WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

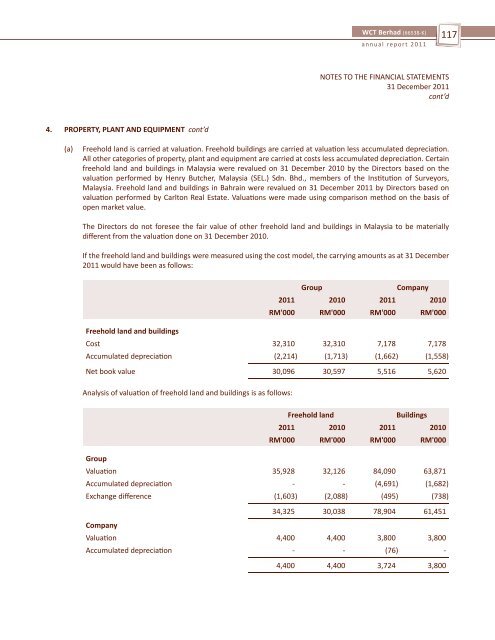

4. PROPERTY, PLANT AND EQUIPMENT cont’d<br />

<strong>WCT</strong> Berhad (66538-K)<br />

annual report 2011<br />

(a) Freehold land is carried at valuation. Freehold buildings are carried at valuation less accumulated depreciation.<br />

All other categories of property, plant and equipment are carried at costs less accumulated depreciation. Certain<br />

freehold land and buildings in Malaysia were revalued on 31 December 2010 by the Direc<strong>to</strong>rs based on the<br />

valuation performed by Henry Butcher, Malaysia (SEL.) Sdn. Bhd., members of the Institution of Surveyors,<br />

Malaysia. Freehold land and buildings in Bahrain were revalued on 31 December 2011 by Direc<strong>to</strong>rs based on<br />

valuation performed by Carl<strong>to</strong>n Real Estate. Valuations were made using comparison method on the basis of<br />

open market value.<br />

The Direc<strong>to</strong>rs do not foresee the fair value of other freehold land and buildings in Malaysia <strong>to</strong> be materially<br />

different from the valuation done on 31 December 2010.<br />

If the freehold land and buildings were measured using the cost model, the carrying amounts as at 31 December<br />

2011 would have been as follows:<br />

Group Company<br />

2011 2010 2011 2010<br />

RM'000 RM'000 RM'000 RM'000<br />

Freehold land and buildings<br />

Cost 32,310 32,310 7,178 7,178<br />

Accumulated depreciation (2,214) (1,713) (1,662) (1,558)<br />

Net book value <strong>30</strong>,096 <strong>30</strong>,597 5,516 5,620<br />

Analysis of valuation of freehold land and buildings is as follows:<br />

Freehold land Buildings<br />

2011 2010 2011 2010<br />

RM'000 RM'000 RM'000 RM'000<br />

Group<br />

Valuation 35,928 32,126 84,090 63,871<br />

Accumulated depreciation - - (4,691) (1,682)<br />

Exchange difference (1,603) (2,088) (495) (738)<br />

34,325 <strong>30</strong>,038 78,904 61,451<br />

Company<br />

Valuation 4,400 4,400 3,800 3,800<br />

Accumulated depreciation - - (76) -<br />

4,400 4,400 3,724 3,800<br />

117<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 December 2011<br />

cont’d