WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

26. ISLAMIC SERIAL REDEEMABLE BONDS �"SUKUK"� cont’d<br />

<strong>WCT</strong> Berhad (66538-K)<br />

annual report 2011<br />

The Company issued RM<strong>30</strong>0 million of SUKUK on 26 March 2008 under the Islamic financial principles of Musyarakah<br />

in 3 series and have tenures of 3, 4 and 5 years with 139,887,452 rights <strong>to</strong> allotment of warrants on bought deal<br />

basis <strong>to</strong> the Primary Subscriber. All the SUKUK were issued in one lump sum at a discount <strong>to</strong> their nominal value and<br />

redemption is at the nominal value of SUKUK.<br />

Upon issuance, the Primary Subscriber detached the provisional rights <strong>to</strong> allotment of warrants and placed out only<br />

the SUKUK <strong>to</strong> secondary inves<strong>to</strong>rs. The Primary Subscriber or the Offerer offered the provisional rights <strong>to</strong> the allotment<br />

of the warrants for sale <strong>to</strong> the existing shareholders of the Company on the basis of 1 provisional right allotment <strong>to</strong> 1<br />

warrant for every 5 <strong>WCT</strong> shares held on at an offer price of RM0.25 per warrant.<br />

The profit is 2% per annum and payable semi-annually in arrears commencing 6 months after the issue date. The yield<br />

<strong>to</strong> maturity was in the range of 4.90% <strong>to</strong> 5.20%. The SUKUK are direct, unconditional, unsecured and unsubordinated.<br />

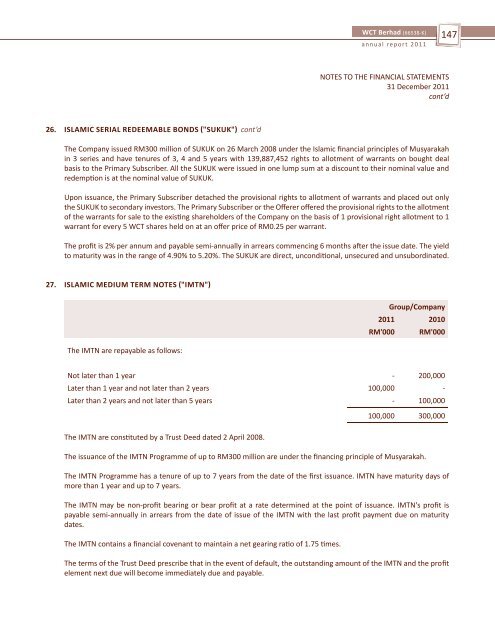

27. ISLAMIC MEDIUM TERM NOTES �"IMTN"�<br />

The IMTN are repayable as follows:<br />

Group/Company<br />

2011 2010<br />

RM'000 RM'000<br />

Not later than 1 year - 200,000<br />

Later than 1 year and not later than 2 years 100,000 -<br />

Later than 2 years and not later than 5 years - 100,000<br />

The IMTN are constituted by a Trust Deed dated 2 April 2008.<br />

100,000 <strong>30</strong>0,000<br />

The issuance of the IMTN Programme of up <strong>to</strong> RM<strong>30</strong>0 million are under the financing principle of Musyarakah.<br />

The IMTN Programme has a tenure of up <strong>to</strong> 7 years from the date of the first issuance. IMTN have maturity days of<br />

more than 1 year and up <strong>to</strong> 7 years.<br />

The IMTN may be non-profit bearing or bear profit at a rate determined at the point of issuance. IMTN's profit is<br />

payable semi-annually in arrears from the date of issue of the IMTN with the last profit payment due on maturity<br />

dates.<br />

The IMTN contains a financial covenant <strong>to</strong> maintain a net gearing ratio of 1.75 times.<br />

The terms of the Trust Deed prescribe that in the event of default, the outstanding amount of the IMTN and the profit<br />

element next due will become immediately due and payable.<br />

147<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 December 2011<br />

cont’d