2009 Annual Report and Financial Statements - UBA Plc

2009 Annual Report and Financial Statements - UBA Plc

2009 Annual Report and Financial Statements - UBA Plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Risk management report (continued)<br />

The Group’s regulatory capital as managed by its <strong>Financial</strong> Control <strong>and</strong> Treasury Units is divided into two tiers:<br />

Tier 1 capital: share capital, retained earnings <strong>and</strong> reserves created by appropriations of retained earnings. The book value of goodwill is deducted<br />

in arriving at Tier 1 capital; <strong>and</strong><br />

Tier 2 capital: preference shares, minority interests arising on consolidation, qualifying debt stock, fi xed assets revaluation reserves, foreign<br />

currency revaluation reserves, general provisions subject to maximum of 1.25% of risk assets <strong>and</strong> hybrid instruments convertible bonds.<br />

Investments in unconsolidated subsidiaries <strong>and</strong> associates are deducted from Tier 1 <strong>and</strong> Tier 2 capital to arrive at the bank solo regulatory capital<br />

adequacy measurement.<br />

The risk-weighted assets are measured by means of a hierarchy of fi ve risk weights classifi ed according to the nature of – <strong>and</strong> refl ecting an<br />

estimate of credit, market <strong>and</strong> other risks associated with each asset <strong>and</strong> counterparty, taking into account any eligible collateral or guarantees.<br />

A similar treatment is adopted for off -balance sheet exposure, with some adjustments to refl ect the more contingent nature of the potential<br />

losses.<br />

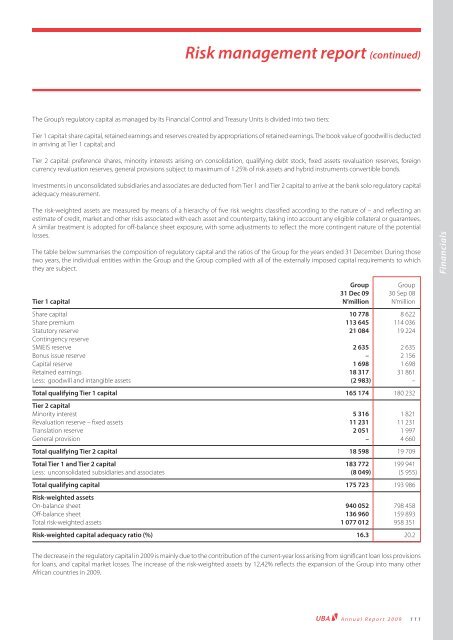

The table below summarises the composition of regulatory capital <strong>and</strong> the ratios of the Group for the years ended 31 December. During those<br />

two years, the individual entities within the Group <strong>and</strong> the Group complied with all of the externally imposed capital requirements to which<br />

they are subject.<br />

Group Group<br />

31 Dec 09 30 Sep 08<br />

Tier 1 capital N’million N’million<br />

Share capital 10 778 8 622<br />

Share premium 113 645 114 036<br />

Statutory reserve<br />

Contingency reserve<br />

21 084 19 224<br />

SMIEIS reserve 2 635 2 635<br />

Bonus issue reserve – 2 156<br />

Capital reserve 1 698 1 698<br />

Retained earnings 18 317 31 861<br />

Less: goodwill <strong>and</strong> intangible assets (2 983) –<br />

Total qualifying Tier 1 capital<br />

Tier 2 capital<br />

165 174 180 232<br />

Minority interest 5 316 1 821<br />

Revaluation reserve – fi xed assets 11 231 11 231<br />

Translation reserve 2 051 1 997<br />

General provision – 4 660<br />

Total qualifying Tier 2 capital 18 598 19 709<br />

Total Tier 1 <strong>and</strong> Tier 2 capital 183 772 199 941<br />

Less: unconsolidated subsidiaries <strong>and</strong> associates (8 049) (5 955)<br />

Total qualifying capital<br />

Risk-weighted assets<br />

175 723 193 986<br />

On-balance sheet 940 052 798 458<br />

Off -balance sheet 136 960 159 893<br />

Total risk-weighted assets 1 077 012 958 351<br />

Risk-weighted capital adequacy ratio (%) 16.3 20.2<br />

The decrease in the regulatory capital in <strong>2009</strong> is mainly due to the contribution of the current-year loss arising from signifi cant loan loss provisions<br />

for loans, <strong>and</strong> capital market losses. The increase of the risk-weighted assets by 12,42% refl ects the expansion of the Group into many other<br />

African countries in <strong>2009</strong>.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2009</strong> 111<br />

<strong>Financial</strong>s