2009 Annual Report and Financial Statements - UBA Plc

2009 Annual Report and Financial Statements - UBA Plc

2009 Annual Report and Financial Statements - UBA Plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the consolidated fi nancial statements<br />

for the period ended 31 December <strong>2009</strong> (continued)<br />

76<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2009</strong><br />

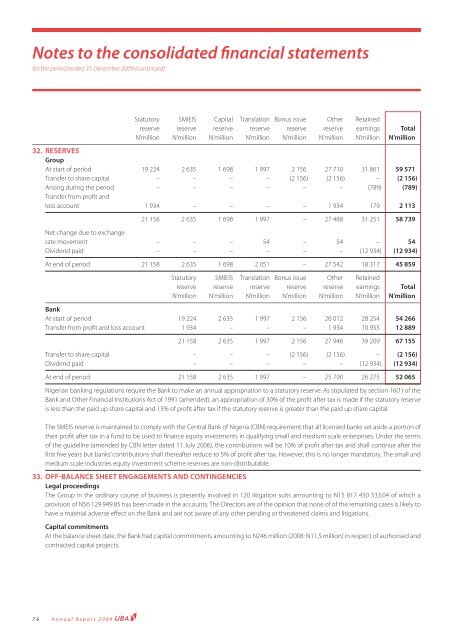

Statutory SMIEIS Capital Translation Bonus issue Other Retained<br />

reserve reserve reserve reserve reserve reserve earnings Total<br />

N’million N’million N’million N’million N’million N’million N’million N’million<br />

32. RESERVES<br />

Group<br />

At start of period 19 224 2 635 1 698 1 997 2 156 27 710 31 861 59 571<br />

Transfer to share capital – – – – (2 156) (2 156) – (2 156)<br />

Arising during the period – – – – – – (789) (789)<br />

Transfer from profi t <strong>and</strong><br />

loss account 1 934 – – – – 1 934 179 2 113<br />

21 158 2 635 1 698 1 997 – 27 488 31 251 58 739<br />

Net change due to exchange<br />

rate movement – – – 54 – 54 – 54<br />

Dividend paid – – – – – – (12 934) (12 934)<br />

At end of period 21 158 2 635 1 698 2 051 – 27 542 18 317 45 859<br />

Statutory SMIEIS Translation Bonus issue Other Retained<br />

reserve reserve reserve reserve reserve earnings Total<br />

N’million N’million N’million N’million N’million N’million N’million<br />

Bank<br />

At start of period 19 224 2 635 1 997 2 156 26 012 28 254 54 266<br />

Transfer from profi t <strong>and</strong> loss account 1 934 – – – 1 934 10 955 12 889<br />

21 158 2 635 1 997 2 156 27 946 39 209 67 155<br />

Transfer to share capital – – – (2 156) (2 156) – (2 156)<br />

Dividend paid – – – – – (12 934) (12 934)<br />

At end of period 21 158 2 635 1 997 – 25 790 26 275 52 065<br />

Nigerian banking regulations require the Bank to make an annual appropriation to a statutory reserve. As stipulated by section 16(1) of the<br />

Bank <strong>and</strong> Other <strong>Financial</strong> Institutions Act of 1991 (amended), an appropriation of 30% of the profi t after tax is made if the statutory reserve<br />

is less than the paid up share capital <strong>and</strong> 15% of profi t after tax if the statutory reserve is greater than the paid up share capital.<br />

The SMEIS reserve is maintained to comply with the Central Bank of Nigeria (CBN) requirement that all licensed banks set aside a portion of<br />

their profi t after tax in a fund to be used to fi nance equity investments in qualifying small <strong>and</strong> medium scale enterprises. Under the terms<br />

of the guideline (amended by CBN letter dated 11 July 2006), the contributions will be 10% of profi t after tax <strong>and</strong> shall continue after the<br />

fi rst fi ve years but banks’ contributions shall thereafter reduce to 5% of profi t after tax. However, this is no longer m<strong>and</strong>atory. The small <strong>and</strong><br />

medium scale industries equity investment scheme reserves are non-distributable.<br />

33. OFF-BALANCE SHEET ENGAGEMENTS AND CONTINGENCIES<br />

Legal proceedings<br />

The Group in the ordinary course of business is presently involved in 120 litigation suits amounting to N15 817 430 533.04 of which a<br />

provision of N56 129 949.85 has been made in the accounts. The Directors are of the opinion that none of of the remaining cases is likely to<br />

have a material adverse eff ect on the Bank <strong>and</strong> are not aware of any other pending or threatened claims <strong>and</strong> litigations.<br />

Capital commitments<br />

At the balance sheet date, the Bank had capital commitments amounting to N246 million (2008: N11.5 million) in respect of authorised <strong>and</strong><br />

contracted capital projects.