Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Special: CSR<br />

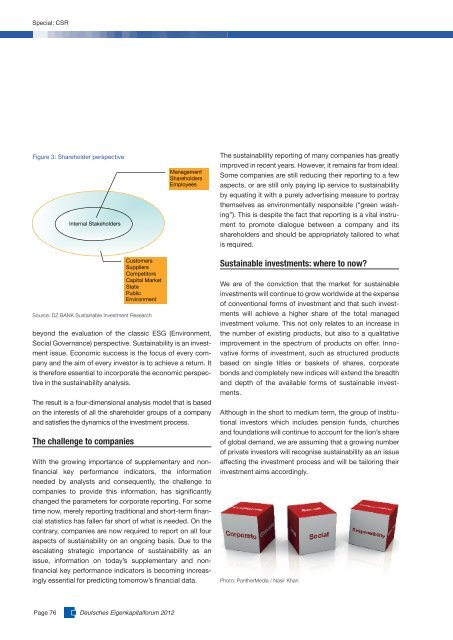

Figure 3: Sharehol<strong>de</strong>r perspective<br />

Internal Stakehol<strong>de</strong>rs<br />

beyond the evaluation of the classic ESG (Environment,<br />

Social Governance) perspective. Sustainability is an investment<br />

issue. Economic success is the focus of every company<br />

and the aim of every investor is to achieve a return. It<br />

is therefore essential to incorporate the economic perspective<br />

in the sustainability analysis.<br />

The result is a four-dimensional analysis mo<strong>de</strong>l that is based<br />

on the interests of all the sharehol<strong>de</strong>r groups of a company<br />

and satisfies the dynamics of the investment process.<br />

The challenge to companies<br />

Customers<br />

Suppliers<br />

Competitors<br />

Capital Market<br />

State<br />

Public<br />

Environment<br />

Source: DZ BANK Sustainable Investment Research<br />

With the growing importance of supplementary and nonfinancial<br />

key performance indicators, the information<br />

nee<strong>de</strong>d by analysts and consequently, the challenge to<br />

companies to provi<strong>de</strong> this information, has significantly<br />

changed the parameters for corporate reporting. For some<br />

time now, merely reporting traditional and short-term financial<br />

statistics has fallen far short of what is nee<strong>de</strong>d. On the<br />

contrary, companies are now required to report on all four<br />

aspects of sustainability on an ongoing basis. Due to the<br />

escalating strategic importance of sustainability as an<br />

issue, information on today’s supplementary and nonfinancial<br />

key performance indicators is becoming increasingly<br />

essential for predicting tomorrow’s financial data.<br />

Page 76 <strong>Deutsches</strong> <strong>Eigenkapitalforum</strong> 2012<br />

Management<br />

Sharehol<strong>de</strong>rs<br />

Employees<br />

The sustainability reporting of many companies has greatly<br />

improved in recent years. However, it remains far from i<strong>de</strong>al.<br />

Some companies are still reducing their reporting to a few<br />

aspects, or are still only paying lip service to sustainability<br />

by equating it with a purely advertising measure to portray<br />

themselves as environmentally responsible (“green washing”).<br />

This is <strong>de</strong>spite the fact that reporting is a vital instrument<br />

to promote dialogue between a company and its<br />

sharehol<strong>de</strong>rs and should be appropriately tailored to what<br />

is required.<br />

Sustainable investments: where to now?<br />

We are of the conviction that the market for sustainable<br />

investments will continue to grow worldwi<strong>de</strong> at the expense<br />

of conventional forms of investment and that such investments<br />

will achieve a higher share of the total managed<br />

investment volume. This not only relates to an increase in<br />

the number of existing products, but also to a qualitative<br />

improvement in the spectrum of products on offer. Inno -<br />

vative forms of investment, such as structured products<br />

based on single titles or baskets of shares, corporate<br />

bonds and completely new indices will extend the breadth<br />

and <strong>de</strong>pth of the available forms of sustainable investments.<br />

Although in the short to medium term, the group of institutional<br />

investors which inclu<strong>de</strong>s pension funds, churches<br />

and foundations will continue to account for the lion’s share<br />

of global <strong>de</strong>mand, we are assuming that a growing number<br />

of private investors will recognise sustainability as an issue<br />

affecting the investment process and will be tailoring their<br />

investment aims accordingly.<br />

Photo: PantherMedia / Nasir Khan