WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

146<br />

<strong>WCT</strong> Berhad (66538-K)<br />

annual report 2011<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 December 2011<br />

cont’d<br />

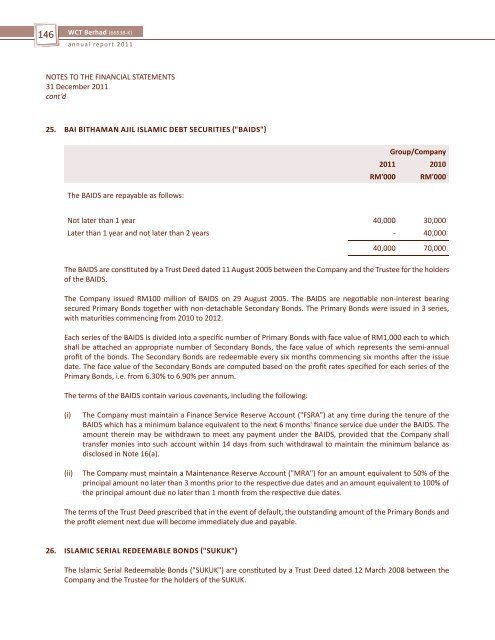

25. BAI BITHAMAN AJIL ISLAMIC DEBT SECURITIES �"BAIDS"�<br />

The BAIDS are repayable as follows:<br />

Group/Company<br />

2011 2010<br />

RM'000 RM'000<br />

Not later than 1 year 40,000 <strong>30</strong>,000<br />

Later than 1 year and not later than 2 years - 40,000<br />

40,000 70,000<br />

The BAIDS are constituted by a Trust Deed dated 11 August 2005 between the Company and the Trustee for the holders<br />

of the BAIDS.<br />

The Company issued RM100 million of BAIDS on 29 August 2005. The BAIDS are negotiable non-interest bearing<br />

secured Primary Bonds <strong>to</strong>gether with non-detachable Secondary Bonds. The Primary Bonds were issued in 3 series,<br />

with maturities commencing from 2010 <strong>to</strong> 2012.<br />

Each series of the BAIDS is divided in<strong>to</strong> a specific number of Primary Bonds with face value of RM1,000 each <strong>to</strong> which<br />

shall be attached an appropriate number of Secondary Bonds, the face value of which represents the semi-annual<br />

profit of the bonds. The Secondary Bonds are redeemable every six months commencing six months after the issue<br />

date. The face value of the Secondary Bonds are computed based on the profit rates specified for each series of the<br />

Primary Bonds, i.e. from 6.<strong>30</strong>% <strong>to</strong> 6.90% per annum.<br />

The terms of the BAIDS contain various covenants, including the following:<br />

(i) The Company must maintain a Finance Service Reserve Account ("FSRA") at any time during the tenure of the<br />

BAIDS which has a minimum balance equivalent <strong>to</strong> the next 6 months' finance service due under the BAIDS. The<br />

amount therein may be withdrawn <strong>to</strong> meet any payment under the BAIDS, provided that the Company shall<br />

transfer monies in<strong>to</strong> such account within 14 days from such withdrawal <strong>to</strong> maintain the minimum balance as<br />

disclosed in Note 16(a).<br />

(ii) The Company must maintain a Maintenance Reserve Account ("MRA") for an amount equivalent <strong>to</strong> 50% of the<br />

principal amount no later than 3 months prior <strong>to</strong> the respective due dates and an amount equivalent <strong>to</strong> 100% of<br />

the principal amount due no later than 1 month from the respective due dates.<br />

The terms of the Trust Deed prescribed that in the event of default, the outstanding amount of the Primary Bonds and<br />

the profit element next due will become immediately due and payable.<br />

26. ISLAMIC SERIAL REDEEMABLE BONDS �"SUKUK"�<br />

The Islamic Serial Redeemable Bonds ("SUKUK") are constituted by a Trust Deed dated 12 March 2008 between the<br />

Company and the Trustee for the holders of the SUKUK.