WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

156<br />

<strong>WCT</strong> Berhad (66538-K)<br />

annual report 2011<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 December 2011<br />

cont’d<br />

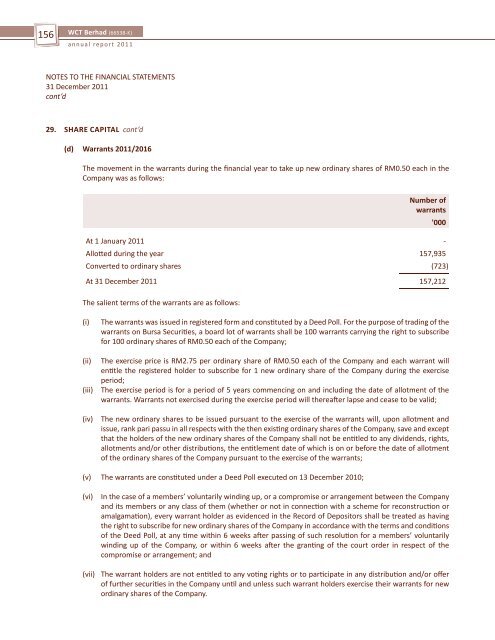

29. SHARE CAPITAL cont’d<br />

(d) Warrants 2011/2016<br />

The movement in the warrants during the financial year <strong>to</strong> take up new ordinary shares of RM0.50 each in the<br />

Company was as follows:<br />

Number of<br />

warrants<br />

'000<br />

At 1 January 2011 -<br />

Allotted during the year 157,935<br />

Converted <strong>to</strong> ordinary shares (723)<br />

At 31 December 2011 157,212<br />

The salient terms of the warrants are as follows:<br />

(i) The warrants was issued in registered form and constituted by a Deed Poll. For the purpose of trading of the<br />

warrants on <strong>Bursa</strong> Securities, a board lot of warrants shall be 100 warrants carrying the right <strong>to</strong> subscribe<br />

for 100 ordinary shares of RM0.50 each of the Company;<br />

(ii) The exercise price is RM2.75 per ordinary share of RM0.50 each of the Company and each warrant will<br />

entitle the registered holder <strong>to</strong> subscribe for 1 new ordinary share of the Company during the exercise<br />

period;<br />

(iii) The exercise period is for a period of 5 years commencing on and including the date of allotment of the<br />

warrants. Warrants not exercised during the exercise period will thereafter lapse and cease <strong>to</strong> be valid;<br />

(iv) The new ordinary shares <strong>to</strong> be issued pursuant <strong>to</strong> the exercise of the warrants will, upon allotment and<br />

issue, rank pari passu in all respects with the then existing ordinary shares of the Company, save and except<br />

that the holders of the new ordinary shares of the Company shall not be entitled <strong>to</strong> any dividends, rights,<br />

allotments and/or other distributions, the entitlement date of which is on or before the date of allotment<br />

of the ordinary shares of the Company pursuant <strong>to</strong> the exercise of the warrants;<br />

(v) The warrants are constituted under a Deed Poll executed on 13 December 2010;<br />

(vi) In the case of a members’ voluntarily winding up, or a compromise or arrangement between the Company<br />

and its members or any class of them (whether or not in connection with a scheme for reconstruction or<br />

amalgamation), every warrant holder as evidenced in the Record of Deposi<strong>to</strong>rs shall be treated as having<br />

the right <strong>to</strong> subscribe for new ordinary shares of the Company in accordance with the terms and conditions<br />

of the Deed Poll, at any time within 6 weeks after passing of such resolution for a members’ voluntarily<br />

winding up of the Company, or within 6 weeks after the granting of the court order in respect of the<br />

compromise or arrangement; and<br />

(vii) The warrant holders are not entitled <strong>to</strong> any voting rights or <strong>to</strong> participate in any distribution and/or offer<br />

of further securities in the Company until and unless such warrant holders exercise their warrants for new<br />

ordinary shares of the Company.