PGP Handbook - Institute of Public Enterprise

PGP Handbook - Institute of Public Enterprise

PGP Handbook - Institute of Public Enterprise

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8. “Economic Survey” (recent year), Ministry <strong>of</strong> Finance,<br />

Government <strong>of</strong> India New Delhi<br />

9. “Currency and Finance” (recent year), Reserve<br />

Bank <strong>of</strong> India, Ministry <strong>of</strong> Finance, Government <strong>of</strong><br />

India, New Delhi<br />

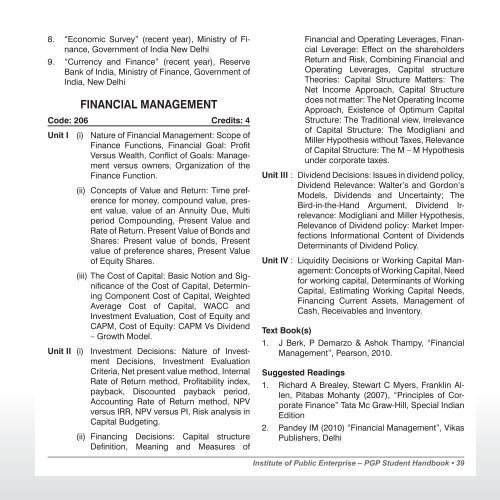

FINANCIAL MANAGEMENT<br />

Code: 206 Credits: 4<br />

Unit I (i) Nature <strong>of</strong> Financial Management: Scope <strong>of</strong><br />

Finance Functions, Financial Goal: Pr<strong>of</strong>it<br />

Versus Wealth, Conflict <strong>of</strong> Goals: Management<br />

versus owners, Organization <strong>of</strong> the<br />

Finance Function.<br />

(ii) Concepts <strong>of</strong> Value and Return: Time preference<br />

for money, compound value, present<br />

value, value <strong>of</strong> an Annuity Due, Multi<br />

period Compounding, Present Value and<br />

Rate <strong>of</strong> Return. Present Value <strong>of</strong> Bonds and<br />

Shares: Present value <strong>of</strong> bonds, Present<br />

value <strong>of</strong> preference shares, Present Value<br />

<strong>of</strong> Equity Shares.<br />

(iii) The Cost <strong>of</strong> Capital: Basic Notion and Significance<br />

<strong>of</strong> the Cost <strong>of</strong> Capital, Determining<br />

Component Cost <strong>of</strong> Capital, Weighted<br />

Average Cost <strong>of</strong> Capital, WACC and<br />

Investment Evaluation, Cost <strong>of</strong> Equity and<br />

CAPM, Cost <strong>of</strong> Equity: CAPM Vs Dividend<br />

– Growth Model.<br />

Unit II (i) Investment Decisions: Nature <strong>of</strong> Investment<br />

Decisions, Investment Evaluation<br />

Criteria, Net present value method, Internal<br />

Rate <strong>of</strong> Return method, Pr<strong>of</strong>itability index,<br />

payback, Discounted payback period,<br />

Accounting Rate <strong>of</strong> Return method, NPV<br />

versus IRR, NPV versus PI, Risk analysis in<br />

Capital Budgeting.<br />

(ii) Financing Decisions: Capital structure<br />

Definition, Meaning and Measures <strong>of</strong><br />

Financial and Operating Leverages, Financial<br />

Leverage: Effect on the shareholders<br />

Return and Risk, Combining Financial and<br />

Operating Leverages, Capital structure<br />

Theories: Capital Structure Matters: The<br />

Net Income Approach, Capital Structure<br />

does not matter: The Net Operating Income<br />

Approach, Existence <strong>of</strong> Optimum Capital<br />

Structure: The Traditional view, Irrelevance<br />

<strong>of</strong> Capital Structure: The Modigliani and<br />

Miller Hypothesis without Taxes, Relevance<br />

<strong>of</strong> Capital Structure: The M – M Hypothesis<br />

under corporate taxes.<br />

Unit III : Dividend Decisions: Issues in dividend policy,<br />

Dividend Relevance: Walter’s and Gordon’s<br />

Models, Dividends and Uncertainty; The<br />

Bird-in-the-Hand Argument, Dividend Irrelevance:<br />

Modigliani and Miller Hypothesis,<br />

Relevance <strong>of</strong> Dividend policy: Market Imperfections<br />

Informational Content <strong>of</strong> Dividends<br />

Determinants <strong>of</strong> Dividend Policy.<br />

Unit IV : Liquidity Decisions or Working Capital Management:<br />

Concepts <strong>of</strong> Working Capital, Need<br />

for working capital, Determinants <strong>of</strong> Working<br />

Capital, Estimating Working Capital Needs,<br />

Financing Current Assets, Management <strong>of</strong><br />

Cash, Receivables and Inventory.<br />

Text Book(s)<br />

1. J Berk, P Demarzo & Ashok Thampy, “Financial<br />

Management”, Pearson, 2010.<br />

Suggested Readings<br />

1. Richard A Brealey, Stewart C Myers, Franklin Allen,<br />

Pitabas Mohanty (2007), “Principles <strong>of</strong> Corporate<br />

Finance” Tata Mc Graw-Hill, Special Indian<br />

Edition<br />

2. Pandey IM (2010) “Financial Management”, Vikas<br />

Publishers, Delhi<br />

<strong>Institute</strong> <strong>of</strong> <strong>Public</strong> <strong>Enterprise</strong> – <strong>PGP</strong> Student <strong>Handbook</strong> • 39