Queensland Life Sciences Industry Report 2012 (PDF, 3.5MB)

Queensland Life Sciences Industry Report 2012 (PDF, 3.5MB)

Queensland Life Sciences Industry Report 2012 (PDF, 3.5MB)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Queensland</strong> <strong>Life</strong> <strong>Sciences</strong> <strong>Industry</strong> <strong>Report</strong> <strong>2012</strong><br />

28<br />

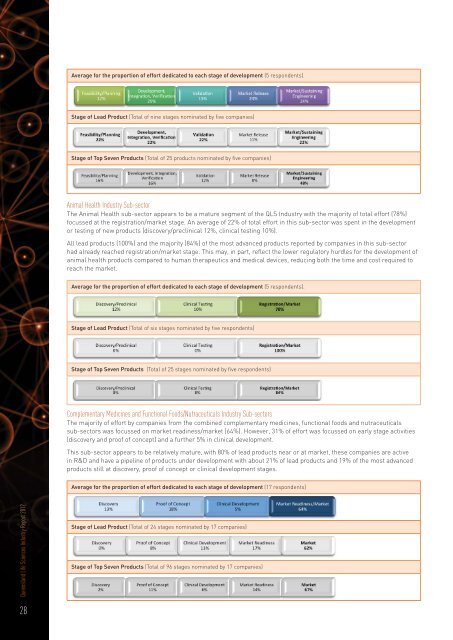

Average for the proportion of effort dedicated to each stage of development (5 respondents).<br />

Stage of Lead Product (Total of nine stages nominated by five companies)<br />

Stage of Top Seven Products (Total of 25 products nominated by five companies)<br />

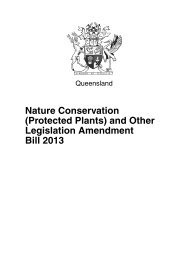

Animal Health <strong>Industry</strong> Sub-sector<br />

The Animal Health sub-sector appears to be a mature segment of the QLS <strong>Industry</strong> with the majority of total effort (78%)<br />

focussed at the registration/market stage. An average of 22% of total effort in this sub-sector was spent in the development<br />

or testing of new products (discovery/preclinical 12%, clinical testing 10%).<br />

All lead products (100%) and the majority (84%) of the most advanced products reported by companies in this sub-sector<br />

had already reached registration/market stage. This may, in part, reflect the lower regulatory hurdles for the development of<br />

animal health products compared to human therapeutics and medical devices, reducing both the time and cost required to<br />

reach the market.<br />

Average for the proportion of effort dedicated to each stage of development (5 respondents).<br />

Stage of Lead Product (Total of six stages nominated by five respondents)<br />

Stage of Top Seven Products (Total of 25 stages nominated by five respondents)<br />

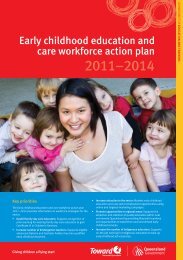

Complementary Medicines and Functional Foods/Nutraceuticals <strong>Industry</strong> Sub-sectors<br />

The majority of effort by companies from the combined complementary medicines, functional foods and nutraceuticals<br />

sub-sectors was focussed on market readiness/market (64%). However, 31% of effort was focussed on early stage activities<br />

(discovery and proof of concept) and a further 5% in clinical development.<br />

This sub-sector appears to be relatively mature, with 80% of lead products near or at market, these companies are active<br />

in R&D and have a pipeline of products under development with about 21% of lead products and 19% of the most advanced<br />

products still at discovery, proof of concept or clinical development stages.<br />

Average for the proportion of effort dedicated to each stage of development (17 respondents)<br />

Stage of Lead Product (Total of 24 stages nominated by 17 companies)<br />

Stage of Top Seven Products (Total of 96 stages nominated by 17 companies)