WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES cont’d<br />

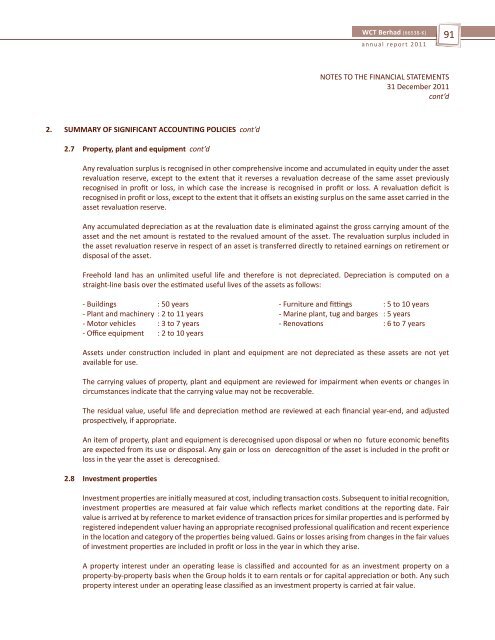

2.7 Property, plant and equipment cont’d<br />

<strong>WCT</strong> Berhad (66538-K)<br />

annual report 2011<br />

Any revaluation surplus is recognised in other comprehensive income and accumulated in equity under the asset<br />

revaluation reserve, except <strong>to</strong> the extent that it reverses a revaluation decrease of the same asset previously<br />

recognised in profit or loss, in which case the increase is recognised in profit or loss. A revaluation deficit is<br />

recognised in profit or loss, except <strong>to</strong> the extent that it offsets an existing surplus on the same asset carried in the<br />

asset revaluation reserve.<br />

Any accumulated depreciation as at the revaluation date is eliminated against the gross carrying amount of the<br />

asset and the net amount is restated <strong>to</strong> the revalued amount of the asset. The revaluation surplus included in<br />

the asset revaluation reserve in respect of an asset is transferred directly <strong>to</strong> retained earnings on retirement or<br />

disposal of the asset.<br />

Freehold land has an unlimited useful life and therefore is not depreciated. Depreciation is computed on a<br />

straight-line basis over the estimated useful lives of the assets as follows:<br />

- Buildings : 50 years - Furniture and fittings : 5 <strong>to</strong> 10 years<br />

- Plant and machinery : 2 <strong>to</strong> 11 years - Marine plant, tug and barges : 5 years<br />

- Mo<strong>to</strong>r vehicles : 3 <strong>to</strong> 7 years - Renovations : 6 <strong>to</strong> 7 years<br />

- Office equipment : 2 <strong>to</strong> 10 years<br />

Assets under construction included in plant and equipment are not depreciated as these assets are not yet<br />

available for use.<br />

The carrying values of property, plant and equipment are reviewed for impairment when events or changes in<br />

circumstances indicate that the carrying value may not be recoverable.<br />

The residual value, useful life and depreciation method are reviewed at each financial year-end, and adjusted<br />

prospectively, if appropriate.<br />

An item of property, plant and equipment is derecognised upon disposal or when no future economic benefits<br />

are expected from its use or disposal. Any gain or loss on derecognition of the asset is included in the profit or<br />

loss in the year the asset is derecognised.<br />

2.8 Investment properties<br />

Investment properties are initially measured at cost, including transaction costs. Subsequent <strong>to</strong> initial recognition,<br />

investment properties are measured at fair value which reflects market conditions at the reporting date. Fair<br />

value is arrived at by reference <strong>to</strong> market evidence of transaction prices for similar properties and is performed by<br />

registered independent valuer having an appropriate recognised professional qualification and recent experience<br />

in the location and category of the properties being valued. Gains or losses arising from changes in the fair values<br />

of investment properties are included in profit or loss in the year in which they arise.<br />

A property interest under an operating lease is classified and accounted for as an investment property on a<br />

property-by-property basis when the Group holds it <strong>to</strong> earn rentals or for capital appreciation or both. Any such<br />

property interest under an operating lease classified as an investment property is carried at fair value.<br />

91<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 December 2011<br />

cont’d