WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

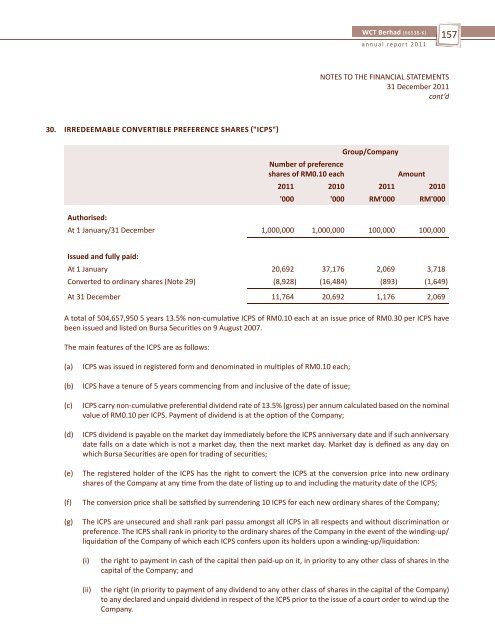

<strong>30</strong>. IRREDEEMABLE CONVERTIBLE PREFERENCE SHARES �"ICPS"�<br />

<strong>WCT</strong> Berhad (66538-K)<br />

annual report 2011<br />

Group/Company<br />

Number of preference<br />

shares of RM0.10 each Amount<br />

2011 2010 2011 2010<br />

'000 '000 RM'000 RM'000<br />

Authorised:<br />

At 1 January/31 December 1,000,000 1,000,000 100,000 100,000<br />

Issued and fully paid:<br />

At 1 January 20,692 37,176 2,069 3,718<br />

Converted <strong>to</strong> ordinary shares (Note 29) (8,928) (16,484) (893) (1,649)<br />

At 31 December 11,764 20,692 1,176 2,069<br />

A <strong>to</strong>tal of 504,657,950 5 years 13.5% non-cumulative ICPS of RM0.10 each at an issue price of RM0.<strong>30</strong> per ICPS have<br />

been issued and listed on <strong>Bursa</strong> Securities on 9 August 2007.<br />

The main features of the ICPS are as follows:<br />

(a) ICPS was issued in registered form and denominated in multiples of RM0.10 each;<br />

(b) ICPS have a tenure of 5 years commencing from and inclusive of the date of issue;<br />

(c) ICPS carry non-cumulative preferential dividend rate of 13.5% (gross) per annum calculated based on the nominal<br />

value of RM0.10 per ICPS. Payment of dividend is at the option of the Company;<br />

(d) ICPS dividend is payable on the market day immediately before the ICPS anniversary date and if such anniversary<br />

date falls on a date which is not a market day, then the next market day. Market day is defined as any day on<br />

which <strong>Bursa</strong> Securities are open for trading of securities;<br />

(e) The registered holder of the ICPS has the right <strong>to</strong> convert the ICPS at the conversion price in<strong>to</strong> new ordinary<br />

shares of the Company at any time from the date of listing up <strong>to</strong> and including the maturity date of the ICPS;<br />

(f) The conversion price shall be satisfied by surrendering 10 ICPS for each new ordinary shares of the Company;<br />

(g) The ICPS are unsecured and shall rank pari passu amongst all ICPS in all respects and without discrimination or<br />

preference. The ICPS shall rank in priority <strong>to</strong> the ordinary shares of the Company in the event of the winding-up/<br />

liquidation of the Company of which each ICPS confers upon its holders upon a winding-up/liquidation:<br />

(i) the right <strong>to</strong> payment in cash of the capital then paid-up on it, in priority <strong>to</strong> any other class of shares in the<br />

capital of the Company; and<br />

(ii) the right (in priority <strong>to</strong> payment of any dividend <strong>to</strong> any other class of shares in the capital of the Company)<br />

<strong>to</strong> any declared and unpaid dividend in respect of the ICPS prior <strong>to</strong> the issue of a court order <strong>to</strong> wind up the<br />

Company.<br />

157<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 December 2011<br />

cont’d