Annual report - About TELUS

Annual report - About TELUS

Annual report - About TELUS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

management discussion and analysis<br />

by higher interest income due to higher average cash and<br />

investment balances.<br />

Financing costs increased by $128.2 million<br />

Financing costs increased mainly because of an increase<br />

in debt balances due to the purchase of QuébecTel,<br />

the purchase of Clearnet and $12.5 million net foreign<br />

exchange losses in 2000 compared with $9.4 million net<br />

foreign exchange gains in 1999. The foreign exchange<br />

losses were attributable to the effects of valuation of<br />

U.S. dollar debt and a comparatively lower Canadian dollar.<br />

Financing costs included $56.5 million of non-cash accreted<br />

interest expense related to Clearnet long term debt from<br />

October 20 onward.<br />

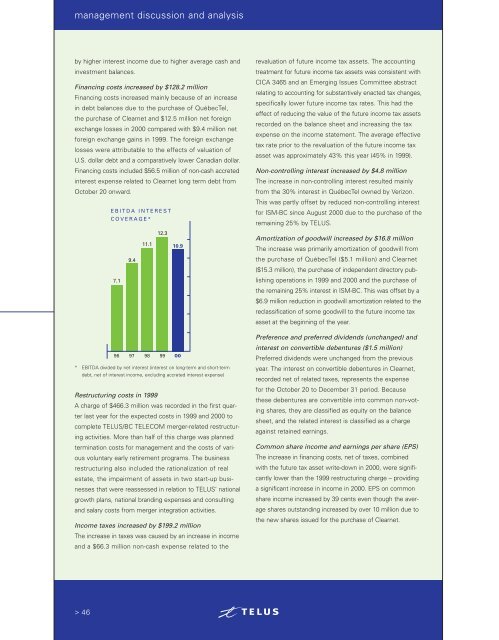

* EBITDA divided by net interest (interest on long-term and short-term<br />

debt, net of interest income, excluding accreted interest expense)<br />

Restructuring costs in 1999<br />

A charge of $466.3 million was recorded in the first quarter<br />

last year for the expected costs in 1999 and 2000 to<br />

complete <strong>TELUS</strong>/BC TELECOM merger-related restructuring<br />

activities. More than half of this charge was planned<br />

termination costs for management and the costs of various<br />

voluntary early retirement programs. The business<br />

restructuring also included the rationalization of real<br />

estate, the impairment of assets in two start-up businesses<br />

that were reassessed in relation to <strong>TELUS</strong>’ national<br />

growth plans, national branding expenses and consulting<br />

and salary costs from merger integration activities.<br />

Income taxes increased by $199.2 million<br />

The increase in taxes was caused by an increase in income<br />

and a $66.3 million non-cash expense related to the<br />

> 46<br />

EBITDA INTEREST<br />

COVERAGE*<br />

7.1<br />

9.4<br />

11.1<br />

12.3<br />

10.9<br />

96 97 98 99 00<br />

revaluation of future income tax assets. The accounting<br />

treatment for future income tax assets was consistent with<br />

CICA 3465 and an Emerging Issues Committee abstract<br />

relating to accounting for substantively enacted tax changes,<br />

specifically lower future income tax rates. This had the<br />

effect of reducing the value of the future income tax assets<br />

recorded on the balance sheet and increasing the tax<br />

expense on the income statement. The average effective<br />

tax rate prior to the revaluation of the future income tax<br />

asset was approximately 43% this year (45% in 1999).<br />

Non-controlling interest increased by $4.8 million<br />

The increase in non-controlling interest resulted mainly<br />

from the 30% interest in QuébecTel owned by Verizon.<br />

This was partly offset by reduced non-controlling interest<br />

for ISM-BC since August 2000 due to the purchase of the<br />

remaining 25% by <strong>TELUS</strong>.<br />

Amortization of goodwill increased by $16.8 million<br />

The increase was primarily amortization of goodwill from<br />

the purchase of QuébecTel ($5.1 million) and Clearnet<br />

($15.3 million), the purchase of independent directory publishing<br />

operations in 1999 and 2000 and the purchase of<br />

the remaining 25% interest in ISM-BC. This was offset by a<br />

$6.9 million reduction in goodwill amortization related to the<br />

reclassification of some goodwill to the future income tax<br />

asset at the beginning of the year.<br />

Preference and preferred dividends (unchanged) and<br />

interest on convertible debentures ($1.5 million)<br />

Preferred dividends were unchanged from the previous<br />

year. The interest on convertible debentures in Clearnet,<br />

recorded net of related taxes, represents the expense<br />

for the October 20 to December 31 period. Because<br />

these debentures are convertible into common non-voting<br />

shares, they are classified as equity on the balance<br />

sheet, and the related interest is classified as a charge<br />

against retained earnings.<br />

Common share income and earnings per share (EPS)<br />

The increase in financing costs, net of taxes, combined<br />

with the future tax asset write-down in 2000, were significantly<br />

lower than the 1999 restructuring charge – providing<br />

a significant increase in income in 2000. EPS on common<br />

share income increased by 39 cents even though the average<br />

shares outstanding increased by over 10 million due to<br />

the new shares issued for the purchase of Clearnet.

![DISK004:[98CLG6.98CLG3726]BA3726A.;28 - About TELUS](https://img.yumpu.com/16786670/1/190x245/disk00498clg698clg3726ba3726a28-about-telus.jpg?quality=85)