Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Legal<br />

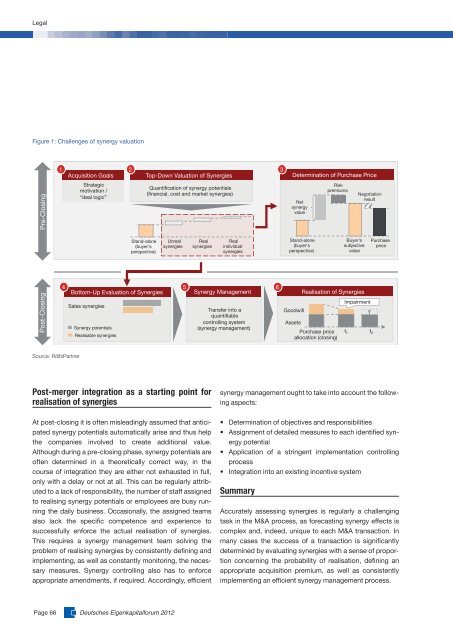

Figure 1: Challenges of synergy valuation<br />

Pre-Closing<br />

Post-Closing<br />

1<br />

Source: RölfsPartner<br />

Acquisition Goals<br />

Strategic<br />

motivation /<br />

“<strong>de</strong>al logic”<br />

4 5<br />

Bottom-Up Evaluation of Synergies<br />

Sales synergies<br />

Synergy potentials<br />

Realisable synergies<br />

Post-merger integration as a starting point for<br />

realisation of synergies<br />

At post-closing it is often misleadingly assumed that anticipated<br />

synergy potentials automatically arise and thus help<br />

the companies involved to create additional value.<br />

Although during a pre-closing phase, synergy potentials are<br />

often <strong>de</strong>termined in a theoretically correct way, in the<br />

course of integration they are either not exhausted in full,<br />

only with a <strong>de</strong>lay or not at all. This can be regularly attributed<br />

to a lack of responsibility, the number of staff assigned<br />

to realising synergy potentials or employees are busy running<br />

the daily business. Occasionally, the assigned teams<br />

also lack the specific competence and experience to<br />

successfully enforce the actual realisation of synergies.<br />

This requires a synergy management team solving the<br />

problem of realising synergies by consistently <strong>de</strong>fining and<br />

implementing, as well as constantly monitoring, the necessary<br />

measures. Synergy controlling also has to enforce<br />

appropriate amendments, if required. Accordingly, efficient<br />

Page 66 <strong>Deutsches</strong> <strong>Eigenkapitalforum</strong> 2012<br />

2<br />

Stand-alone<br />

(buyer's<br />

perspective)<br />

Top-Down Valuation of Synergies<br />

Quantification of synergy potentials<br />

(financial, cost and market synergies)<br />

Unreal<br />

synergies<br />

Real<br />

synergies<br />

Real<br />

individual<br />

synergies<br />

Synergy Management<br />

Transfer into a<br />

quantifiable<br />

controlling system<br />

(synergy management)<br />

synergy management ought to take into account the following<br />

aspects:<br />

• Determination of objectives and responsibilities<br />

• Assignment of <strong>de</strong>tailed measures to each i<strong>de</strong>ntified synergy<br />

potential<br />

• Application of a stringent implementation controlling<br />

process<br />

• Integration into an existing incentive system<br />

Summary<br />

6<br />

3<br />

Determination of Purchase Price<br />

Net<br />

synergy<br />

value<br />

Stand-alone<br />

(buyer's<br />

perspective)<br />

Goodwill<br />

Assets<br />

Risk<br />

premiums<br />

Realisation of Synergies<br />

Purchase price<br />

allocation (closing)<br />

Buyer’s<br />

subjective<br />

value<br />

Impairment<br />

Accurately assessing synergies is regularly a challenging<br />

task in the M&A process, as forecasting synergy effects is<br />

complex and, in<strong>de</strong>ed, unique to each M&A transaction. In<br />

many cases the success of a transaction is significantly<br />

<strong>de</strong>termined by evaluating synergies with a sense of proportion<br />

concerning the probability of realisation, <strong>de</strong>fining an<br />

appropriate acquisition premium, as well as con sistently<br />

implementing an efficient synergy management process.<br />

t 1<br />

Negotiation<br />

result<br />

?<br />

Purchase<br />

price<br />

t 2