2009 Annual Report and Financial Statements - UBA Plc

2009 Annual Report and Financial Statements - UBA Plc

2009 Annual Report and Financial Statements - UBA Plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

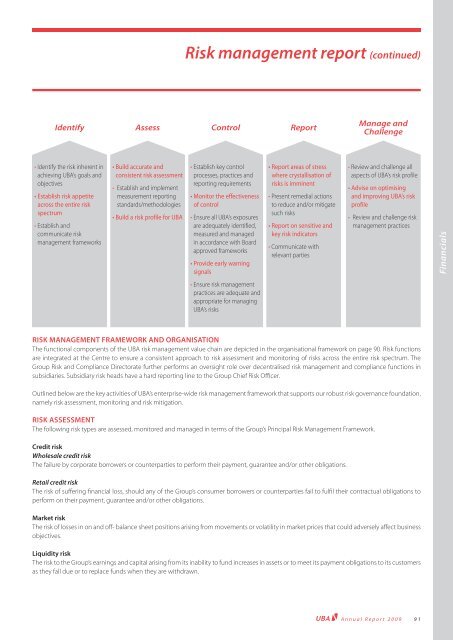

• Identify the risk inherent in<br />

achieving <strong>UBA</strong>’s goals <strong>and</strong><br />

objectives<br />

• Establish risk appetite<br />

across the entire risk<br />

spectrum<br />

• Establish <strong>and</strong><br />

communicate risk<br />

management frameworks<br />

Risk management report (continued)<br />

Identify Assess Control <strong>Report</strong><br />

• Build accurate <strong>and</strong><br />

consistent risk assessment<br />

• Establish <strong>and</strong> implement<br />

measurement reporting<br />

st<strong>and</strong>ards/methodologies<br />

• Build a risk profile for <strong>UBA</strong><br />

• Establish key control<br />

processes, practices <strong>and</strong><br />

reporting requirements<br />

• Monitor the effectiveness<br />

of control<br />

• Ensure all <strong>UBA</strong>’s exposures<br />

are adequately identified,<br />

measured <strong>and</strong> managed<br />

in accordance with Board<br />

approved frameworks<br />

• Provide early warning<br />

signals<br />

• Ensure risk management<br />

practices are adequate <strong>and</strong><br />

appropriate for managing<br />

<strong>UBA</strong>’s risks<br />

• <strong>Report</strong> areas of stress<br />

where crystallisation of<br />

risks is imminent<br />

• Present remedial actions<br />

to reduce <strong>and</strong>/or mitigate<br />

such risks<br />

• <strong>Report</strong> on sensitive <strong>and</strong><br />

key risk indicators<br />

• Communicate with<br />

relevant parties<br />

Manage <strong>and</strong><br />

Challenge<br />

• Review <strong>and</strong> challenge all<br />

aspects of <strong>UBA</strong>’s risk profile<br />

• Advise on optimising<br />

<strong>and</strong> improving <strong>UBA</strong>’s risk<br />

profile<br />

• Review <strong>and</strong> challenge risk<br />

management practices<br />

RISK MANAGEMENT FRAMEWORK AND ORGANISATION<br />

The functional components of the <strong>UBA</strong> risk management value chain are depicted in the organisational framework on page 90. Risk functions<br />

are integrated at the Centre to ensure a consistent approach to risk assessment <strong>and</strong> monitoring of risks across the entire risk spectrum. The<br />

Group Risk <strong>and</strong> Compliance Directorate further performs an oversight role over decentralised risk management <strong>and</strong> compliance functions in<br />

subsidiaries. Subsidiary risk heads have a hard reporting line to the Group Chief Risk Offi cer.<br />

Outlined below are the key activities of <strong>UBA</strong>’s enterprise-wide risk management framework that supports our robust risk governance foundation,<br />

namely risk assessment, monitoring <strong>and</strong> risk mitigation.<br />

RISK ASSESSMENT<br />

The following risk types are assessed, monitored <strong>and</strong> managed in terms of the Group’s Principal Risk Management Framework.<br />

Credit risk<br />

Wholesale credit risk<br />

The failure by corporate borrowers or counterparties to perform their payment, guarantee <strong>and</strong>/or other obligations.<br />

Retail credit risk<br />

The risk of suff ering fi nancial loss, should any of the Group’s consumer borrowers or counterparties fail to fulfi l their contractual obligations to<br />

perform on their payment, guarantee <strong>and</strong>/or other obligations.<br />

Market risk<br />

The risk of losses in on <strong>and</strong> off - balance sheet positions arising from movements or volatility in market prices that could adversely aff ect business<br />

objectives.<br />

Liquidity risk<br />

The risk to the Group’s earnings <strong>and</strong> capital arising from its inability to fund increases in assets or to meet its payment obligations to its customers<br />

as they fall due or to replace funds when they are withdrawn.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2009</strong> 91<br />

<strong>Financial</strong>s