WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

WCT-Page 30 to ProxyForm (2.4MB).pdf - Announcements - Bursa ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

47. FINANCIAL INSTRUMENTS cont’d<br />

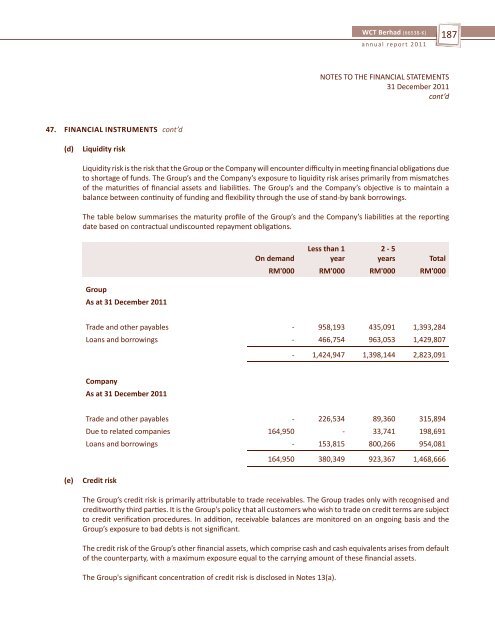

(d) Liquidity risk<br />

<strong>WCT</strong> Berhad (66538-K)<br />

annual report 2011<br />

Liquidity risk is the risk that the Group or the Company will encounter difficulty in meeting financial obligations due<br />

<strong>to</strong> shortage of funds. The Group’s and the Company’s exposure <strong>to</strong> liquidity risk arises primarily from mismatches<br />

of the maturities of financial assets and liabilities. The Group’s and the Company’s objective is <strong>to</strong> maintain a<br />

balance between continuity of funding and flexibility through the use of stand-by bank borrowings.<br />

The table below summarises the maturity profile of the Group’s and the Company’s liabilities at the reporting<br />

date based on contractual undiscounted repayment obligations.<br />

Group<br />

As at 31 December 2011<br />

Less than 1 2 - 5<br />

On demand year years Total<br />

RM'000 RM'000 RM'000 RM'000<br />

Trade and other payables - 958,193 435,091 1,393,284<br />

Loans and borrowings - 466,754 963,053 1,429,807<br />

Company<br />

As at 31 December 2011<br />

- 1,424,947 1,398,144 2,823,091<br />

Trade and other payables - 226,534 89,360 315,894<br />

Due <strong>to</strong> related companies 164,950 - 33,741 198,691<br />

Loans and borrowings - 153,815 800,266 954,081<br />

(e) Credit risk<br />

164,950 380,349 923,367 1,468,666<br />

The Group’s credit risk is primarily attributable <strong>to</strong> trade receivables. The Group trades only with recognised and<br />

creditworthy third parties. It is the Group’s policy that all cus<strong>to</strong>mers who wish <strong>to</strong> trade on credit terms are subject<br />

<strong>to</strong> credit verification procedures. In addition, receivable balances are moni<strong>to</strong>red on an ongoing basis and the<br />

Group’s exposure <strong>to</strong> bad debts is not significant.<br />

The credit risk of the Group’s other financial assets, which comprise cash and cash equivalents arises from default<br />

of the counterparty, with a maximum exposure equal <strong>to</strong> the carrying amount of these financial assets.<br />

The Group's significant concentration of credit risk is disclosed in Notes 13(a).<br />

187<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 December 2011<br />

cont’d