 285 995 17 173 133 167 79.67 21 556 462 462<br />

285 995 100.00 21 556 462 462 100.00<br />

GDR PROGRAMME<br />

In order to facilitate investment from foreign institutions which are unable to invest directly into Nigeria, a GDR programme was established<br />

in 1998. This GDR programme trades over-the-counter <strong>and</strong> is administered by the Bank of New York Mellon. The GDRs are denominated in US<br />

Dollars <strong>and</strong> 1 GDR is equivalent to 200 underlying shares. GDRs are freely fungible into local shares, but local shares are not fungible into GDRs.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2009</strong> 117<br />

Shareholder information