Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

Conference Magazine - GoingPublic.de - Deutsches Eigenkapitalforum

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Equity Markets<br />

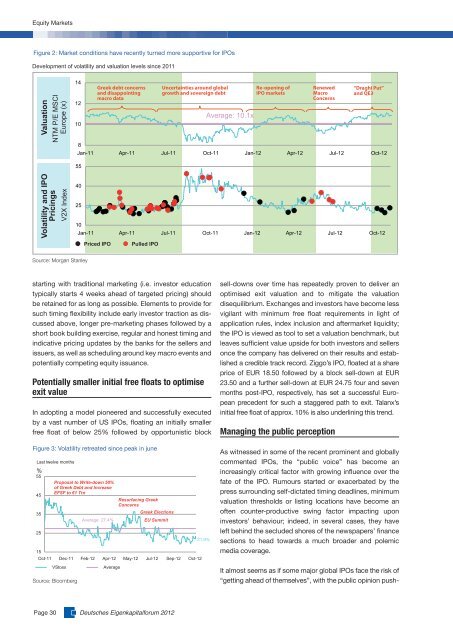

Figure 2: Market conditions have recently turned more supportive for IPOs<br />

Development of volatility and valuation levels since 2011<br />

Valuation<br />

NTM P/E MSCI<br />

Europe (x)<br />

Volatility and IPO<br />

Pricings<br />

starting with traditional marketing (i.e. investor education<br />

typically starts 4 weeks ahead of targeted pricing) should<br />

be retained for as long as possible. Elements to provi<strong>de</strong> for<br />

such timing flexibility inclu<strong>de</strong> early investor traction as discussed<br />

above, longer pre-marketing phases followed by a<br />

short book building exercise, regular and honest timing and<br />

indicative pricing updates by the banks for the sellers and<br />

issuers, as well as scheduling around key macro events and<br />

potentially competing equity issuance.<br />

Potentially smaller initial free floats to optimise<br />

exit value<br />

In adopting a mo<strong>de</strong>l pioneered and successfully executed<br />

by a vast number of US IPOs, floating an initially smaller<br />

free float of below 25% followed by opportunistic block<br />

%<br />

55<br />

45<br />

35<br />

25<br />

15<br />

V2X In<strong>de</strong>x<br />

Last twelve months<br />

Proposal to Write-down 50%<br />

of Greek Debt and Increase<br />

EFSF to 1 Trn<br />

Resurfacing Greek<br />

Concerns<br />

Greek Elections<br />

Average: 27.4%<br />

EU Summit<br />

Oct-11 Dec-11 Feb-12 Apr-12 May-12 Jul-12 Sep-12 Oct-12<br />

VStoxx Average<br />

Source: Bloomberg<br />

14<br />

12<br />

10<br />

8<br />

Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12<br />

55<br />

40<br />

25<br />

10<br />

Source: Morgan Stanley<br />

Greek <strong>de</strong>bt concerns<br />

and disappointing<br />

macro data<br />

Priced IPO Pulled IPO<br />

Figure 3: Volatility retreated since peak in june<br />

Page 30 <strong>Deutsches</strong> <strong>Eigenkapitalforum</strong> 2012<br />

Uncertainties around global<br />

growth and sovereign <strong>de</strong>bt<br />

21.9%<br />

Average: 10.1x<br />

Re-opening of<br />

IPO markets<br />

Renewed<br />

Macro<br />

Concerns<br />

Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12<br />

sell-downs over time has repeatedly proven to <strong>de</strong>liver an<br />

optimised exit valuation and to mitigate the valuation<br />

disequilibrium. Exchanges and investors have become less<br />

vigilant with minimum free float requirements in light of<br />

application rules, in<strong>de</strong>x inclusion and aftermarket liquidity;<br />

the IPO is viewed as tool to set a valuation benchmark, but<br />

leaves sufficient value upsi<strong>de</strong> for both investors and sellers<br />

once the company has <strong>de</strong>livered on their results and established<br />

a credible track record. Ziggo’s IPO, floated at a share<br />

price of EUR 18.50 followed by a block sell-down at EUR<br />

23.50 and a further sell-down at EUR 24.75 four and seven<br />

months post-IPO, respectively, has set a successful European<br />

prece<strong>de</strong>nt for such a staggered path to exit. Talanx’s<br />

initial free float of approx. 10% is also un<strong>de</strong>rlining this trend.<br />

Managing the public perception<br />

“Draghi Put”<br />

and QE3<br />

As witnessed in some of the recent prominent and globally<br />

commented IPOs, the “public voice” has become an<br />

increasingly critical factor with growing influence over the<br />

fate of the IPO. Rumours started or exacerbated by the<br />

press surrounding self-dictated timing <strong>de</strong>adlines, minimum<br />

valuation thresholds or listing locations have become an<br />

often counter-productive swing factor impacting upon<br />

investors’ behaviour; in<strong>de</strong>ed, in several cases, they have<br />

left behind the seclu<strong>de</strong>d shores of the newspapers’ finance<br />

sections to head towards a much broa<strong>de</strong>r and polemic<br />

media coverage.<br />

It almost seems as if some major global IPOs face the risk of<br />

“getting ahead of themselves”, with the public opinion push-