WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

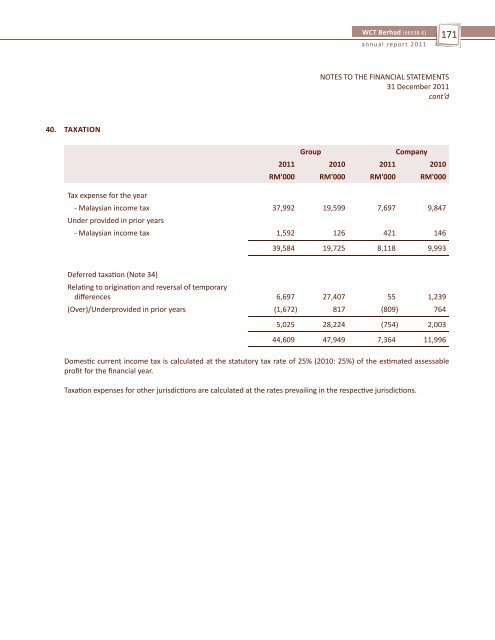

40. TAXATION<br />

Tax expense for the year<br />

<strong>WCT</strong> Berhad (66538-K)<br />

annual report 2011<br />

Group Company<br />

2011 2010 2011 2010<br />

RM'000 RM'000 RM'000 RM'000<br />

- Malaysian income tax 37,992 19,599 7,697 9,847<br />

Under provided in prior years<br />

- Malaysian income tax 1,592 126 421 146<br />

Deferred taxation (Note 34)<br />

39,584 19,725 8,118 9,993<br />

Relating <strong>to</strong> origination and reversal of temporary<br />

differences 6,697 27,407 55 1,239<br />

(Over)/Underprovided in prior years (1,672) 817 (809) 764<br />

5,025 28,224 (754) 2,003<br />

44,609 47,949 7,364 11,996<br />

Domestic current income tax is calculated at the statu<strong>to</strong>ry tax rate of 25% (2010: 25%) of the estimated assessable<br />

profit for the financial year.<br />

Taxation expenses for other jurisdictions are calculated at the rates prevailing in the respective jurisdictions.<br />

171<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 December 2011<br />

cont’d