Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Special: CSR<br />

Sustainability is an investment issue<br />

Shares must be selected based on a dynamic,<br />

multi-dimensional analysis<br />

The upheaval on the financial markets continues. What can<br />

investors do in these turbulent times? Sustainable investment<br />

is the name of the game – and not just in times of<br />

crisis!<br />

For a long time, those making sustainable investments<br />

were regar<strong>de</strong>d as a strange and exotic species among<br />

investors and were mocked as i<strong>de</strong>alistic “do goo<strong>de</strong>rs”.<br />

However, the current lively global <strong>de</strong>bate taking place in<br />

society on the subject of sustainability has not passed the<br />

financial markets by. For some years now, issues such as<br />

global climate change have been penetrating the collective<br />

consciousness of the financial world and this has increasingly<br />

resulted in special forms of investment, a trend confirmed<br />

by the high growth rates.<br />

Talk of anachronistic trends or passing fads no longer has<br />

any place in the current <strong>de</strong>bate on every aspect of sustainable<br />

investment. Sustainable investments have become an<br />

established form of investment, combining the potential for<br />

economic returns with ethical, social and ecological<br />

motives.<br />

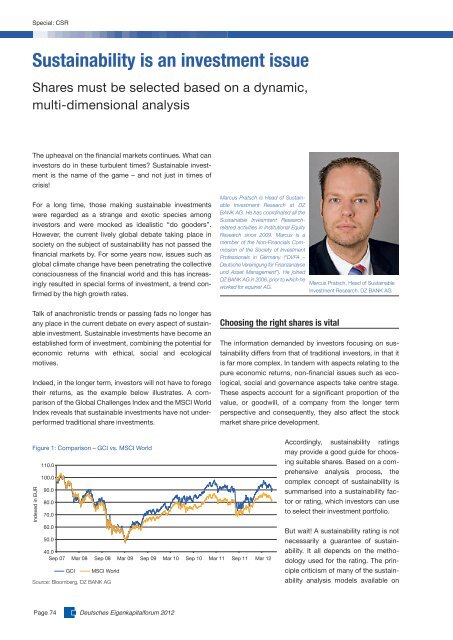

In<strong>de</strong>ed, in the longer term, investors will not have to forego<br />

their returns, as the example below illustrates. A com -<br />

parison of the Global Challenges In<strong>de</strong>x and the MSCI World<br />

In<strong>de</strong>x reveals that sustainable investments have not un<strong>de</strong>rperformed<br />

traditional share investments.<br />

Figure 1: Comparison – GCI vs. MSCI World<br />

In<strong>de</strong>xed in EUR<br />

110.0<br />

100.0<br />

90.0<br />

80.0<br />

70.0<br />

60.0<br />

50.0<br />

40.0<br />

Sep 07 Mar 08 Sep 08 Mar 09 Sep 09 Mar 10 Sep 10 Mar 11 Sep 11<br />

GCI MSCI World<br />

Source: Bloomberg, DZ BANK AG<br />

Page 74 <strong>Deutsches</strong> <strong>Eigenkapitalforum</strong> 2012<br />

Marcus Pratsch is Head of Sustainable<br />

Investment Research at DZ<br />

BANK AG. He has coordinated all the<br />

Sustainable Invesmtent Researchrelated<br />

activities in Institutional Equity<br />

Research since 2009. Marcus is a<br />

member of the Non-Financials Commission<br />

of the Society of Investment<br />

Professionals in Germany (“DVFA –<br />

Deutsche Vereinigung für Finanzanalyse<br />

und Asset Management”). He joined<br />

DZ BANK AG in 2006, prior to which he<br />

worked for equinet AG.<br />

Choosing the right shares is vital<br />

Marcus Pratsch, Head of Sustainable<br />

Investment Research, DZ BANK AG<br />

The information <strong>de</strong>man<strong>de</strong>d by investors focusing on sustainability<br />

differs from that of traditional investors, in that it<br />

is far more complex. In tan<strong>de</strong>m with aspects relating to the<br />

pure economic returns, non-financial issues such as ecological,<br />

social and governance aspects take centre stage.<br />

These aspects account for a significant proportion of the<br />

value, or goodwill, of a company from the longer term<br />

perspective and consequently, they also affect the stock<br />

market share price <strong>de</strong>velopment.<br />

Mar 12<br />

Accordingly, sustainability ratings<br />

may provi<strong>de</strong> a good gui<strong>de</strong> for choosing<br />

suitable shares. Based on a comprehensive<br />

analysis process, the<br />

complex concept of sustainability is<br />

summarised into a sustainability factor<br />

or rating, which investors can use<br />

to select their investment portfolio.<br />

But wait! A sustainability rating is not<br />

necessarily a guarantee of sustainability.<br />

It all <strong>de</strong>pends on the metho -<br />

dology used for the rating. The prin -<br />

ciple criticism of many of the sustainability<br />

analysis mo<strong>de</strong>ls available on