Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Bond Issuance<br />

Corporate financing via bonds for SMEs<br />

The capital market as the “new” source of financing<br />

on the <strong>de</strong>bt capital si<strong>de</strong><br />

Solvency II and Basel III are keywords that are prompting<br />

many companies to reconsi<strong>de</strong>r their corporate financing.<br />

These regulatory measures pose strategic questions such<br />

as: what is the right financing mix of <strong>de</strong>bt and equity if companies<br />

are to continue benefiting from low overall cost of<br />

capital in the future? Which capital sources will continue to<br />

be available in the long term? What advantages does the<br />

capital market offer? Is this financing source a good fit for<br />

my company, and how can I prepare for this step? One of<br />

the <strong>de</strong>cisive factors is how well companies prepare for the<br />

duties of the regulated capital market.<br />

The typical profile of an SME bond<br />

The current and expected changes to classic bank financing<br />

impact upon SMEs in particular. As a result, these companies<br />

are now investigating bond financing through the<br />

capital market. In Germany, a relatively new SME bond market<br />

is taking shape for these companies. Since 2010, five<br />

stock exchanges have generated new segments and a total<br />

issue volume of more than EUR 2.4 billion. By mid-2012,<br />

more than 44 companies had used this financing channel.<br />

Five companies have even placed more than one issue,<br />

making multiple use of the bond market. The 50 issues to<br />

date are characterised by the following typical bond profile:<br />

Terms and conditions<br />

► Issue volume: min. EUR 10 million, max. EUR 200 million,<br />

avg. EUR 54 million<br />

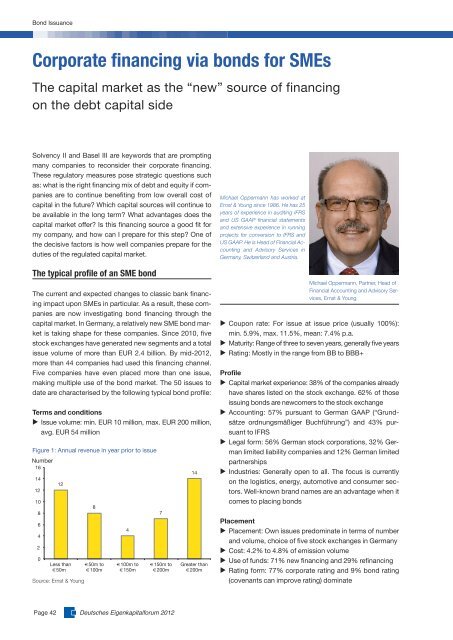

Figure 1: Annual revenue in year prior to issue<br />

Number<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

12<br />

Less than<br />

50m<br />

Source: Ernst & Young<br />

8<br />

50m to<br />

100m<br />

Page 42 <strong>Deutsches</strong> <strong>Eigenkapitalforum</strong> 2012<br />

4<br />

100m to<br />

150m<br />

7<br />

150m to<br />

200m<br />

14<br />

Greater than<br />

200m<br />

Michael Oppermann has worked at<br />

Ernst & Young since 1986. He has 25<br />

years of experience in auditing IFRS<br />

and US GAAP financial statements<br />

and extensive experience in running<br />

projects for conversion to IFRS and<br />

US GAAP. He is Head of Financial Accounting<br />

and Advisory Services in<br />

Germany, Switzerland and Austria.<br />

Michael Oppermann, Partner, Head of<br />

Financial Accounting and Advisory Services,<br />

Ernst & Young<br />

► Coupon rate: For issue at issue price (usually 100%):<br />

min. 5.9%, max. 11.5%, mean: 7.4% p.a.<br />

► Maturity: Range of three to seven years, generally five years<br />

► Rating: Mostly in the range from BB to BBB+<br />

Profile<br />

► Capital market experience: 38% of the companies already<br />

have shares listed on the stock exchange. 62% of those<br />

issuing bonds are newcomers to the stock exchange<br />

► Accounting: 57% pursuant to German GAAP (“Grundsätze<br />

ordnungsmäßiger Buchführung”) and 43% pursuant<br />

to IFRS<br />

► Legal form: 56% German stock corporations, 32% German<br />

limited liability companies and 12% German limited<br />

partnerships<br />

► Industries: Generally open to all. The focus is currently<br />

on the logistics, energy, automotive and consumer sectors.<br />

Well-known brand names are an advantage when it<br />

comes to placing bonds<br />

Placement<br />

► Placement: Own issues predominate in terms of number<br />

and volume, choice of five stock exchanges in Germany<br />

► Cost: 4.2% to 4.8% of emission volume<br />

► Use of funds: 71% new financing and 29% refinancing<br />

► Rating form: 77% corporate rating and 9% bond rating<br />

(covenants can improve rating) dominate