Annual report - About TELUS

Annual report - About TELUS

Annual report - About TELUS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

notes to consolidated financial statements<br />

general corporate purposes (Tranche A, known as the 364-Day Non-Revolving Bridge Facility, with $5 billion in available<br />

credit); and to refinance existing and acquired indebtedness for general corporate purposes other than repayment of<br />

Tranche A (Tranche B, known as the 364-Day Revolving Line of Credit with $1.25 billion in available credit).<br />

Upon the acquisition of Clearnet, net proceeds from the bank credit facilities were applied to the retirement of outstanding<br />

bank debt, the purchase of Clearnet shares, related Clearnet acquisition costs and the retirement of certain outstanding<br />

debt owed by Clearnet such as the 14.75% Senior Discount Notes due December 15, 2005, the Lucent Credit Facilities<br />

and the Mike Credit Facility. Interest rates on outstanding bank debt are based upon the public ratings from the U.S. credit<br />

rating agencies of Standard & Poor’s and Moody’s. Bank debt can take one or more of the following forms: prime rate loans<br />

in Canadian dollars; Bankers’ Acceptances in Canadian dollars; U.S. Base Rate Loans in U.S. dollars; London Interbank<br />

Offered Rate Loans (LIBOR) in U.S. dollars; and Standby Letters of Credit in Canadian dollars or U.S. dollars only (Tranche B<br />

only). Other key terms and conditions for these facilities include compliance to financial covenants, mandatory prepayment<br />

under certain conditions and voluntary prepayments/cancellations. Additionally, the shares of <strong>TELUS</strong>’ major operating<br />

subsidiaries have been pledged as security for this bank credit facility.<br />

At December 31, 2000, the QuébecTel Group had lines of credit available at the banks’ prime rates of interest maturing<br />

between February 1 and August 31, 2001, which covered the amount of $95.0 million authorized by its Board of Directors.<br />

Used bank credit totaled $67.2 million at December 31, 2000. The average interest rate on short-term borrowings for the<br />

QuébecTel Group was 7.2% in 2000.<br />

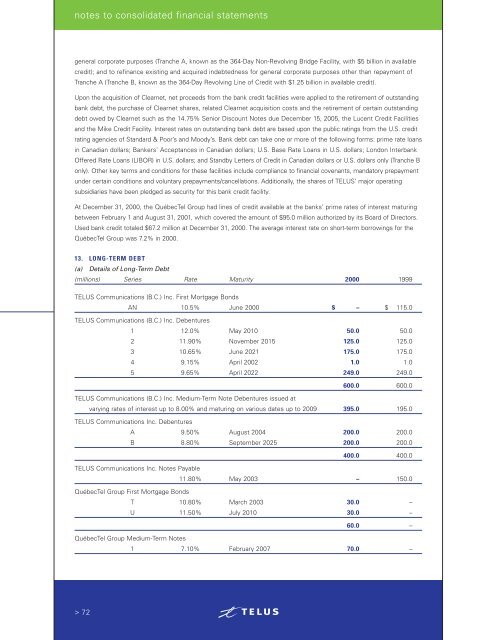

13. LONG-TERM DEBT<br />

(a) Details of Long-Term Debt<br />

(millions) Series Rate Maturity 2000 1999<br />

<strong>TELUS</strong> Communications (B.C.) Inc. First Mortgage Bonds<br />

AN 10.5% June 2000 $ – $ 115.0<br />

<strong>TELUS</strong> Communications (B.C.) Inc. Debentures<br />

1 12.0% May 2010 50.0 50.0<br />

2 11.90% November 2015 125.0 125.0<br />

3 10.65% June 2021 175.0 175.0<br />

4 9.15% April 2002 1.0 1.0<br />

> 72<br />

5 9.65% April 2022 249.0 249.0<br />

600.0 600.0<br />

<strong>TELUS</strong> Communications (B.C.) Inc. Medium-Term Note Debentures issued at<br />

varying rates of interest up to 8.00% and maturing on various dates up to 2009 395.0 195.0<br />

<strong>TELUS</strong> Communications Inc. Debentures<br />

A 9.50% August 2004 200.0 200.0<br />

B 8.80% September 2025 200.0 200.0<br />

400.0 400.0<br />

<strong>TELUS</strong> Communications Inc. Notes Payable<br />

11.80% May 2003 – 150.0<br />

QuébecTel Group First Mortgage Bonds<br />

T 10.80% March 2003 30.0 –<br />

U 11.50% July 2010 30.0 –<br />

60.0 –<br />

QuébecTel Group Medium-Term Notes<br />

1 7.10% February 2007 70.0 –

![DISK004:[98CLG6.98CLG3726]BA3726A.;28 - About TELUS](https://img.yumpu.com/16786670/1/190x245/disk00498clg698clg3726ba3726a28-about-telus.jpg?quality=85)