Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Corporate Financing<br />

What are credit ratings?<br />

Ratings reduce information asymmetry and improve<br />

market functioning and efficiency<br />

Credit ratings are opinions about credit risk. Standard &<br />

Poor’s ratings express the agency’s opinion on the ability<br />

and willingness of an issuer, such as a corporation, to meet<br />

its financial obligations in full and on time. Credit ratings<br />

can also allow individuals to get a picture of the credit<br />

quality of an individual <strong>de</strong>bt issue, such as a corporate<br />

bond, and the relative likelihood that the issue may <strong>de</strong>fault.<br />

We express our ratings as letter gra<strong>de</strong>s ranging from ‘AAA’<br />

to ‘D’ to communicate our opinion on the relative level of<br />

credit risk.<br />

We base our ratings on analyses performed by experienced<br />

credit analysts who evaluate and interpret information<br />

received from issuers and other available sources to form a<br />

consi<strong>de</strong>red opinion. Unlike other types of opinions, such<br />

as, for example, those provi<strong>de</strong>d by doctors or lawyers,<br />

credit ratings opinions are not inten<strong>de</strong>d to be a prognosis or<br />

recommendation. Ratings should not be viewed as an<br />

assurance of credit quality nor as an exact measure of the<br />

likelihood of <strong>de</strong>fault. Rather, they are primarily inten<strong>de</strong>d to<br />

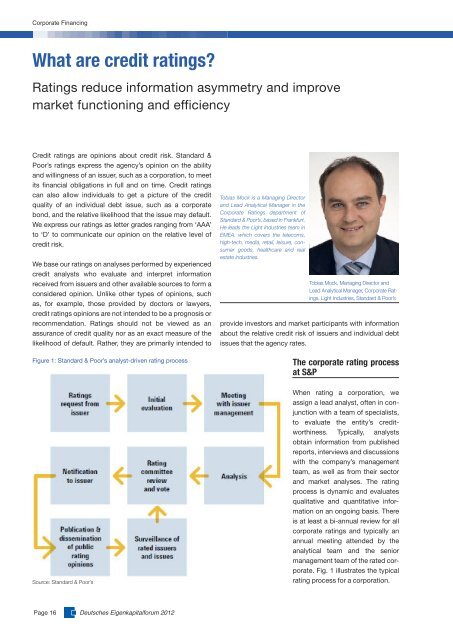

Figure 1: Standard & Poor’s analyst-driven rating process<br />

Source: Standard & Poor’s<br />

Page 16 <strong>Deutsches</strong> <strong>Eigenkapitalforum</strong> 2012<br />

Tobias Mock is a Managing Director<br />

and Lead Analytical Manager in the<br />

Corporate Ratings <strong>de</strong>partment of<br />

Standard & Poor’s, based in Frankfurt.<br />

He leads the Light Industries team in<br />

EMEA, which covers the telecoms,<br />

high-tech, media, retail, leisure, consumer<br />

goods, healthcare and real<br />

estate industries.<br />

Tobias Mock, Managing Director and<br />

Lead Analytical Manager, Corporate Ratings,<br />

Light Industries, Standard & Poor’s<br />

provi<strong>de</strong> investors and market participants with information<br />

about the relative credit risk of issuers and individual <strong>de</strong>bt<br />

issues that the agency rates.<br />

The corporate rating process<br />

at S&P<br />

When rating a corporation, we<br />

assign a lead analyst, often in conjunction<br />

with a team of specialists,<br />

to evaluate the entity’s credit -<br />

worthiness. Typically, analysts<br />

obtain information from published<br />

reports, interviews and discussions<br />

with the company’s management<br />

team, as well as from their sector<br />

and market analyses. The rating<br />

process is dynamic and evaluates<br />

qualitative and quantitative information<br />

on an ongoing basis. There<br />

is at least a bi-annual review for all<br />

corporate ratings and typically an<br />

annual meeting atten<strong>de</strong>d by the<br />

analytical team and the senior<br />

management team of the rated corporate.<br />

Fig. 1 illustrates the typical<br />

rating process for a corporation.