WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

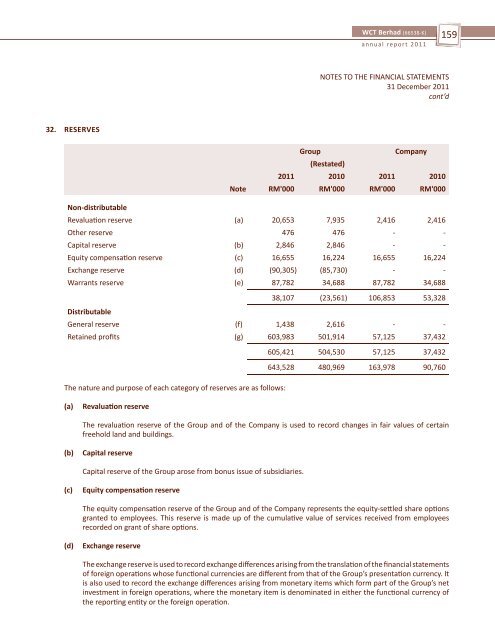

32. RESERVES<br />

<strong>WCT</strong> Berhad (66538-K)<br />

annual report 2011<br />

Group<br />

(Restated)<br />

Company<br />

2011 2010 2011 2010<br />

Note RM'000 RM'000 RM'000 RM'000<br />

Non-distributable<br />

Revaluation reserve (a) 20,653 7,935 2,416 2,416<br />

Other reserve 476 476 - -<br />

Capital reserve (b) 2,846 2,846 - -<br />

Equity compensation reserve (c) 16,655 16,224 16,655 16,224<br />

Exchange reserve (d) (90,<strong>30</strong>5) (85,7<strong>30</strong>) - -<br />

Warrants reserve (e) 87,782 34,688 87,782 34,688<br />

38,107 (23,561) 106,853 53,328<br />

Distributable<br />

General reserve (f) 1,438 2,616 - -<br />

Retained profits (g) 603,983 501,914 57,125 37,432<br />

The nature and purpose of each category of reserves are as follows:<br />

(a) Revaluation reserve<br />

605,421 504,5<strong>30</strong> 57,125 37,432<br />

643,528 480,969 163,978 90,760<br />

The revaluation reserve of the Group and of the Company is used <strong>to</strong> record changes in fair values of certain<br />

freehold land and buildings.<br />

(b) Capital reserve<br />

Capital reserve of the Group arose from bonus issue of subsidiaries.<br />

(c) Equity compensation reserve<br />

The equity compensation reserve of the Group and of the Company represents the equity-settled share options<br />

granted <strong>to</strong> employees. This reserve is made up of the cumulative value of services received from employees<br />

recorded on grant of share options.<br />

(d) Exchange reserve<br />

The exchange reserve is used <strong>to</strong> record exchange differences arising from the translation of the financial statements<br />

of foreign operations whose functional currencies are different from that of the Group’s presentation currency. It<br />

is also used <strong>to</strong> record the exchange differences arising from monetary items which form part of the Group’s net<br />

investment in foreign operations, where the monetary item is denominated in either the functional currency of<br />

the reporting entity or the foreign operation.<br />

159<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 December 2011<br />

cont’d